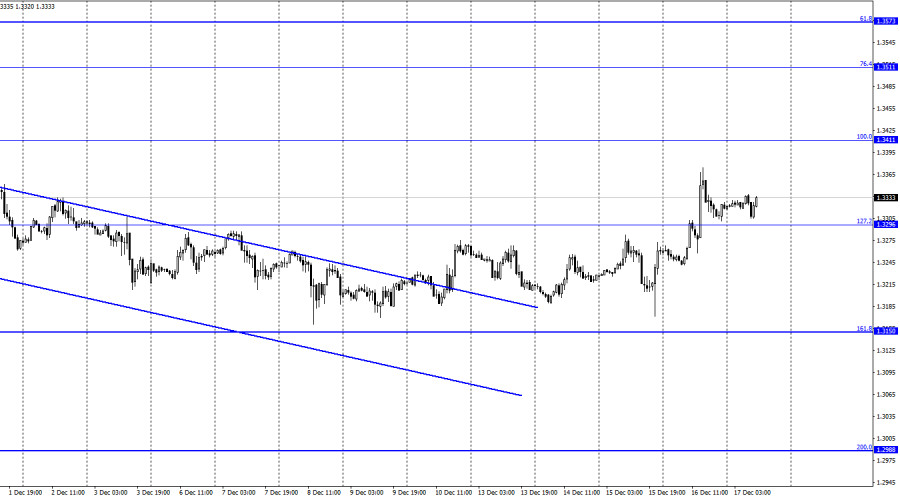

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair resumed the growth process on Thursday, secured above the corrective level of 127.2% (1.3296), and is currently trying to continue growing again in the direction of the Fibo level of 100.0% (1.3411). Fixing the pair's exchange rate below the level of 1.3296 will work in favor of the US currency and the beginning of a fall in the direction of the corrective level of 161.8% (1.3150). The background information of yesterday was extensive, but the main event was the meeting of the Bank of England and its results. Let me remind you that a month earlier, two members of the Bank of England voted for a rate hike, which came as a surprise to traders. Therefore, at the December meeting, it was possible to expect an increase in the number of functionaries who would vote for a rate increase. However, hardly anyone expected that the decision on the increase would be made almost unanimously, 8 against 1, and the rate would be raised in December! However, it happened, which provided significant support to bull traders.

In the late afternoon, the quotes of the British rolled back slightly down, but at the moment the "bullish" mood remains, since the level of 1.3296 has been overcome, and the pair have left the downward trend corridor. Therefore, I believe that further growth of the British pound is quite possible, although, as in the case of the euro, the dollar should also have shown growth over the past two days. Today, a report on the change in retail trade volume in November was released in the UK, and it turned out to be much better than traders' expectations. The pound, thanks to this report, received a little more support. However, if a new trend begins at this time, then the Briton is only at the very beginning of its way up. Bull traders will need to prove next week that the pair's growth was not a coincidence. Otherwise, the dollar may "remember" that the Fed meeting was in its favor and resume growth, and the pair may fall. Let me remind you that the information background from the UK continues to be not the most cheerful and optimistic, and traders pay attention not only to the actions of the central bank once every six weeks.

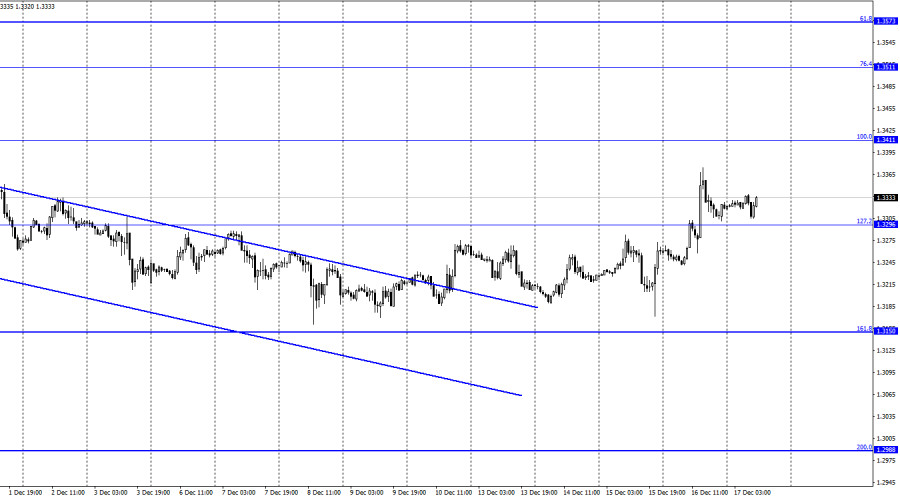

GBP/USD – 4H.

On the 4-hour chart, the pair has secured above the corrective level of 61.8% (1.3274). The growth process can be continued in the direction of the next corrective level of 50.0% (1.3457). Emerging divergences are not observed in any indicator today. Closing quotes below the level of 61.8% will work in favor of the US dollar and a new fall in the direction of the Fibo level of 76.4% (1.3044).

News calendar for the USA and the UK:

UK - change in retail trade volume with and without fuel costs (07:00 UTC).

On Friday, all the planned reports were already released in the UK, and in the USA today the calendar of economic events is empty. Thus, during the rest of the day, the influence of the information background on the mood of traders will be absent.

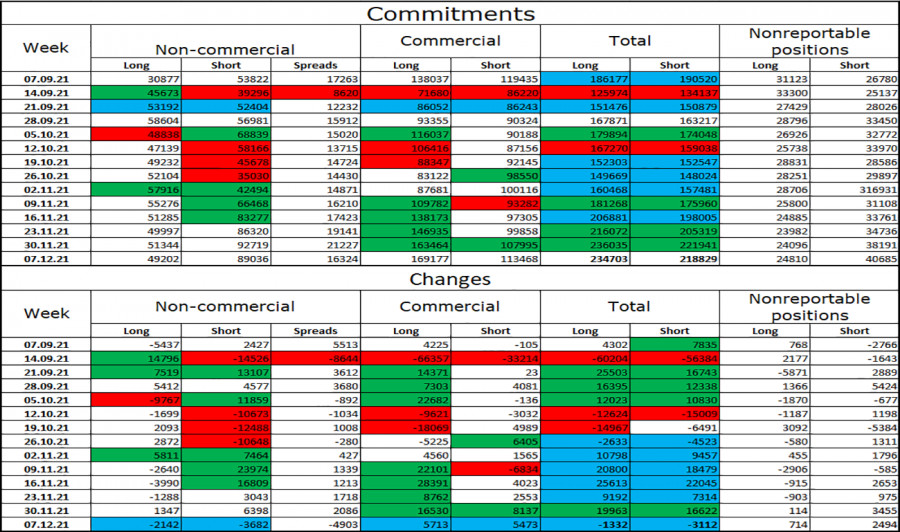

COT (Commitments of Traders) report:

The latest COT report from December 7 on the British showed that the mood of the major players has not changed much. The trend of strengthening the "bearish" mood has been observed for five weeks in a row and now it persists. In the reporting week, speculators closed 2,142 long contracts and 3,682 short contracts. However, the total number of short contracts in the "Non-commercial" category of traders is now almost twice as high as the number of long contracts. Thus, based on the results of the next week and the next COT report, I cannot conclude that the situation for the Briton has improved at least a little. It can continue the process of falling.

GBP/USD forecast and recommendations to traders:

I recommend buying the pound if the 4-hour chart closes above the level of 1.3274 with targets of 1.3296 and 1.3411. Now, these deals can be kept open. I do not recommend new sales of the pair yet.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.