The EUR/USD currency pair continued to trade very calmly on Wednesday and inside the side channel, which we have been constantly talking about in recent weeks. The problem is that the pair cannot leave this channel in any way (1.1230 - 1.1353). Over the past month, there have been only two attempts to get out of it and both failed. Thus, although there is a minimal upward slope, the price remains flat. This flat is perfectly visible in the illustration above. Even without the lower linear regression channel, which just shows the lateral direction with a minimal, purely formal upward slope. Thus, from a technical point of view, nothing changes for the euro/dollar pair. Unfortunately, the flat can last as long as you want. Therefore, it is hardly possible to conclude that it will be completed in the next week or two. By the way, for it to end, it may not even require a strong fundamental or macroeconomic background. It often happens that at some certain moment the price comes out of the flat and this is not preceded by any important event. That is, even important events and publications are not very easy to focus on. This week, a Nonfarm Payrolls report will be published, which may contribute to the pair's exit from the side channel. However, this does not mean that it will be so. Pay attention to the movement of the pair at the very beginning of this channel, as well as in its middle. In the beginning, the last Nonfarm Payrolls report was published, and in the middle, the results of the ECB and Fed meetings were summed up. That is, even such important events could not affect the current flat. Thus, now we just have to wait for the price to leave the specified range.

Omicron remains a key topic in the foreign exchange market.

But at the same time, it does not affect the movement of the pair in any way. As we have already said more than once, the topic of the next "wave" of the pandemic itself cannot be insignificant. Moreover, it is during this "wave" that anti-records of morbidity are updated almost every day in many countries of the world. In the States, the day before yesterday, a fantastic figure of 1 million diseases was achieved in one day. Recall that during the first "waves" it was believed that 200-300 thousand diseases per day would lead to a complete collapse of the medical system. However, we are already seeing a million infections per day, but because the course of the disease with omicron is much easier than with other strains, no one (practically) sounds the alarm about this. In the States, the government takes only local measures to contain the "coronavirus". A similar situation is observed in the UK and many EU countries. Thus, the markets are waiting for macroeconomic statistics in January and February to see how negative the consequences for the economy from the next "wave" will be. Most likely, it is by these "consequences" that they will judge and make trading decisions based on them. Already, this Friday a report on Non-farms will be published, which will allow us to conclude how much the situation on the labor market in the United States has deteriorated by the end of December. Recall that at the end of November, Non-farm also disappointed traders, and meanwhile the dollar continues to trade in pairs with the euro near its annual highs. That is, the market now finds no reason to buy the euro and sell the dollar. Perhaps the situation will change if Nonfarms are weak again. Perhaps the situation will change after the next Fed meeting, which will be held at the end of this month. In any case, to conclude the possible end of the downward trend (formally, it has not yet been completed), we need something that will support the euro and put pressure on the dollar.

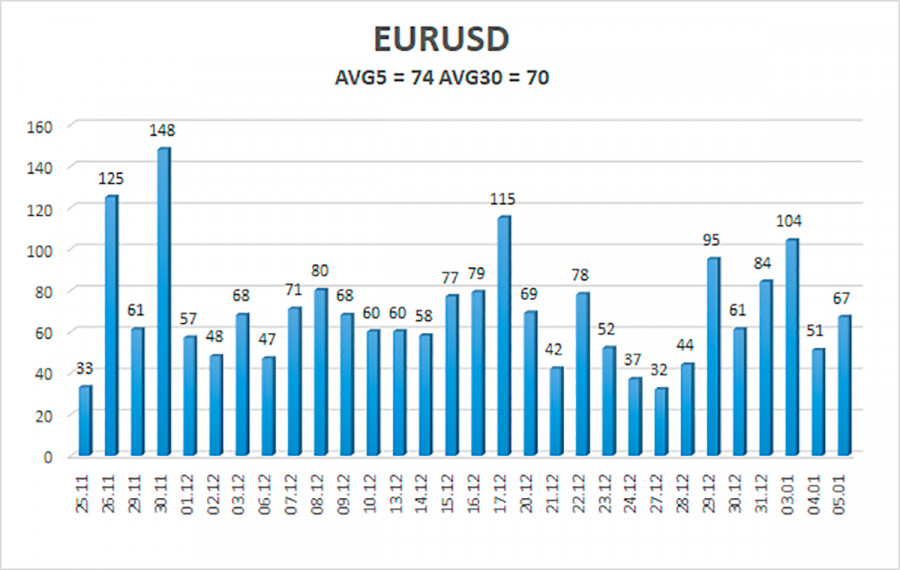

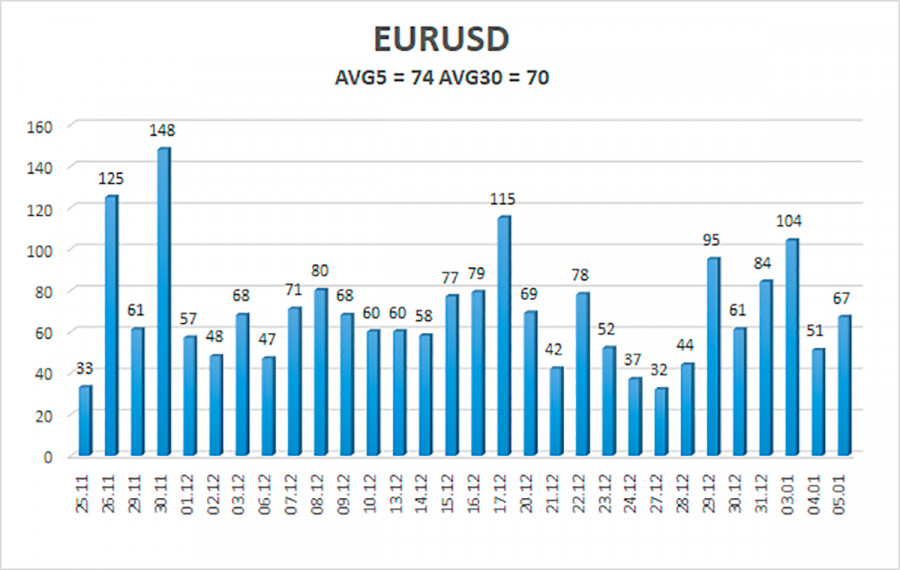

The volatility of the euro/dollar currency pair as of January 6 is 74 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1258 and 1.1406. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement in the limited range of 1.1230 - 1.1353.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to be located inside the 1.1230 - 1.1353 channel. Thus, the movement now remains as lateral as possible and inconvenient for trading. We expect that a downward reversal and a new round of downward movement may occur today. It is good if it will be preceded by a rebound from 1.1353. When overcoming the level of 1.1353, you can try small purchases, but there is no guarantee of a further hike up. The target is 1.1406.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.