The pound/dollar pair continued to grow this week, despite the macroeconomic background. The upward trend continues. In previous articles, we have already said that this week, if we take into account the "macroeconomics", the pair should have fallen most of it, and on Friday it should have grown. However, in reality, the movement was the exact opposite. Thus, we can say that market participants ignored all the most important events and reports. And this applies not only to American data and speeches by Fed members. This also applies to British statistics. On Friday, reports on industrial production and GDP were published, which turned out to be better than forecasts, and in the States, on the same day a disastrous report on retail sales was released, but at the end of the day, it was the American currency that rose in price. Thus, it is far from a fact that all the macroeconomic statistics of the next week will be taken into account by traders. The pound sterling is now really ready for the formation of a new upward trend, since, unlike EUR/USD, it has overcome all the important lines of the Ichimoku indicator. But at the same time, its growth is already almost 600 points in a few weeks and now it's time to adjust at least a little. We want to say that at this time "technology" is more important than the macroeconomic background. The markets also continue to ignore the fundamental background. What has been happening in the UK over the past few years cannot be called anything other than a farce. Even if we do not take into account all the events related to Brexit, the country constantly finds itself in the center of political scandals related to the current government, which is quietly having fun during "lockdowns". Of course, this news does not affect the economy. But for that, the economy is influenced by the decisions that the government makes. Of course, we are talking about a pandemic and its next "wave". Boris Johnson did not want to close the country to quarantine and therefore at this time the daily number of diseases exceeds 100,000. Over the past week, the average daily value has begun to decline, which may indicate the passage of the peak of the "wave". Now it remains only to understand what the consequences for the economy will be.

There will be a lot of macroeconomic statistics in Britain next week. An unemployment report, applications for unemployment benefits, and wages will be published on Tuesday. These are not the most important data, but they can't be called "passable" either. On Wednesday morning, the consumer price index for December will be published and, according to forecasts, this indicator will continue to accelerate and will amount to 5.2% y/y. On Friday, the retail sales report for December will be published. Please note that it was in December that a new "wave" of the pandemic began, so we should expect a deterioration in macroeconomic indicators. There are no important macroeconomic publications scheduled in the States next week. In Britain, a speech by the chairman of the Bank of England, Andrew Bailey, is also scheduled for Wednesday, the first in the new year. Therefore, this may be an interesting event, especially because the British regulator raised the rate in December and now the markets are waiting for information about further actions. Thus, all the most interesting things in the new week will happen in the UK. But will traders react to these events?

Recommendations for the GBP/USD pair:

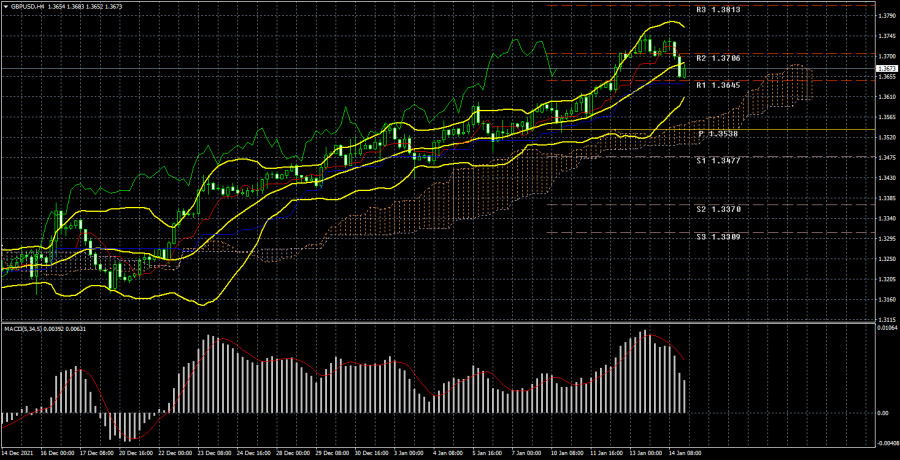

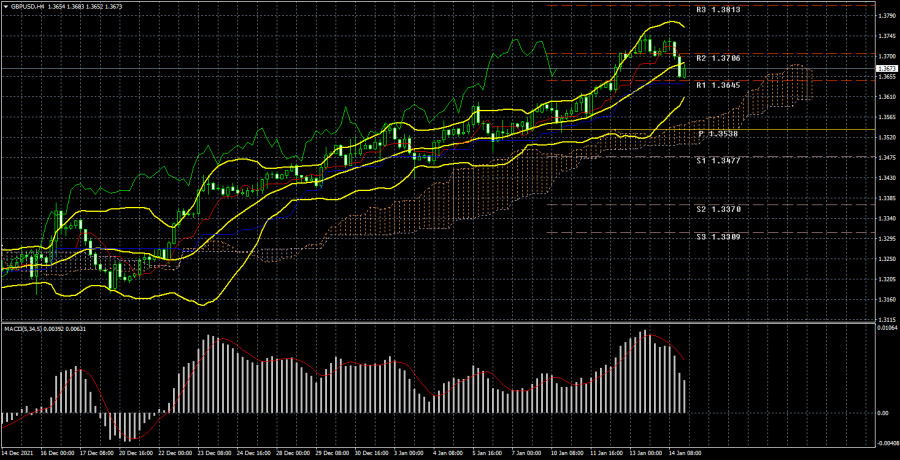

The pound/dollar pair continues its upward trend on the 4-hour timeframe, as evidenced by the Bollinger Bands and Ichimoku indicators. A small correction on Friday failed to break it. Thus, a rebound from the critical line may provoke a resumption of upward movement. However, we still expect that a more tangible correction will begin, at least 200-250 points down, after which we will count on the resumption of the upward trend if the key lines of the Ichimoku indicator on the 24-hour TF resist the onslaught. So far, there are no technical prerequisites for completing the upward trend on the 4-hour TF, which means that trading should continue to increase.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).