The pound/dollar pair traded the same way as the euro/dollar pair this week. In general, the last two weeks have passed in an identical fall of both currency pairs. Thus, we can make an almost unambiguous conclusion that it is the US dollar that is growing at this time, and not the euro or the pound is depreciating. In principle, it is not difficult to guess why the dollar is growing at this time. After all, by and large, there is now only one factor working in favor of the US currency: the future multiple tightening of the Fed's monetary policy. In principle, this is not even just market expectations, it is practically a fait accompli since the US has no other way to curb inflation. Consequently, the US currency gets an excellent opportunity to continue to grow for a long period. Two factors speak against this scenario. The first is a possible repeated increase in the key rate by the Bank of England. In recent years, there has been an impression that the British economy has slipped almost to the level of Zimbabwe after Brexit. However, as practice shows, the situation in the UK is not much worse than in the same European Union, from where it came out with such pathos a little over a year ago. The Bank of England has now clearly chosen its path of development and is no longer looking back at the ECB or the Fed. However, even if a rate increase of another 0.25% is announced in February, this does not mean that the regulator will raise the rate for the whole of 2022. In the case of BA, it's just more about one or two promotions and that's it. At least, neither Andrew Bailey nor other representatives of the regulator have declared their readiness to start a whole course of raising the key rate. The second factor is the same as the euro. At some point, the markets may fully work out all future Fed rate hikes, so the US regulator may continue to tighten policy, but the dollar will stop its growth in the medium term.

Next week, business activity indices in the construction and manufacturing sectors will be published in the UK, and the results of the Bank of England meeting will be announced. As already mentioned, with a probability of 80-90% (judging by current forecasts), the Bank of England will raise the key rate to 0.5%. Moreover, forecasts indicate that all 9 members of the committee will vote "for" the increase. Naturally, such a decision by BA not only can but should provoke the growth of the British currency. Considering that it has been falling for two weeks in a row and non-stop, the correction will not be superfluous.

Several important events are planned in the States as well. Next week will generally be very rich in macroeconomic and fundamental events. On Tuesday, the ISM business activity index for the manufacturing sector will be published, on Wednesday - the ADP report on changes in the number of people employed in the private sector, on Thursday - the ISM business activity index for the service sector, and Friday - the unemployment rate and Nonfarm Payrolls. It is hardly necessary to say that the NonFarm Payrolls report is the most important. Over the past two months, it has been much lower than forecast values. This time, forecasts predict an increase in the number of new jobs created outside the agricultural sector by only 150-200 thousand. However, let's recall the words of Jerome Powell: the labor market is now in good condition, and the main thing now is to lower inflation. We also believe that the ISM indices may affect the movement of the pair during the week. In general, almost every day there will be a report or event that can significantly affect the movement of the pound/dollar pair.

Recommendations for the GBP/USD pair:

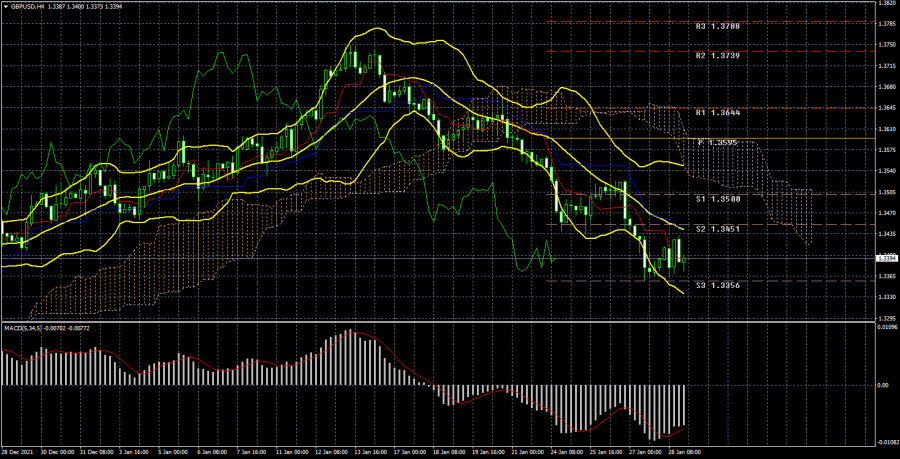

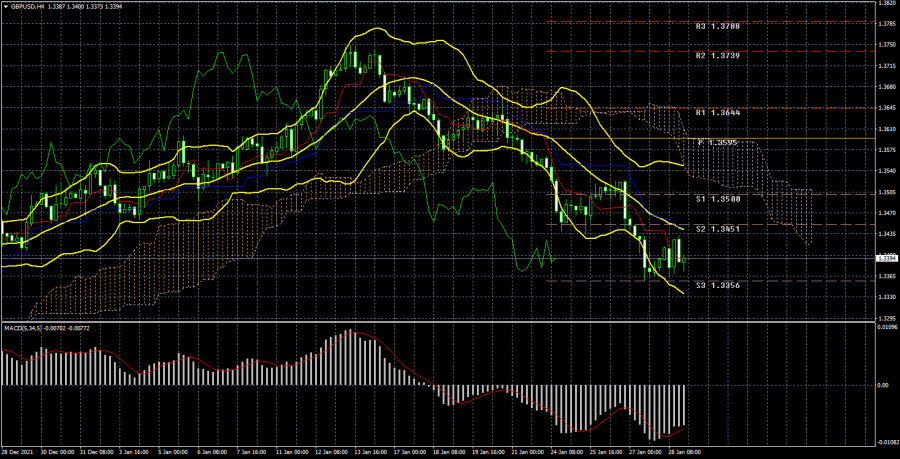

The pound/dollar pair continues a short-term downward trend on a 4-hour timeframe. In general, based on the 24-hour TF, we conclude that the decline may continue, but at least a slight upward correction is needed on the 4-hour TF. In any case, as long as the price is below the critical line, you should sell the pair. Fixing above the Kijun-sen may signal just the correction we talked about. Next week there will be a very strong "foundation" and "macroeconomics", so the pair can often and sharply change the direction of movement.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).