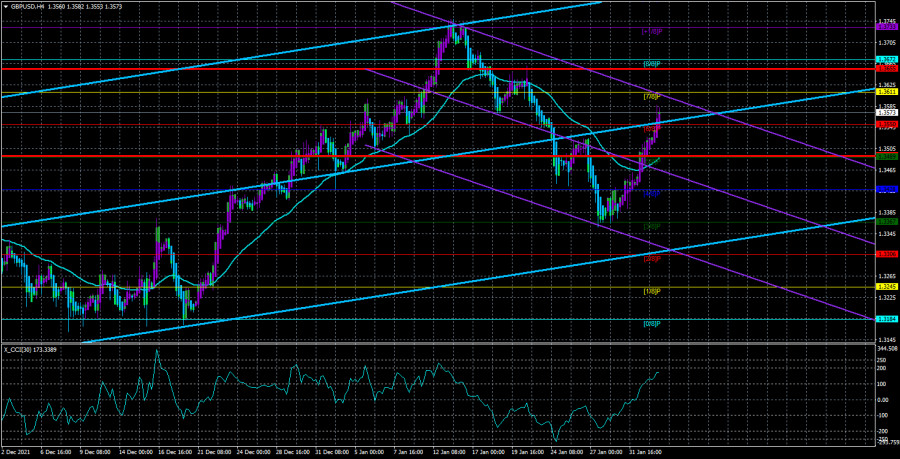

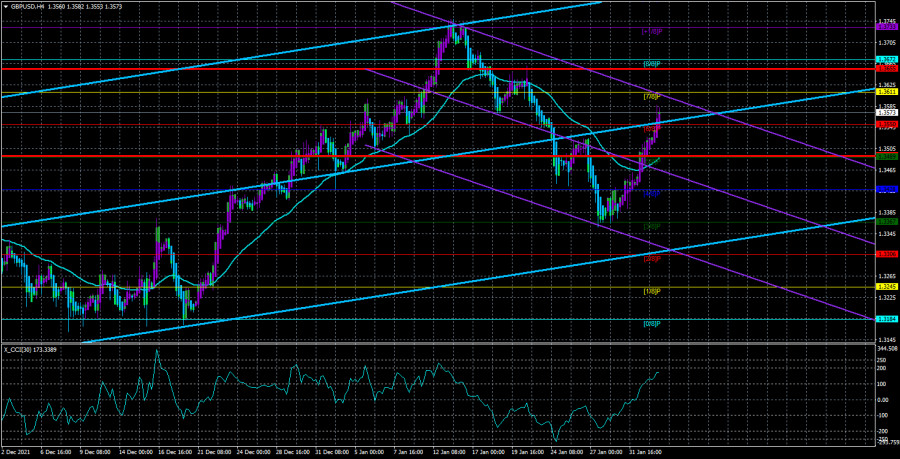

The GBP/USD currency pair continued to grow on Wednesday morning. Just like the EUR/USD pair. Thus, our conclusion made in the euro/dollar article regarding the non-involvement of the EU inflation report in the strengthening of the European currency seems to be 100% correct. If the growth of the euro currency was provoked by strong inflation, then why was the British pound growing at the same time? European inflation has nothing to do with it. And in the UK itself, there was not a single important macroeconomic publication yesterday. There was not a single important event. And not for a long time. Nevertheless, the pound sterling is also growing by leaps and bounds. On the one hand, it still has some support. After all, the probability of a key rate increase by the Bank of England is 95%. Therefore, traders can buy out this decision of the British regulator in advance. However, in this case, the question is different: why is the euro currency growing then? After all, the ECB is not only not going to raise the rate now. It does not intend to do this at all this year. In general, although the movement this week is quite good (the trend is the best friend of traders), we still note some of its strangeness. Perhaps everything will fall into place when the results of the BA and ECB meetings become known today. At least, I want to believe it. The technical picture for the pound sterling is also quite eloquent now. The price has been fixed above the moving average line, so the upward movement continues. Moreover, the Heiken Ashi indicator has never been turned down in three days. Therefore, traders just needed to maintain longs all this time.

A failed report on the US labor market.

Let's move a little away from the UK, the Bank of England, and the British pound. Yesterday, a secondary report on the labor market was published in the States – ADP. It shows the change in the number of jobs in the US private sector. The market rarely reacts to this report. However, we cannot pass by the significance of this report. It showed that the number of employees decreased by 300 thousand in January. Now let's turn to statistics. The last negative value was recorded in December 2020. Then the number of employees decreased by 75 thousand. Even further back is the report for April 2020 - the height of the first wave of the pandemic, quarantines, lockdown - a drop of almost 20 million. It turns out that now, almost out of the blue, the ADP report shows the minimum value for the last almost 2 years? Although many other indicators of the state of the American economy showed steady growth over the same period. It should also be noted that NonFarm Payrolls and ADP reports very rarely correlate with each other. If ADP grows, it does not mean that the number of Non-Farms will also grow. However, what is interesting: the last time a negative value of Nonfarm was recorded in the same December 2020. And even earlier – in April 2020. That is, the match is almost perfect. Now let's remember that the last two reports of NonFarm Payrolls turned out to be weaker than forecasts. There has been a negative trend. And this is although the Fed has not even started raising the key rate yet. Instead, the quantitative stimulus program began to be curtailed. I started just two or three months ago. And if such figures are a reaction to the rejection of QE, then on Friday the Nonfarm report may disappoint buyers of the US dollar for the third time. Given that at the moment the euro and the pound are growing almost synchronously, isn't the main reason precisely in the fall of the dollar, and not in the meetings of the ECB and the BA, not in high inflation in the EU or a very likely increase in the BA rate? What if major market players already clearly understand that Nonfarm Payrolls will fail miserably? And it is against this background that the US currency has been falling since the beginning of the week?

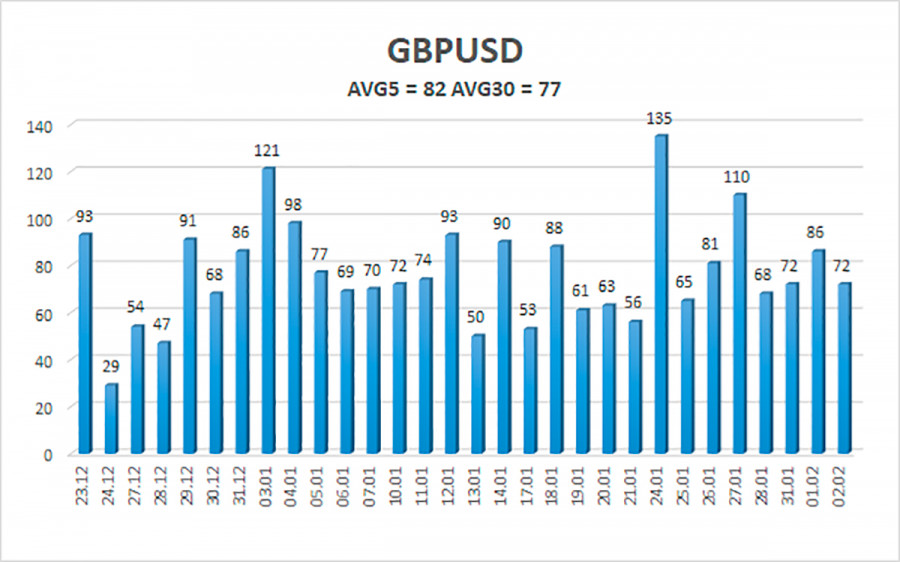

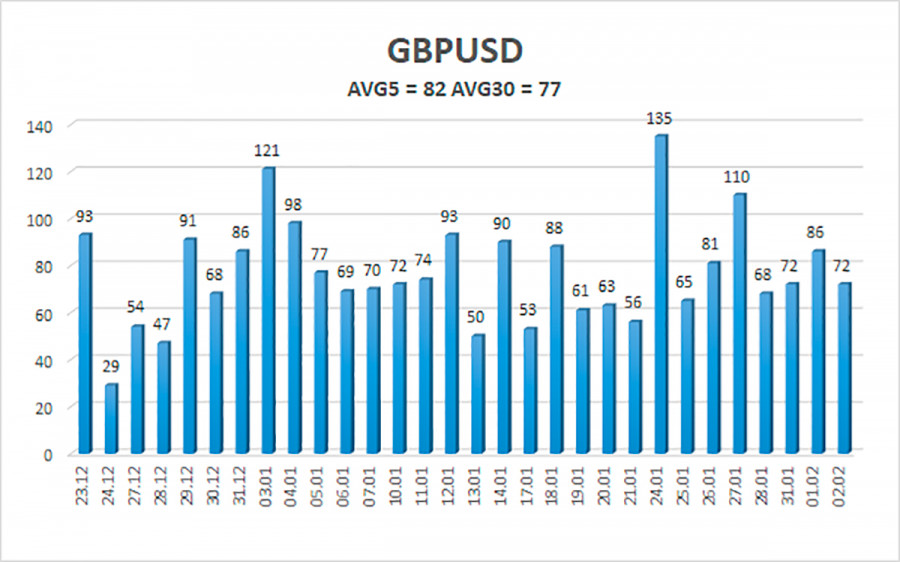

The average volatility of the GBP/USD pair is currently 82 points per day. For the pound/dollar pair, this value is "average". On Thursday, February 3, thus, we expect movement inside the channel, limited by the levels of 1.3490 and 1.3655. The reversal of the Heiken Ashi indicator downwards signals a round of corrective movement.

Nearest support levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest resistance levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading recommendations:

The GBP/USD pair continues to move up on the 4-hour timeframe. Thus, at this time, it is recommended to stay in long positions with targets of 1.3611 and 1.3655 until the Heiken Ashi indicator turns down. It is recommended to consider short positions if the pair is fixed below the moving average, with targets of 1.3428 and 1.3367, and keep them open until the Heiken Ashi indicator turns up.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.