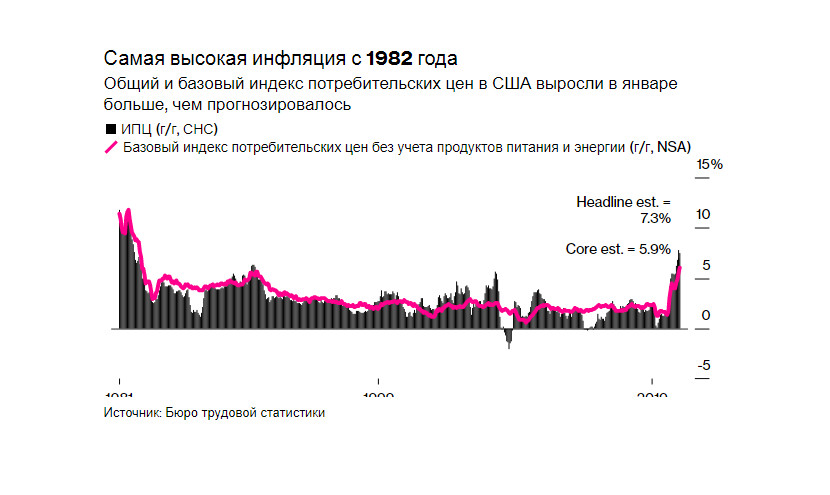

US consumer prices rose solidly in January, leading to the biggest annual increase in inflation in 40 years. Such news could spark debate among investors and traders about the size of the Federal Reserve's interest rate hike next month.

The consumer price index gained 0.6% last month after increasing 0.6% in December, the Labor Department said. In the 12 months through January, the CPI jumped 7.5%, the biggest year-on-year increase since February 1982.

That marked the fourth straight month of annual increases in excess of 6%. Economists had forecast the CPI rising 0.5% and accelerating 7.3% on a year-on-year basis.

Effective with the January report, the CPI was re-weighted based on consumer expenditure data from 2019-2020. The new weights, which are based on spending habits in 2019 and 2020, include changes like a bigger weighting for used cars and trucks - a reflection of how the pandemic changed consumption patterns in the US.

"This is a goods-dominated inflation backdrop," said Tom Porcelli, chief US economist at RBC Capital Markets LLC, who noted that merchandise now has a larger weighting in the CPI. "If the transition from goods to services spending is slower to evolve this year, you could continue to see some additional upward pressure on inflation."

The economy is grappling with high inflation, caused by a shift in spending to goods from services during the COVID-19 pandemic. Trillions of dollars in pandemic relief fired up spending, which ran against capacity constraints as the coronavirus sidelined workers needed to produce and move goods to consumers.

Soaring inflation has reduced purchasing power for households and eroded President Joe Biden's popularity. As many pointed to last year's White House stimulus bill as a key factor in the price rise, Biden's approval ratings took a big hit. This is despite the economy growing at its strongest rate in 37 years in 2021 and the labor market rapidly churning out jobs. Meanwhile, several indicators of wage inflation have risen sharply in recent months.

The Fed is expected to start raising rates in March, to rein in inflation, which has overshot the US central bank's 2% target. However, the amount of the increase remains questionable.

No doubt, the regulator will take into account the impressive rise in inflation. On the other hand, markets are already ready for such news.

Financial markets are predicting a 25% chance of a 50 basis points increase, according to CME's FedWatch tool. However, this figure will now rise, in part because price pressures are intensifying.

Economists, however, believe it is unlikely that the Fed would move so aggressively. They expect the central bank to raise rates by 25 basis points at least seven times this year.

"The Fed does not want to create undue volatility in its first hike, which only makes further increases more difficult," said Scott Ruesterholz, a Portfolio Manager at Insight Investment in New York. "Rather, the Fed would be more likely to guide to an accelerated pace of hikes at consecutive meetings to crack down on inflation."

Food prices rose 0.9% in January, the most in three months, and energy costs also advanced 0.9% on gains in fuel oil and electricity.

Residential electricity costs increased last month by the most in 16 years. From a year ago, food inflation is up 7%, the most since 1981.

Excluding the volatile food and energy components, the CPI increased 0.6% last month after rising 0.6% in December.

In the 12 months through January, the so-called core CPI jumped 6.0%. That was the largest year-on-year gain since August 1982 and followed a 5.5% advance in December.

Rising rents and shortages of goods such as cars, microchips, sports equipment, cosmetics and household chemicals and furniture, with some alarming growth in previously unseen categories such as health services, which have a much greater weight in the PCE deflator, the Fed's preferred price indicator, are fuelling the underlying consumer price index much more than before.

Although imports of goods increased to a record high in December as ships were still able to unload after months of delays due to labour shortages at ports, shortages of goods continue. Vehicle inventories in the wholesale trade rose in December to their highest level in 10 years, reflecting a specific increase in the importance of getting goods to the consumer.

Still, inflation will remain high for a while, in part reflecting the delayed impact of rising wages. Employers are boosting compensation as they compete for scarce workers. There were 10.9 million job openings at the end of December.

Inflation-adjusted average hourly earnings fell 1.7 per cent in January from a year earlier, marking the 10th straight decline.

Shelter costs, which are considered to be a more structural component of the CPI and make up about a third of the overall index, climbed 0.3% from the prior month. The increase reflected the biggest jump in rent of primary residence since May 2001. Owners' equivalent rent also rose. However, the cost of temporary accommodation such as hotels fell by 0.3%, probably reflecting the lower travel intensity of Americans.

Like wage increases, shelter is often considered a "sticky" component of inflation, meaning once prices rise, they're less likely to come back down. A sustained acceleration in structural categories like shelter, rather than surges in volatile CPI components such as energy, presents a more serious threat to the central bank's inflation target.

Still, monthly inflation could slow down in the coming months as supply bottlenecks are removed, as coronavirus infections caused by the Omicron variant subside. However, the process is unlikely to start before May 2022.

Kevin Cummins, one of the leading analysts and economists in the US, believes that the factors that have driven inflation higher in 2021 are only expected to dissipate gradually and are likely to keep pushing inflation higher through the first half of 2022. "We expect that there will be a shift from goods inflation, particularly motor vehicle and commodities prices to more persistent services inflation, such as wages and heavily-weighted rents," he said.

A separate report from the Labor Department on Thursday showed initial claims for state unemployment benefits fell 16,000 to a seasonally adjusted 223,000 for the week ended February 5. Economists had forecast 230,000 applications for the latest week. Claims increased from the beginning of January through the middle of the month as Omicron raged across the country. They have dropped from a record high of 6.149 million in early April 2020.

US Treasury yields rose, the dollar gained, and the S&P 500 fell at the opening of trading. A broad sell-off should be expected during this and the next trading session, including in the Asian sector.

Notably, economists underestimated the monthly change in CPI in eight of the last 10 months.