The EUR/USD currency pair on Friday spent most of the day trying to maintain a bullish mood after eventually collapsing on Thursday after the publication of the US inflation report. It should be noted that we consider the growth of the dollar against the background of strong inflation in the United States a logical outcome. We just don't understand why from the very beginning the dollar was falling in price against its main competitors. However, the market's reaction to important macroeconomic reports is not always unambiguous and as desired. However, how to explain the fall of the European currency at the end of Friday? Recall that the fall began about 4 hours before the close of trading. It is quite possible that it was provoked by the speech of Christine Lagarde, who once again openly stated that there would be no rate hike this year since the European economy is too weak. But in this case, why did the pound sterling fall synchronously with the euro currency? After all, European monetary policy has nothing to do with the pound.

It is also completely unclear why the markets reacted so violently to a completely ordinary saying of the head of the ECB. Her words are exactly what she's been saying for more than a year. They absolutely should not have become something unexpected for the market. If you dig even deeper, there are still questions about the growth of the European currency immediately after the ECB meeting the week before last and, in general, the entire growth of the euro that week. After all, immediately after the meeting of the European regulator, there was also no reason to buy the euro. In general, in the last couple of weeks, the European currency has grown undeservedly, and we conclude that this growth was purely "technical". Moreover, not even provoked by technical signals, but provoked simply because of the need to adjust from time to time. As a result, the correction is most likely completed and, logically, the pair should now resume falling.

EU: forecasts are getting worse, the rate is not rising, prices are rising.

We have already said earlier that the economic situation in the European Union is now, if not difficult, but rather stalemate. After all, economic growth is minimal, which means it is impossible to raise the key rate, as this will further slow it down. Consequently, there is nothing to influence inflation with. Yes, this year the EU is also going to completely abandon the QE program, but, as we could see in the example with the US, this measure does not stop the consumer price index. It continues to grow. Therefore, in the near future, inflation in the EU may continue to accelerate and what the ECB will do about it is still completely unclear. Since monetary policy will not be tightened in the EU, but it will be in the US, it is reasonable to assume that the European currency will continue its decline. For a long time, we believed that the downward trend of 2021 for the euro/dollar pair was about to end, but new factors suggest that the dollar may continue to rise in price throughout 2022. Moreover, contrary to Christine Lagarde's hopes, oil and gas prices continue to rise, the pandemic does not recede, so it is not possible to solve problems with supply chains. Therefore, we would say that now, on the contrary, inflation has a whole layer of fertile soil to continue to grow.

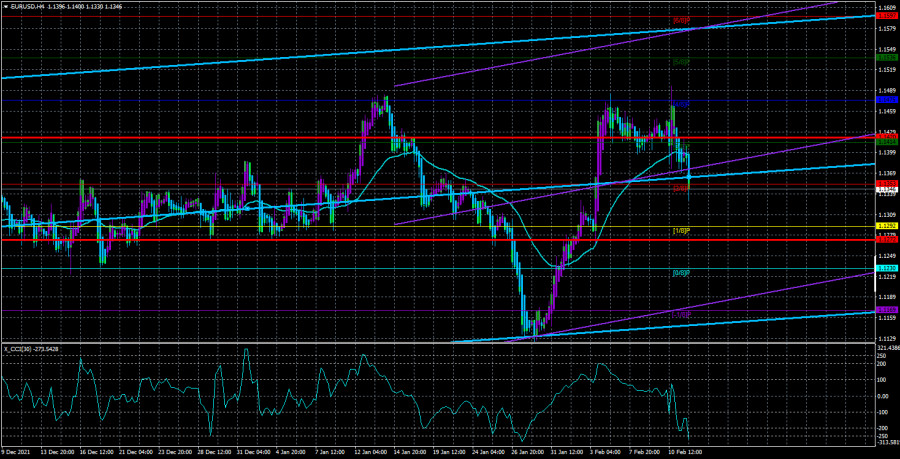

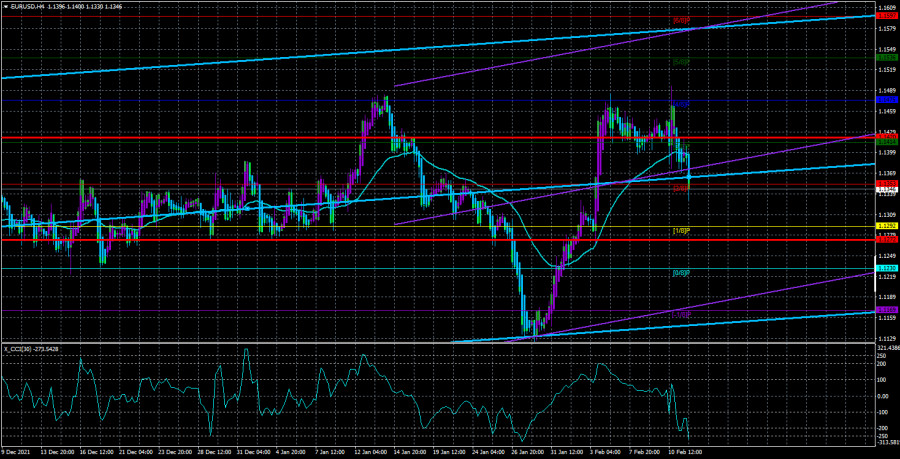

On the 4-hour TF, the pair returned below the moving average line, so the trend is now descending again. A very important point is that the pair bounced twice last week from the Murray level of "4/8" - 1.1475. And a few weeks ago, it also could not overcome it. Therefore, it is reasonable to assume that there are pending sell orders located near this level, which are triggered as soon as the price approaches this level. As a result, we believe that now the pair can return to the annual lows near the 11th level and even continue the medium-term downward trend. We do not see any fundamental reasons why the euro currency can continue to grow.

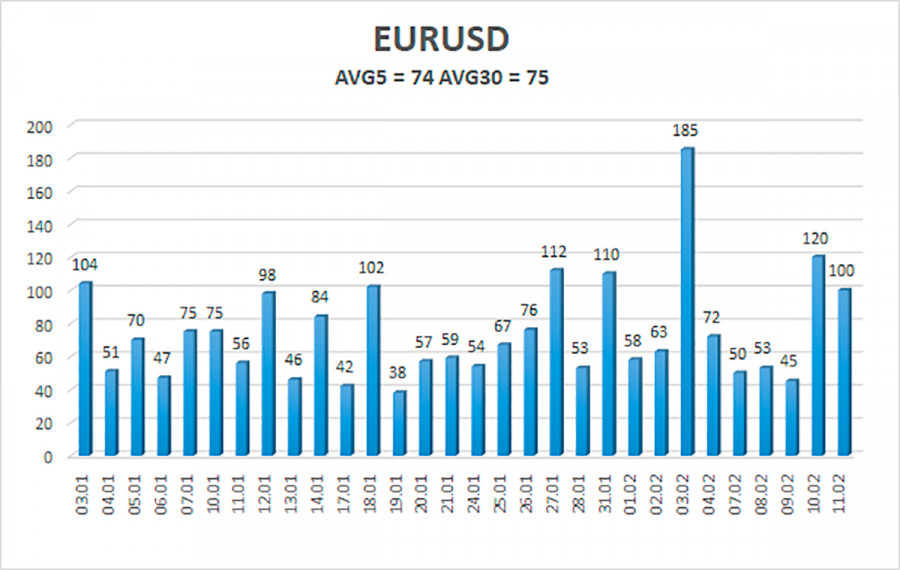

The volatility of the euro/dollar currency pair as of February 14 is 74 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1272 and 1.1420. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair has consolidated below the moving average line. Thus, now you should stay in short positions with targets of 1.1292 and 1.1272 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than fixing the price above the moving average with a target of 1.1475.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.