The EUR/USD currency pair continued to trade very calmly on Wednesday. During the day, there was an increase in the quotEs of the euro currency, but the overall technical picture continues to speak in favor of the growth of the US currency. We have already talked earlier about the extremely important rebound from the 1.1475 level. And there were even three such bounces. Thus, in the near future, of course, the pair may once again return to this level and even try to gain a foothold above it once again, but we remind you that there were no good fundamental reasons for the growth of the euro either. Moreover, from our point of view, the euro is now just clinging to the last straw, which can break in at least three places. Quite unexpectedly for many, a week or a little more ago, the topic of geopolitics came out on top in the markets. Although the Russian Federation has been accumulating its troops on the border with Ukraine for several months, it was a week ago that the general hysteria about this began. Many Western media even called the exact date of the Russian invasion of Ukraine. However, all these dates have already been left behind, there is no invasion, negotiations are continuing, and the market has finally asked the question: were there any plans in Russia to attack Ukraine at all? Yes, there is still more than 100 thousand Russian military personnel on the border. Naturally, few people believe that it is in these territorial districts that exercises are held. But building an army near the border and starting a full-scale war are completely different things. Of course, the risk of a military conflict was, is, and will continue in the near future, but both in the West and Moscow understand that Ukraine is not Chechnya, Afghanistan, or Iraq. Ukraine has more than 40 million inhabitants, and its territory is much larger than that of the above-mentioned countries. Thus, if you get involved in a war, then it is serious and for a long time. Is it worth saying that spending war is a very expensive business and no one will just start it?

For many, the date of February 16 was something like the "X hour".

As a result, we get a stalemate when time is running out, the Russian military continues to stand on the border with Ukraine, some units have even begun to return to their bases, and negotiations are at an impasse. This situation needs to be solved somehow and the course is now clear for Moscow. Since neither the West nor Kyiv made any concessions, Moscow is unlikely to withdraw troops. This will mean her diplomatic defeat and will put her in a ridiculous position in front of the whole world. It turns out like this: they came, shook their weapons, and left with the words "well, it didn't work out, it didn't work out that way." At the same time, in recent weeks, the top officials of the Russian Federation have continued to say that they have no plans to invade Ukraine, they are moving troops on their territory and are not obliged to report to the West about these movements. Therefore, Moscow can at any moment make a "horse-back move", withdraw troops and say that the exercises have been completed, and we don't know what the West has been hysterical about all this time. The only question remains, will Moscow want to do so?

Here, of course, we are not talking about the Ukraine-Russia confrontation, but about the US-Russia confrontation. The West is not against using Ukraine to host NATO bases, although no one is talking about it directly. No one except Moscow, just believes that it is completely unwise to place US military bases 50-100 km from Russian military bases. Vladimir Putin said that such a close location of the military bases of two eternally opposing two nuclear powers could lead to a third world war. Moreover, if Ukraine joins NATO and tries to return Crimea or Donbas by force, then NATO will also have to take part in this war. There will be a NATO-Russia confrontation, and this is a full-scale Third World War. Thus, the parties should find a way out of the situation in the near future, and the risk of a military conflict will persist as long as the Russian army continues to be near the Ukrainian borders.

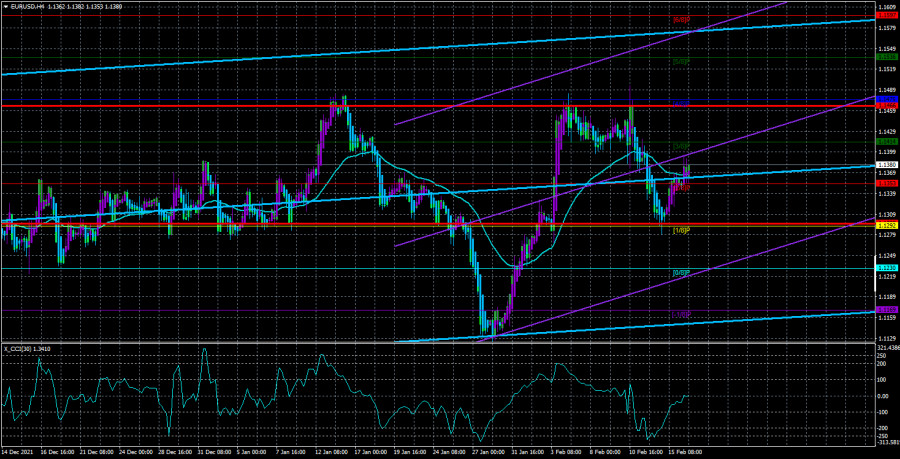

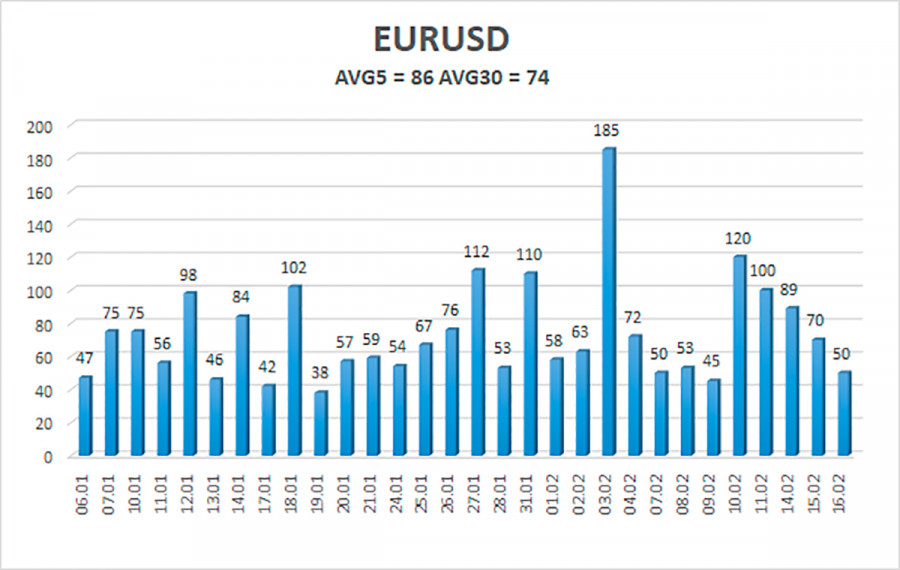

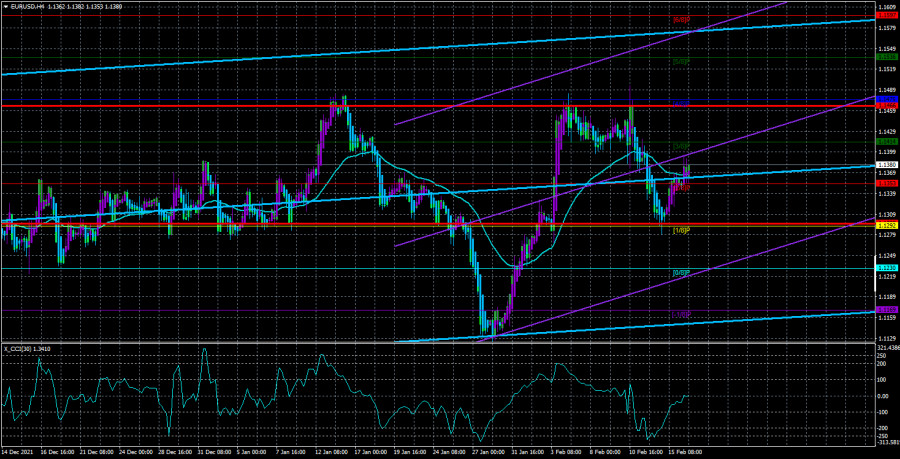

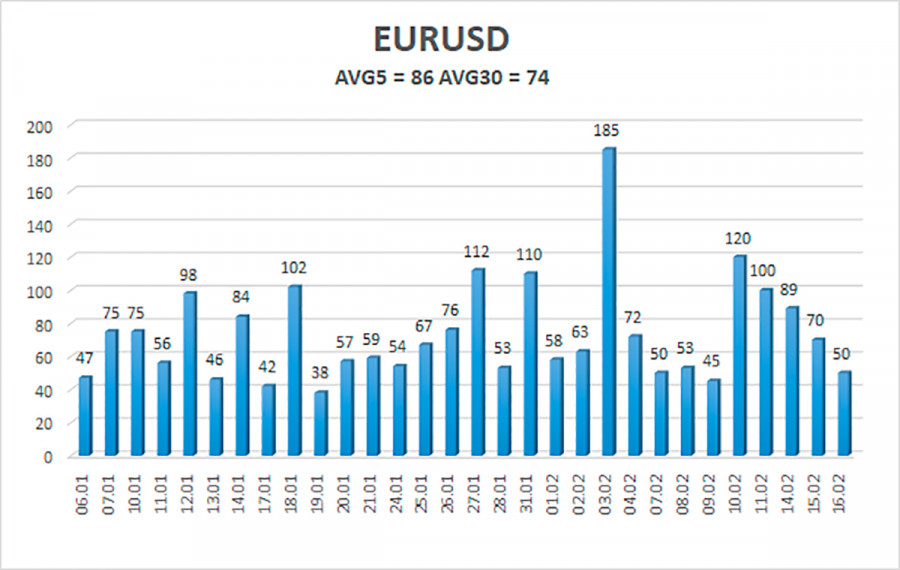

The volatility of the euro/dollar currency pair as of February 17 is 86 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1294 and 1.1466. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading recommendations:

The EUR/USD pair has consolidated above the moving average line. Thus, now we should consider staying in long positions with targets of 1.1414 and 1.1466 until the Heiken Ashi indicator turns down. You should open short positions no earlier than fixing the price below the moving average with a target of 1.1294.

Explanations to the illustrations:

Linear regression channels - help determine the current tr