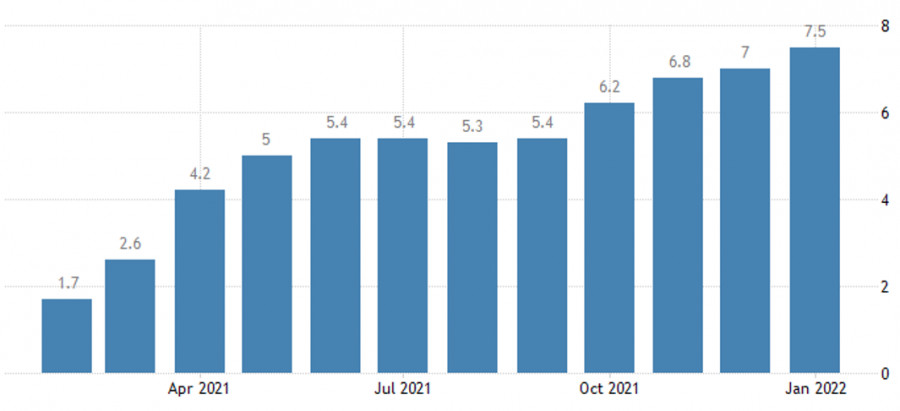

Many experts recently said that February will be the peak of consumer inflation in the U.S., but after recent events, especially in the energy market, inflation of 8.0% may be just the beginning of what the U.S. will face in the near future.

A very important report on the consumer price index in the United States will be released today. Inflation is forecast to jump to 7.8% in February from last year, the highest level since 1982. But already now there are those who are confident in inflation around 8.5%, and this will not be the end, but only the beginning of problems for the Federal Reserve System and the country's economy.

The military special operation of Russia on the territory of Ukraine and the sanctions that followed immediately after that from the EU, the USA and a number of other countries spurred energy prices to such highs, from which to return very quickly will be quite difficult. Strict restrictions for the Russian economy will not pass without leaving a trace for the commodity market, since practically the entire European continent is directly dependent on oil and gas supplies for the normal functioning of the economy.

It is expected that in the next six months there will be a lot of noise in the oil and gas market, in which it will become difficult to make out where the real prices are, and where the impact of sanctions and speculators.

Americans are already facing multi-year inflation that is outpacing wages, and the situation is only going to get worse. Geopolitical tensions have already driven food prices to record highs, with the average gas price at $4.25 a gallon. In some states, it even exceeds $5. Fuel prices will continue to rise, as yesterday it became known that the United States is introducing a ban on the import of Russian oil.

A new bill by the House of Representatives bans the import of Russian crude oil, liquefied natural gas, coal, and refined products such as gasoline and kerosene. The bill will enter into force 45 days after its adoption. According to American politicians, this was a response to the escalation of the conflict between Russia and Ukraine after the start of a military operation on its territory. Russia, in response to Biden's decision, issued an order stating that in response it would restrict trade in certain goods and raw materials, but did not mention key details of which categories of goods could be affected.

Some economists are already acknowledging that an oil shock will slow U.S. growth, but it certainly won't be enough to completely undermine the recovery, which is being driven by a strong labor market and an easing of Covid-related restrictions. As early as next week, the Federal Reserve is expected to raise interest rates for the first time since 2018, and rising energy prices will only add uncertainty to the central bank's rate hike cycle this year and next.

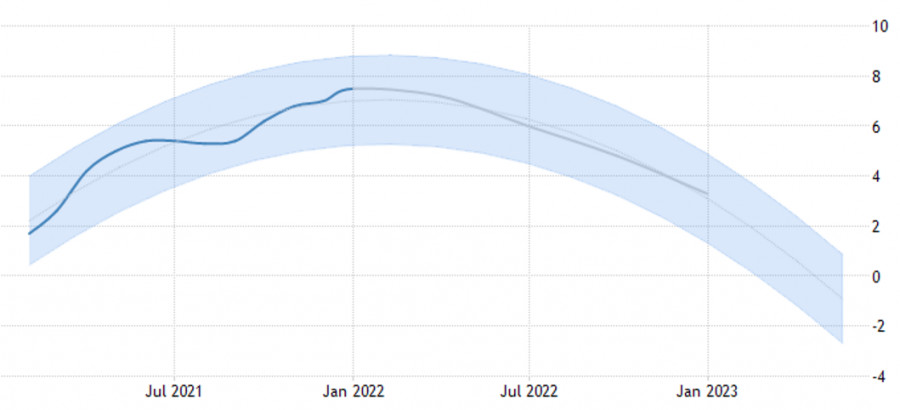

The CPI report, released on Thursday, will reflect the recent rise in oil prices, but most of it will be visible only in the coming months, since the active growth in energy products occurred just at the end of February this year. The data will also give a good indication of future prices for cars, home furnishings and housing. Already, the cost of housing, including rent, is rising steadily in the U.S., and this trend is expected to continue for the foreseeable future. Economists expect CPI growth on an annualized basis to average 7.7% per annum, compared with 7% reflected in the February survey. The consumer price index is also expected to rise by 4.5% over the past three months, more than a percentage point above the previous forecast.

Experts also note that the observed increase in food prices in itself will not have such a big impact on overall inflation as a similar increase in oil prices, however, consumer dissatisfaction is already obvious, who are clearly running out of money faster than they planned. Food and gasoline make up nearly one-fifth of the U.S. consumer basket, and that share is set to rise sharply in the near future for low-income households.

In addition to higher food and gas costs, Americans are simultaneously dealing with higher rents and utility bills. Economists at Barclays Plc expect the surge in energy prices to reduce consumption growth by 0.3 percentage points year-on-year, on average for the quarter to the end of 2023. It is also expected that consumer sentiment in the U.S., fall to a new ten-year low in early March, according to the University of Michigan. The report is scheduled for release this Friday.

Economists from Barclays Plc note that the U.S. economy has become much more resilient to changes in oil prices compared to past decades. Fortunately, the blow to energy prices comes at a time when the U.S. economic recovery is strong enough and on solid footing.

Note that according to the U.S. Department of Labor, 678,000 jobs were created last month, and the unemployment rate approached pre-pandemic levels. And while pandemic relief programs have been phased out, consumers are still sitting on a "significant pile" of excess savings. The downside is that wages have not kept pace with inflation and could fall further.

As for the technical picture of the EURUSD pair

The euro is responding with growth to the expected data on inflation in the U.S., and traders are rapidly fixing profits. Although euro bulls have returned to resistance around 1.1100, which keeps the demand for a trading instrument, however, geopolitical tensions around Russia and Ukraine will limit the upward potential of the pair. Euro buyers need to consolidate above 1.1140, which will allow to continue the correction to the highs: 1.1230 and 1.1310. A decrease in the trading instrument will be met with active purchases in the 1.1000 area. However, the area of 1.0880 remains the key support level.

As for the technical picture of the GBPUSD pair

The buyers of the pound showed themselves after the recent major fall of the pair, and are now focused on the resistance of 1.3194. The return to control of this range will allow us to count on a more powerful correction of the pair in the area of 1.3240 and 1.3320. However, the prospects for growth are overshadowed by Russia's military operation on the territory of Ukraine. If we go below 1.3140, then the pressure on the trading instrument will increase. In this case, we can expect a repeated fall to 1.3085 and the exit of the trading instrument to new lows: 1.3030 and 1.2920.