On Wednesday, EUR/USD jumped 100 pips. In yesterday's article, we tried to figure out the reasons behind such notable growth in EUR. It was amazing because most factors (if not all of them) still prop up the US dollar's strength. We had two assumptions. Technically, EUR rebounded off 1.0809. Fundamentally, US oil inventories expanded last week 9 times as large as in the consensus. However, we found out on Thursday that both assumptions were wrong. On Thursday, EUR/USD plummeted by the same 100 pips that it gained a day earlier. There were formal reasons for the fall in EUR. For example, the ECB completed its policy meeting that was wrapped up by Christine Lagarde at the press conference. What was the underlying reason for massive sell-offs of EUR if Lagarde's rhetoric did not turn either hawkish or dovish? Why did EUR take a nosedive if the ECB did not make any drastic decisions?

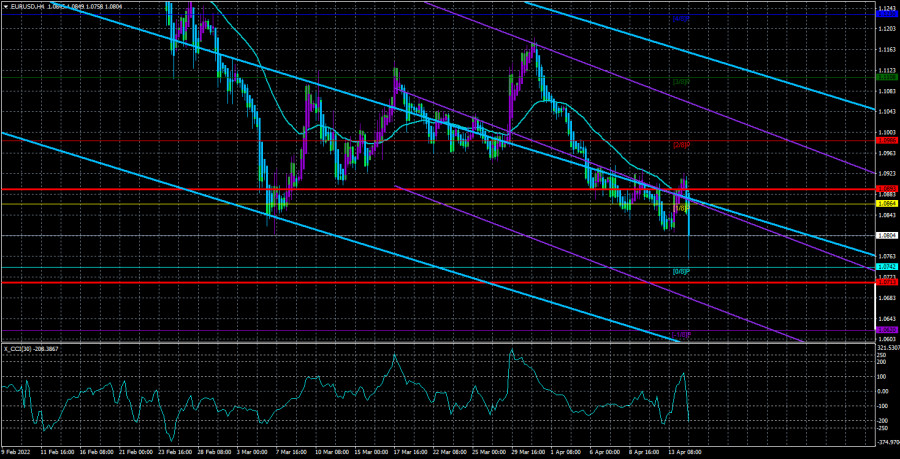

Let's analyze. The move of 100-150 pips is considered highly volatile. Such price action occurs rather seldom. In the context of the ECB policy meetings, the pair gyrates this way if monetary policy is significantly adjusted or if the ECB President makes meaningful statements. Nothing of this kind happened yesterday. So, we make a conclusion that EUR fell steeply on Thursday following a spike on Wednesday. It sounds like a paradox. I assume that some traders expected the ECB to come up with more hawkish statements next day. Alternatively, it could have been a trap for other traders as the market was rocked artificially. On Thursday, the trajectories came back to logical. By the way, the pound sterling also dropped on Thursday, though it has nothing to do with the ECB meeting. By and large, the market was weird in the last two days. At the same time, EUR/USD had nice price action. Technically, EUR again made a failed attempt to cross a moving average. Later on, it reversed to its 15-month lows as expected. Now EUR is expected to make the third attempt to surpass 1.0806(1.0809).

ECB hands are tied

In essence, it does not make sense to expect any decisions from the ECB. Christine Lagarde will hardly make any fresh comments either. The EU economic conditions are so ailing in the EU that ECB policymakers are not able to drop any hints or add ambiguity to their speeches. Christine Lagarde reiterated that the ECB does not aim to catch up with the Federal Reserve because the US economy is more resilient than the European. Thus, the ECB cannot afford to raise interest rates in the year ahead. Moreover, the ECB's APP stimulus program is still running. It will be completed by Q3 or in Q3 2022. Therefore, the ECB is still providing stimulus to the economy, thus supporting inflation. Indeed, the regulator is still injecting dozens of billions euros in monetary stimulus. Did anybody expect the central bank to raise interest rates or withdraw APP program?

The same is about Lagarde's rhetoric. What could she announce if the European economy is slipping into recession and stagflation? Besides, an energy and food crises are on the horizon. Christine Lagarde expanded on these burning issues at the press conference. She noted that the military conflict between Russia and Ukraine entails a variety of risks to the EU economy that is dependent on both Ukraine and Russia. The longer the conflict lasts, the worse things are getting for the EU. Under such economic conditions, the EU might need new stimulus but not tighter monetary policy. To begin a new stimulus program now means to welcome two-digit inflation. Thus, the ECB can do nothing with either inflation or the geopolitical conflict in Ukraine. The EU is committed to its supplies of weapon, humanitarian and financial aid to Ukraine. The RU also has hosted a few million refugees from Ukraine. On the one hand, the authorities help Ukraine to withstand the challenge. On the flip side, it drags on the hostilities.

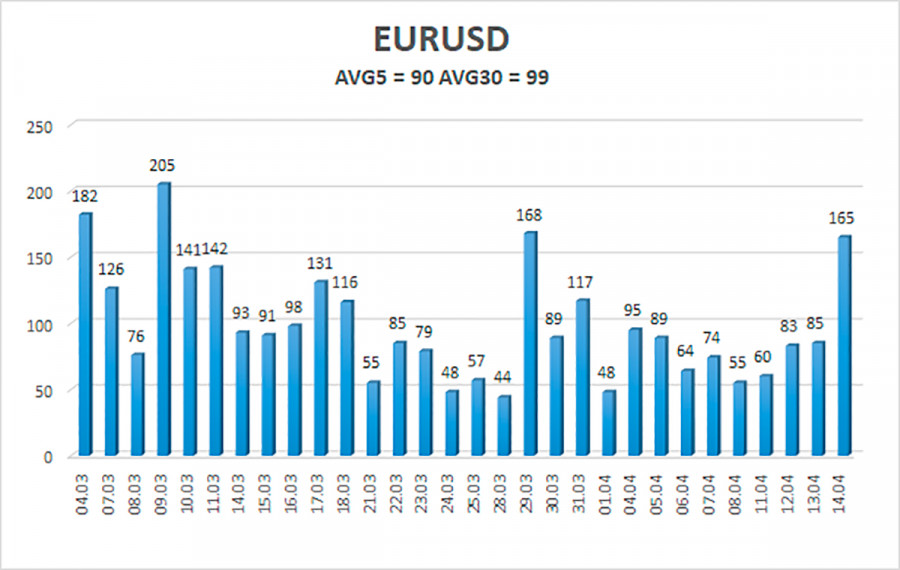

Volatility of EUR/USD on April 15 is measured at 15 pips and characterized as high. So, the currency pair is expected to trade between 1.0713 and 1.0893 today. A reversal of Heikin-Ashi upwards signals a new upward correction.

Nearest support levels

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading tips

Currently, EUR/USD is below the moving average. Thus, it would be wise to keep short positions with targets at 1.0742 and 1.0713 until a reversal of Heikin-Ashi upwards. If the pair settles above the moving average, we could open long positions with the target at 1.0986.

Explanations of the illustrations:

Linear regression channels help to determine the ongoing trend. If both are pointed in the same direction, then the current trend is strong now.

Moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator signals its entry into the oversold area (below -250) or into the overbought area (above +250). It means that a trend reversal in the opposite direction is around the corner.