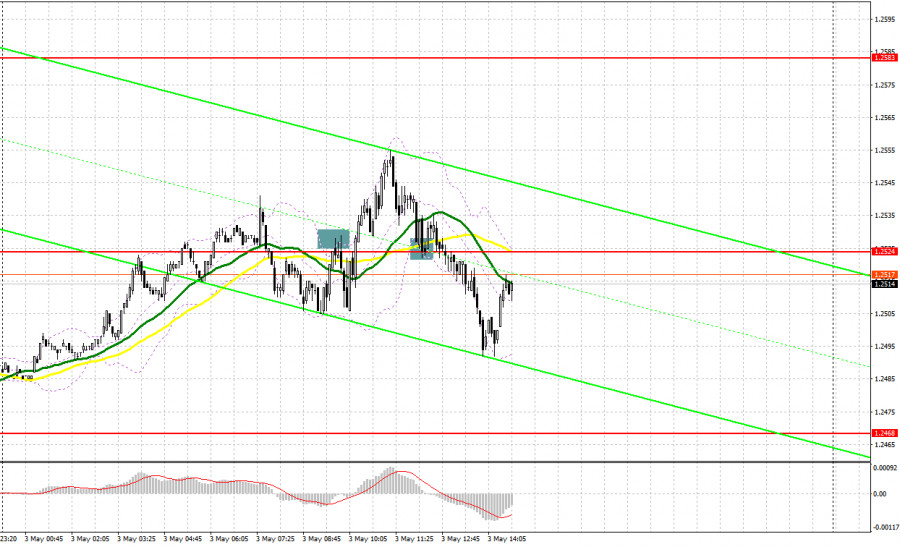

In my morning forecast, I paid attention to the level of 1.2524 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. The unsuccessful attempt of the bears to break above 1.2524 from the first time led to a false breakdown and a signal to sell the pound. Unfortunately, the released good data on production activity limited the downward potential, so the downward movement was about 20 points. After that, the bulls achieved a breakthrough of 1.2524 with a reverse test from top to bottom. This led to a buy signal, but it turned out to be unprofitable. After moving up by 10 points, the bears regained the initiative. And what were the entry points for the euro this morning?

To open long positions on GBP/USD, you need:

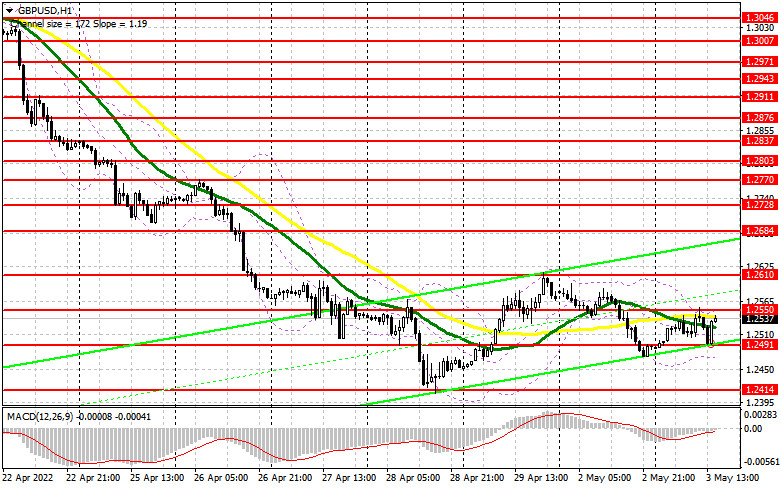

Due to several not quite profitable signals in the first half of the day, I revised the technical picture. During the American session, several not very important statistics are released, so we can count on another attempt by the bulls to seize the initiative. Reports on changes in the volume of production orders and the level of vacancies and labor turnover from the Bureau of Labor Statistics are expected. Very good indicators will lead to a decline in GBP/USD in the afternoon, which new buyers can and should take advantage of - if they exist. In this case, only the protection of the nearest support 1.2491, formed at the end of the first half of the day, as well as the formation of a false breakdown on it will give a signal to open long positions against the trend in the expectation of continuing the upward correction and a breakdown of 1.2550, which we failed to do in the first half of the day. You can expect a more sharp upward jerk, but only after the demolition of the bears' stop orders above 1.2550. A test of this level from top to bottom will give a buy signal already with the aim of correction to the area of 1.2610. A similar consolidation above this level will lead to the highs: 1.2684 and 1.2728, where I recommend fixing profits. In the case of a decline in the pound and the absence of buyers at 1.2491, it is best to postpone purchases until the next support of 1.2414. I also advise you to enter the market there only if there is a false breakdown. It is possible to buy GBP/USD immediately for a rebound from the minimum of 1.2369 and only for a correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

The bears retreated, but they did not stop controlling the market. In the case of GBP/USD growth during the US session after weak US data, sellers should do everything to keep the pair above 1.2550. The formation of a false breakdown at this level will be an excellent sell signal. You can also count on a breakdown of the 1.2491 level, but only after strong statistics on the United States. A breakout and a reverse test from the bottom up of this range will lead to the formation of an additional sell signal that can collapse the pound to lows in the area of 1.2414, where I recommend fixing the profits. The 1.2369 area will be a more distant target, but it will be quite difficult to hope for the implementation of this scenario. With the option of further growth of GBP/USD and the lack of activity at 1.2550, which is more likely to be true, a new upward jerk may occur against the background of the demolition of stop orders. In this case, I advise you to postpone short positions to a larger resistance of 1.2610, from where the bears recently staged a good sale. I also advise you to open short positions there only in case of a false breakdown. You can sell GBP/USD immediately for a rebound from 1.2684, counting on the pair's rebound down by 30-35 points within a day.

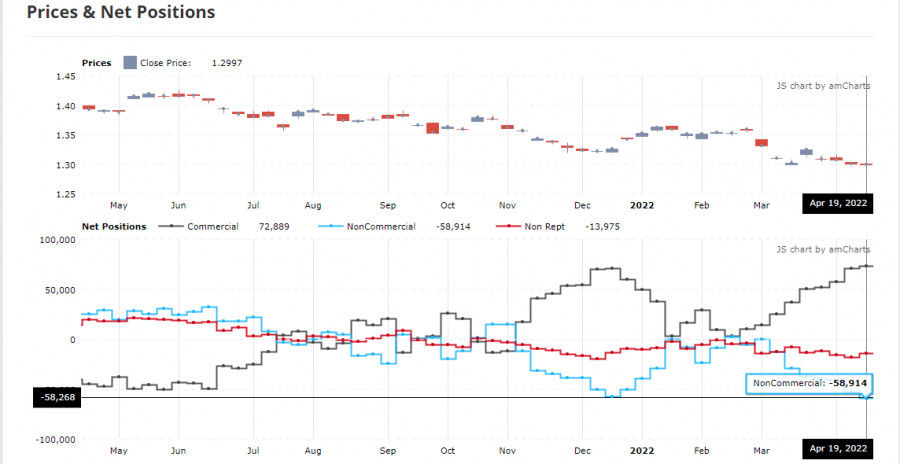

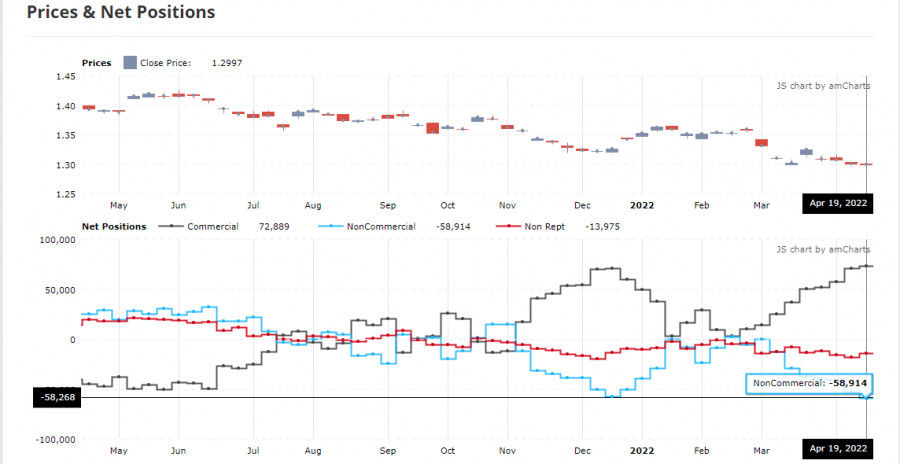

The COT report (Commitment of Traders) for April 19 recorded an increase in both short and long positions, but the former turned out to be much larger, which is obvious if you look at the GBP/USD chart. Things are very bad in the UK economy, which was confirmed last week by the Governor of the Bank of England, Andrew Bailey. His statements that the economy is heading towards recession were the last straw holding back the sellers of the pound in the second half of April. As a result, the breakdown of the finished minimum and a new major sale of the pound have already driven the trading instrument below the 26th figure and it seems that this is not the end. The growth of the consumer price index is steadily moving towards double-digit indicators, and the increasingly complicated situation in the world due to supply chain disruptions against the background of a new wave of COVID-19 in China creates even more problems. The situation will only worsen, as future inflation risks are now quite difficult to assess due to the difficult geopolitical situation, but the consumer price index will continue to grow in the coming months. The situation in the UK labor market, where employers are forced to fight for every employee by offering higher and higher wages, is also pushing inflation higher and higher. The pressure on the pound is also growing for another reason - the aggressive policy of the Federal Reserve System. Already during the May meeting, the committee may announce an increase in interest rates by 0.75% at once - they do not have such problems as in the UK with the economy yet. The COT report for April 19 indicated that long non-profit positions rose from the level of 35,514 to the level of 36,811, while short non-profit positions jumped from the level of 88,568 to the level of 95,727. This led to an increase in the negative value of the non-commercial net position from -53 054 to -58 268. The weekly closing price decreased from 1.3022 to 1.2997.

Signals of indicators:

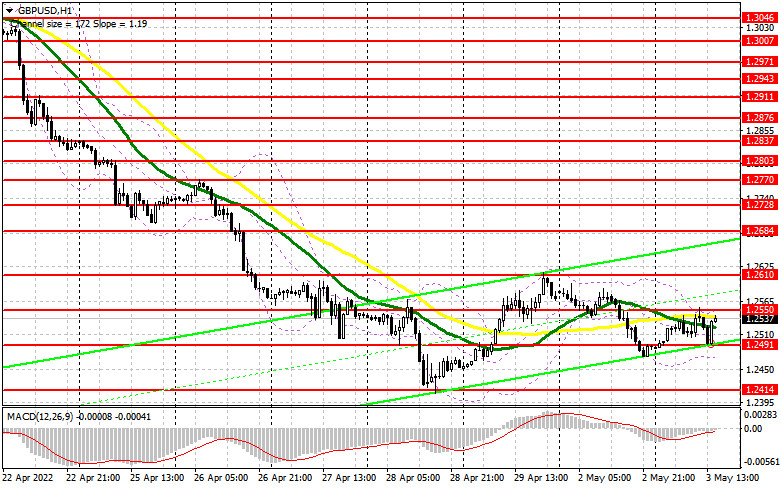

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates the lateral nature of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the lower limit of the indicator around 1.2470 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.