US Nonfarm did not disappoint, but did not impress market participants either. Despite the "red color" of the main indicator (the unemployment rate remained at 3.6%, despite the forecasted decrease to 3.5%), all other components came out in the green zone. The EUR/USD traders reacted quite calmly to the report, without creating a frenzy around the greenback. The bulls even managed to organize a slight correction, rolling back to the borders of the 6th figure. But the bears woke up in this price area, opening positions at a better price. In general, neither bears nor bulls EUR/USD dare to take any active actions of a large-scale nature. First of all, the Friday factor has an effect: traders take profits and do not risk re-entering short positions on the eve of the weekend. Therefore, in this case the Nonfarm is a time bomb. Most likely, the market will play this report next week.

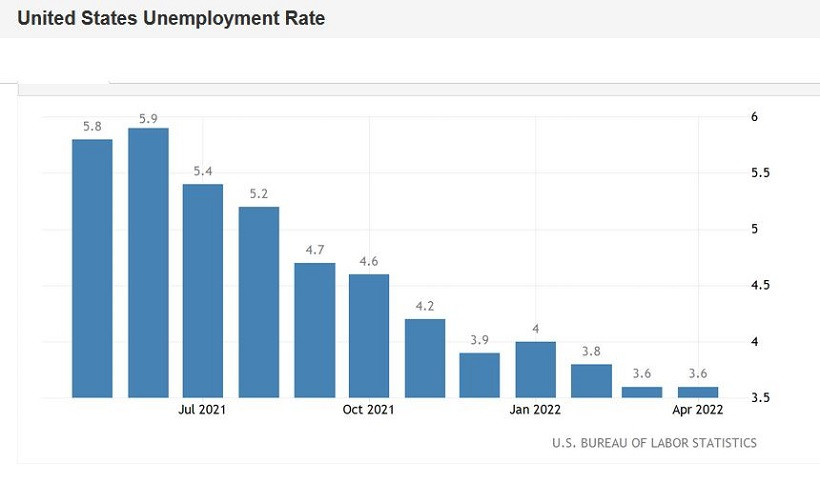

It cannot be said that the release is controversial, with its own strengths and weaknesses. After all, on one side of the scales - only the unemployment rate, which disappointed traders only by the fact that it came out at the level of the previous month. On the other side are all other components of the release that exceeded the predicted values. However, one should not forget here that the unemployment rate is currently in the area of 26-month lows. The last time the indicator was at 3.6% was in February 2020 (that is, before the coronavirus crisis), and before that, back in 1969. Therefore, it is impossible to talk about any disappointment here.

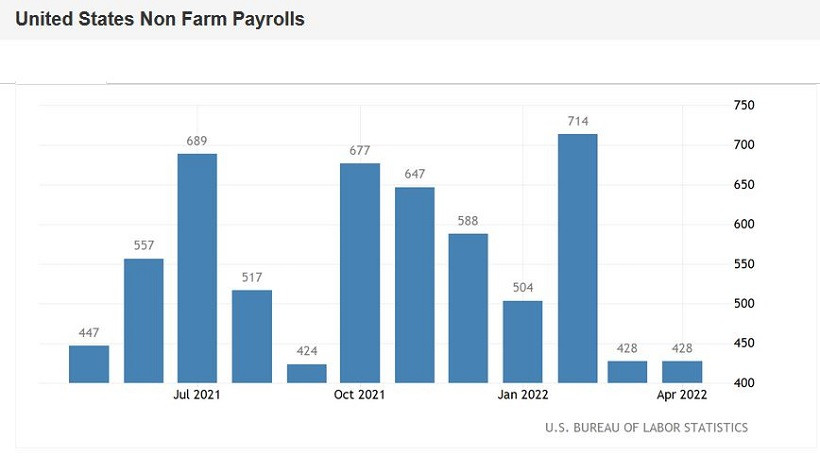

The number of people employed in the non-agricultural sector increased by 428,000 in April (the same as in March), while experts expected to see this indicator slightly lower, at around 390,000. Over the past year, this component has fluctuated in the range of 440-680,000 (it "shot" up to 750,000 only in February of this year). In other words, this indicator did not disappoint either. The indicator of growth in the number of employed in the manufacturing sector similarly went into the green zone - instead of the projected increase by 24,000, it rose by 55,000. A similar situation has developed in the private sector of the economy - experts expected to see an increase of 380,000 jobs, but in fact the indicator grew by 480,000.

One of the most important components of Friday's release also did not disappoint the dollar bulls. It's about the payroll issue. The average hourly wage on a monthly basis should have declined to 0.2%, while traders saw an increase to 0.3%. In annual terms, the index, in accordance with the forecast, fell minimally to 5.5% (after the March value of 5.6%), still remaining at a fairly high level. Here it is necessary to recall Federal Reserve Chairman Jerome Powell's press conference following the results of the US central bank's May meeting, where he paid a lot of attention to the US labor market, especially the salary issue. According to him, "wages are quite important, so it is very important that they grow." The report served as another confirmation of his words.

Thus, the key data on the US labor market did not really disappoint, although it did not surprise with any breakthrough. The April Nonfarm came out "at the level" - quite sufficient for the Fed to continue to implement its announced strategy of tightening monetary policy. Therefore, in my opinion, the current upward pullback of EUR/USD is due solely to the Friday factor: there are no good reasons for a large-scale price increase on Friday.

In this context, it is also worth recalling that rather gloomy macroeconomic data were published in Germany on Friday. The "locomotive of the European economy" is stalling again - this time in the sphere of industrial production. Production fell to -3.9% in March. The indicator came out in the negative area for the first time since September last year.

From a technical point of view, the pair continues to be under significant pressure, and almost on all higher timeframes. On the D1, W1 and MN charts, the pair is either between the lower and middle lines of the Bollinger Bands indicator, or on its lower line, which indicates the priority of the downward movement. The pair demonstrates a pronounced bearish trend, which is confirmed by the main trend indicators – Bollinger Bands and Ichimoku, which has formed a strong bearish Parade of Lines signal on all the above timeframes. All lines of the trend indicator are above the price chart, thus demonstrating pressure on the pair. The target of the downward movement is 1.0500. This is a psychologically important target. The main support level is 1.0450, which corresponds to the lower line of the Bollinger Bands indicator on the daily chart.