Analysis of previous deals:

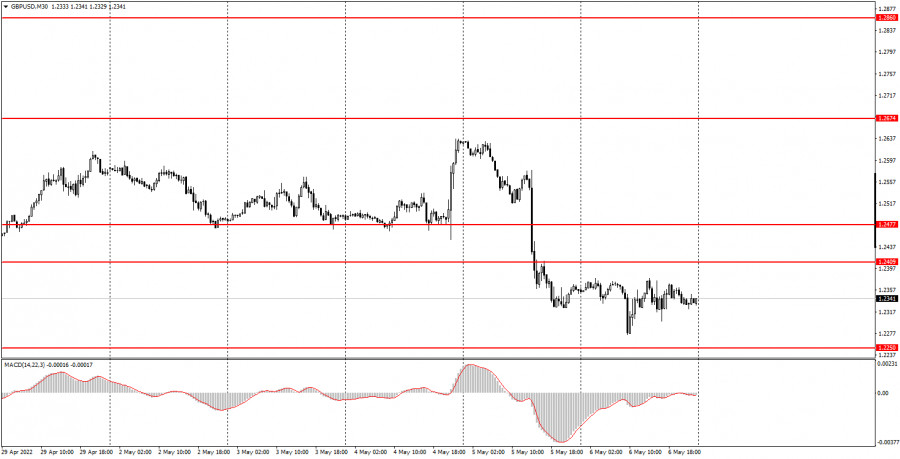

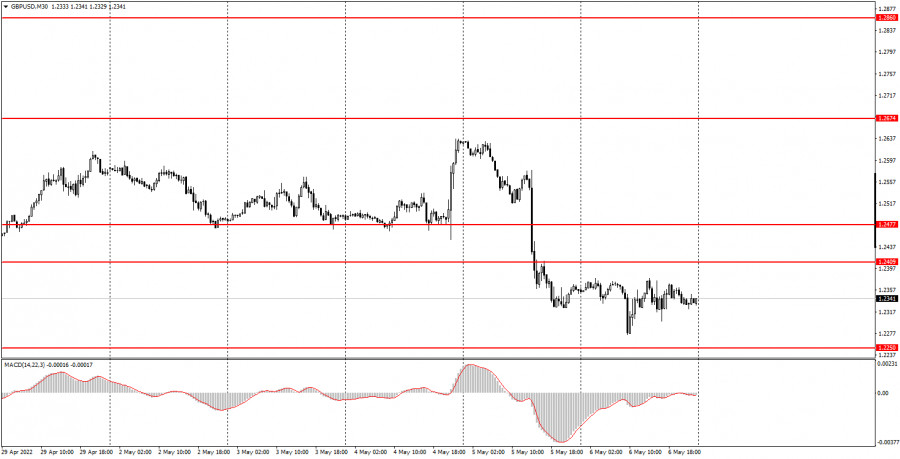

30M chart of the GBP/USD pair

The GBP/USD pair was also trading flat on Friday, but at the same time it renewed its 2-year lows. In general, the pound also continues to be very low and the situation for it is very similar to the technical picture for the euro currency. Thus, we can make an unambiguous conclusion that the downward trend continues, although there is still neither a trend line nor a descending channel on the 30-minute timeframe. We have already said that a downward trend is clearly visible on higher timeframes, but on a 30-minute time frame, the entire movement and even its last part no longer fit on the chart. Plus, the movements are pretty jagged. For example, the pair fell by 300 points on Thursday, and the day before it rose by 150. Macroeconomic statistics from the US had almost no effect on the course of trading. In principle, the pound is now solving the problem of how to avoid a new fall against the dollar. As you can see, even the fact that the Bank of England raised the rate four times, significantly strengthening monetary policy, does not help. It was after the next increase that the pound fell with a slight delay by 300 points. We can only hope for a miracle or a technical correction.

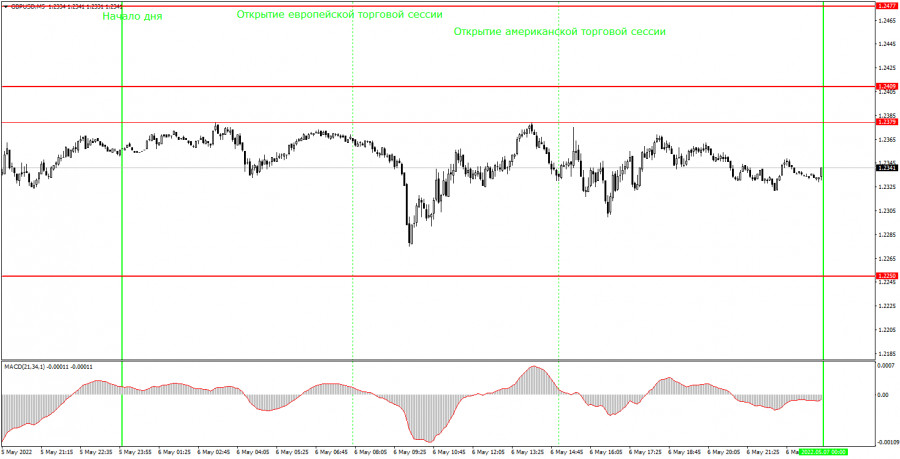

5M chart of the GBP/USD pair

It moved very broadly on the 5-minute timeframe on Friday, but at the same time almost sideways. The pair did not reach any level during the day, therefore, not a single trading signal was formed. The 1.2379 level is the day's high, so it did not take part in the process of forming a signal. Therefore, there is practically nothing to analyze on the current TF. Next week, the pair may spend several days in a wide horizontal channel, which is currently limited by the levels of 1.2409 and 1.2250. However, there is no pronounced channel or flat for the pound now. Much will now depend on geopolitics, as it promises to become more complicated in the near future, which may negatively affect the euro and the pound, as more risky currencies compared to the dollar.

How to trade on Monday:

The downward trend still persists on the 30-minute timeframe. The pound has recently fallen in price by 700 points, and all its attempts to form a tangible correction ended in nothing. Thus, at this time, there are great chances for a continuation of the downward movement, but there is still no trend line, no descending channel. Therefore, you can trade only by levels, and it is more difficult to navigate the current trend. On the 5-minute TF tomorrow it is recommended to trade at the levels of 1.2250, 1.2409, 1.2477, 1.2502. When the price passes after opening a deal in the right direction for 20 points, Stop Loss should be set to breakeven. No important events are scheduled for tomorrow in the UK, and only a speech by Federal Reserve spokesman Rafael Bostic will take place in the US. Thus, traders will have nothing to react to during the day. Volatility should theoretically decrease, but both major pairs have been trading very volatile lately, even on days when there are no events and reports.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.