The EUR/USD currency pair traded very calmly on Monday. Not surprising: we saw another "boring Monday" without macroeconomic statistics and important news. Nevertheless, even in such conditions, the European currency managed to show minimal, but growth. Thus, the euro's ascent continues and, as we have already said, the euro is now using every chance to show as strong growth as possible. We have also already said that the technical factor is now, in fact, the only factor supporting the growth of the euro currency. Monday once again confirmed this hypothesis. If the euro managed to show growth even on a day when there was no reason for it, then the mood of traders is still changing to "bullish". After all, no currency can constantly move in one direction, so no matter how bad things are in the European Union, this does not mean that the euro currency should fall every week. The European Union is an alliance of 27 strong economies, therefore, from our point of view, the euro has fallen even more against the dollar than the geopolitical, fundamental, and macroeconomic backgrounds demanded.

There have been a lot of talks recently about the food and energy crisis. However, many experts find it difficult to answer which regions of the world they will concern about. If Ukraine is unable to start exporting grain, it will primarily hit the poorest countries, which cannot grow and produce food on their own and which have nothing to replace conventional wheat. The European Union, which has a strong and stable economy, will find ways to replace Ukrainian wheat or sunflower oil. Yes, grain prices will rise, respectively, they will rise for bread or flour. But at this time, and without the food crisis, prices are rising for everything. That is, a conditional doubling of the price of flour will not be a "shock" for Europe. But the countries of Africa can be seriously affected, unfortunately. But we are interested in the economy of the European Union and so far everything is going to the fact that there will be a shortage of many food products and prices will rise. The same goes for fuel. Oil and gas from Russia, which the European Union wants to abandon in the near future, can be replaced either by "green energy" or similar hydrocarbons from other countries. Again, it will be hard and slow, and it will be more expensive, but this will not mean that European houses will remain without heating, and cars will have nothing to fill up with. Therefore, the geopolitical factor does not prevent the European currency from growing now.

Is the acceleration of inflation in the EU good or bad for the euro?

Today, perhaps the most important report of the week will be released in the European Union - on inflation. According to experts' forecasts, the consumer price index will rise to 7.6-7.7% y/y. Thus, most likely, inflation will continue to rise in May. On the other hand, why should it decline if the ECB has never raised the rate and continues to pour money into the economy under the APP stimulus program? That is, in Europe, there is just no reason to expect a slowdown in price growth. Moreover, we all see that the Fed has raised the rate to 1% and this has so far led to a slowdown in inflation by 0.2%. The Bank of England also raised the rate to 1% and this did not lead to a slowdown in inflation at all. And in the ECB, the rate remains negative, so it is stupid to expect a decrease in inflation. If the CPI continues its growth, formally it will mean that the chances of an ECB rate hike in the coming months will increase. The higher the inflation, the stronger the public pressure on the European regulator and Christine Lagarde. However, given the passive position of the ECB, we believe that the chances of a rate hike will not increase. Simply put, 1-2 rate increases in 2022 are already the maximum opportunities for the European Central Bank. Consequently, the euro may show growth on an increase in the CPI, but it is very unlikely to be strong. Christine Lagarde's speech tomorrow may confirm our assumption.

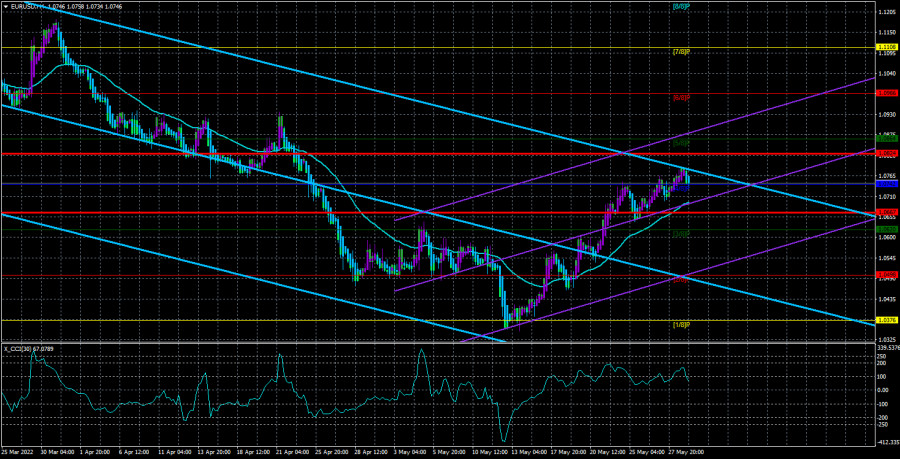

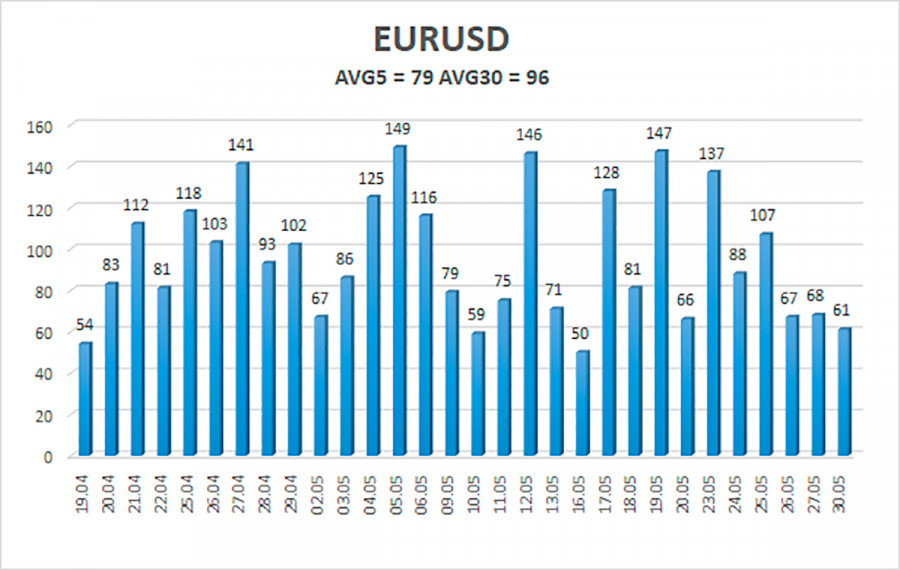

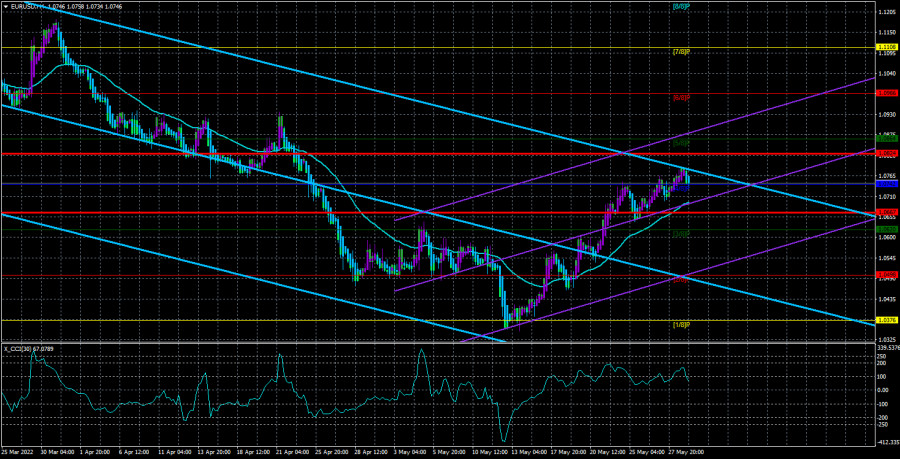

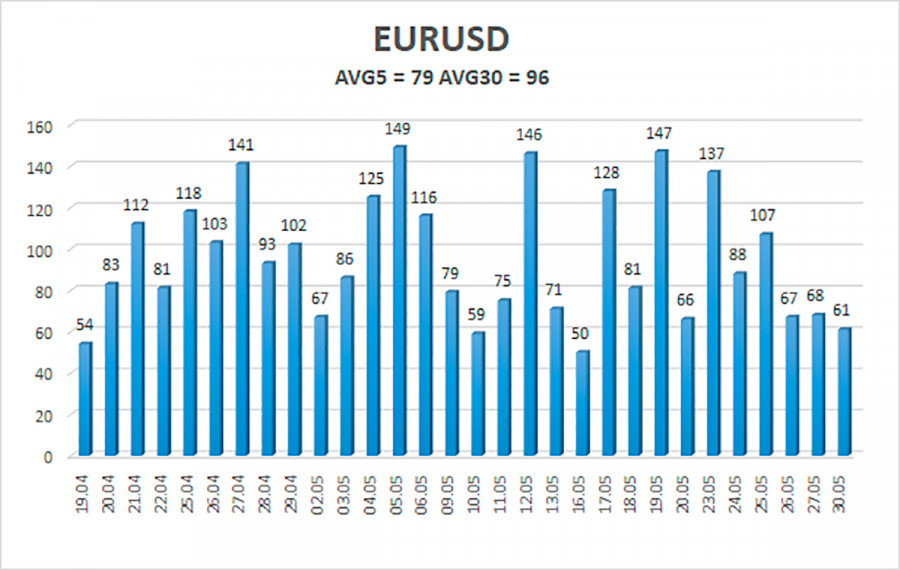

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 31 is 79 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0667 and 1.0824. The reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement.

Nearest support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair continues to be located above the moving average and continues to form an uptrend. Thus, now you should stay in long positions with targets of 1.0824 and 1.0864 until the Heiken Ashi indicator turns down. Short positions should be opened with a target of 1.0498 if the price is fixed below the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.