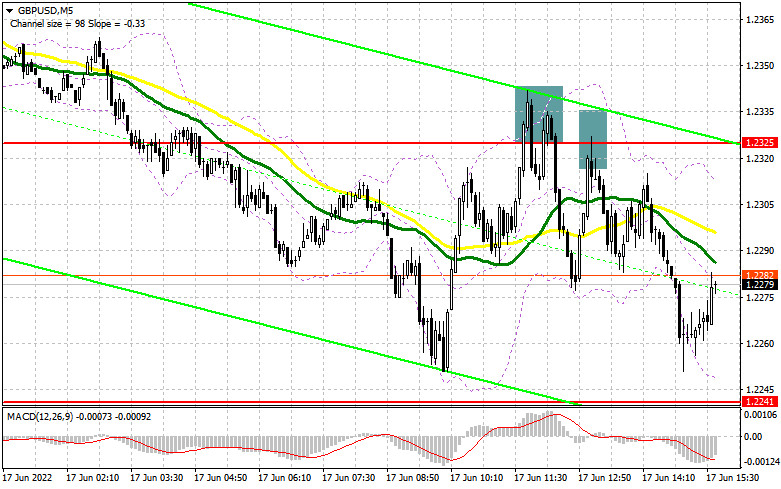

In my morning article, I focused on the level of 1.2325 and recommended making decisions to enter the market, taking it into account. Let's observe the 5-minute chart and analyze it. The pound's failed attempt to return above 1.2325 has resulted in formation of several false breaks which gave signals to sell the pound. Each of them outlined the fall from 60 to 70 pips. Consequently, in the morning the pair did not reach the level of 1.2241 due to the pound's decline. Therefore, it was not possible to await the formation of good entry points there. Besides, what were the euro's entry points this morning?

To open long positions in GBP/USD, you need:

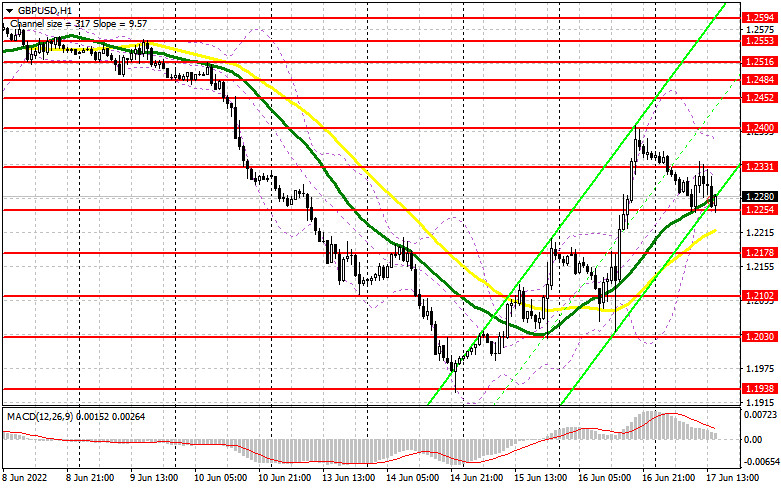

Although the technical picture was revised for the second half of the day, the trading strategy did not change. The US industrial production data will unlikely affect the pound significantly. Therefore, further upward correction is possible. Apparently, the volatility will surge after Fed Chairman Jerome Powell delivers his speech. Only the formation of a false break at 1.2254 which was revised and where the moving averages are, will give a signal to open new long positions with the possibility to rise to the nearest resistance at 1.2331. The bulls' key goal will be to regain control of this level as they failed to do it in the morning. This move will fuel demand for the pound and improve the market sentiment. A breakout and a top-down test of 1.2331 will give a buy signal counting on this week's high renewal near 1.2400. A breakout of this level, which occurred yesterday, will form another long entry point to 1.2452 where I recommend taking profits.The level of 1.2484 will be considered a more distant target. In case the GBP/USD pair falls and there are no buyers at 1.2254, the pressure on the pair will increase. In this case, I recommend opening new long positions only if there is a false break from 1.2178. It is possible to buy the GBP/USD pair on the rebound from 1.2102 or even lower, around 1.2030 with a target of 30-35 pips intraday correction.

To open short positions on GBP/USD, you need:

The bears are trying to take control of the market. However, they have difficulty with it. To build a downward correction, the bears need to reach 1.2254. Nevertheless, they failed to do it in the morning. Only consolidation below this range and reversed bottom-up test will give an entry point to short positions with possible return to 1.2178. The level of 1.2102 will be a more distant target where I recommend taking profits. In the case of the pound's rise, bears are likely to move to the nearest resistance at 1.2331. However, be careful while selling as this level has already been worked out in the morning. Only a false break similar to the discussed above will provide a good entry point to short positions counting on the downtrend resumption. In case there is lack of activity at 1.2331, the pair might surge again amid the cancellation of stop-loss orders of speculators. Therefore, I recommend not to open short positions to 1.2400. However, it is possible to sell the pound only in case of a false break as exit beyond this range will fuel demand for GBP/USD. Short positions can be opened from 1.2452 or even higher, from 1.2484, counting on the pair's downward rebound by 30-35 pips within a day.

The COT report from June 7 recorded a large increase in long positions and only a small increase in short positions. However, it is clear that the current picture is quite different: the last three trading days turned the market upside down. The further direction of the pair, which is near its year lows, depends on the Federal Reserve's meeting and its decisions. A more aggressive policy will lead to the GBP/USD pair's further decline as the UK economy is gradually collapsing according to the latest data. This fact undermines investors' confidence. The Bank of England's meeting is unlikely to support the pound as the regulator will further implement its policy of raising rates. I doubt its further aggressive moves aimed at fighting inflation by reducing economic growth. Although Bank of England Governor Andrew Bailey states that the regulator will definitely raise the interest rates, there are no signs of a more aggressive approach to the monetary policy either. The COT report indicated that long non-commercial positions rose by 3,830 to 34,618, while short non-commercial positions increased by 535 to 105,428. This led to a decrease in the negative non-commercial net position from -74,105 to -70,810. The weekly closing price climbed by 1.2481 to 1.2511.

Indicator Signals:

Moving averages.

Trading is conducted around the 30 and 50 day moving averages, indicating some uncertainty before significant statistics..Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands.

In the case the GBP/USD pair rises, the middle boundary of the indicator will provide resistance around 1.2370.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart;

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart;

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.