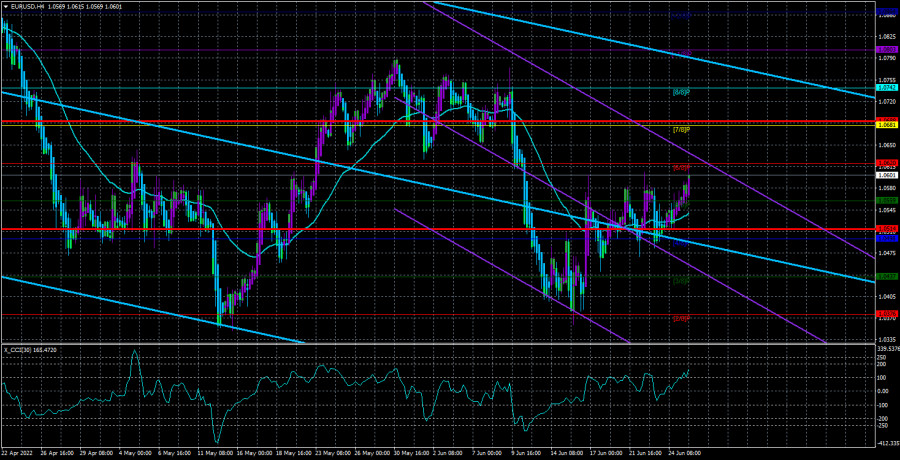

The EUR/USD currency pair continued to ride on a "swing" during Monday and showed absolutely nothing new. In the middle of the day, the euro quotes were again near the upper limit of the improvised side channel, which lies just above the Murray level of "5/8" - 1.0559. Near this level, the price has already been turned down at least four times. Thus, even if the pair manages to continue growing this time, it will not particularly affect the current technical picture, because the "swing" will remain a "swing" for at least a few more days. Both linear regression channels are still directed downward, so the downward trend remains globally. It is the understanding of this moment that makes us wary of buying the euro currency. We assume that the pair may grow by another 100-200-300 points over the next few weeks, but this growth will also be interpreted as corrective. That is, the essence of the upward movement will not change.

As before, a lot now depends on the geopolitical and fundamental background. We have already talked about the "foundation" many times, so we will not repeat ourselves, everything is simple here: as long as the Fed raises the rate, the advantage remains on the side of the US dollar. If we recall the geopolitical situation, it seems that this topic has already fed traders a little. If the military conflict continues for several years, it does not mean that the euro and the pound will fall all this time. The market has worked out the first shock associated with the outbreak of the conflict in Eastern Europe, with a huge number of sanctions that were imposed against Russia, but will also hit the European economy, then new data is needed that will indicate a deterioration of the situation for Europe. And they are not there now. The news about the ban on the import of gold from the Russian Federation is not important.

What awaits us this week?

Last trading week turned out to be quite boring, as nothing but Jerome Powell's speeches in the US Congress can be remembered. This week, the fundamental picture will be about the same. On Monday, Tuesday, and Wednesday, ECB Head Christine Lagarde will deliver a speech every day. Perhaps if she clearly announces that the central bank's key rate will be raised at least twice or more in 2022, this will support the euro currency. In any other case, the market will prefer not to pay attention to the new "water" from Christine Lagarde. So far, the ECB is ready to raise the rate only in July, but it strongly doubts the September meeting. The fact is that not only the American economy is on the verge of recession. European GDP in the first and second quarters showed minimal growth, that is, it can go below zero at any time. And this is a recession. Only now the Fed has already raised the rate to 1.75%, and the ECB has never performed the same action.

In addition to Lagarde's speeches, the unemployment rate will be published on Thursday, which remains at a very high level in the EU – 6.8%. According to experts' forecasts, it will remain unchanged by the end of May. By the way, another Lagarde speech is scheduled for Thursday. The fact that the head of the ECB will speak almost every day also means that there will be little new and important information on the topic of monetary policy from her because she cannot impress the markets every day. On Friday, the consumer price index for June will be released in the EU and, from our point of view, this report is the key event of the week. It is expected that inflation in the European Union will continue to accelerate and will amount to 8.3-8.4% y/y. However, what else can we expect from this indicator if the ECB does not take any steps toward tightening monetary policy? Thus, we believe that this week the euro can only continue its corrective growth. If important information is not received from the EU or the USA, then there will be more chances for a correction. If it does, then traders may well ignore it to continue the correction. But in general, the fundamental and macroeconomic backgrounds remain not on the side of the euro currency.

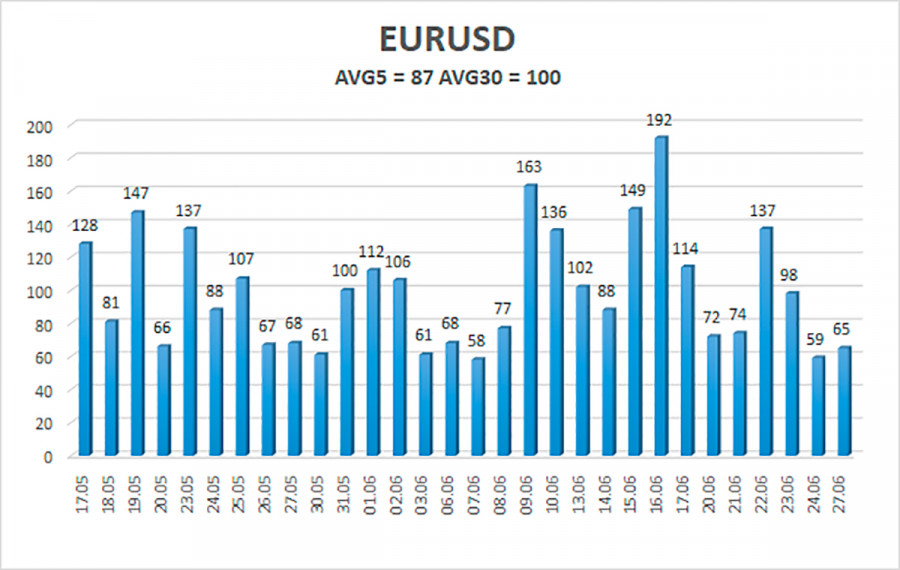

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 28 is 87 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0514 and 1.0688. The reversal of the Heiken Ashi indicator back down will signal a new round of downward movement within the framework of the "swing".

Nearest support levels:

S1 – 1.0559

S2 – 1.0498

S3 – 1.0437

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0681

R3 – 1.0742

Trading recommendations:

The EUR/USD pair continues to trade in different directions every day. Thus, now it is necessary to trade on the reversals of the Heiken Ashi indicator since there is no clear trend. There is a high probability of "swings".

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.