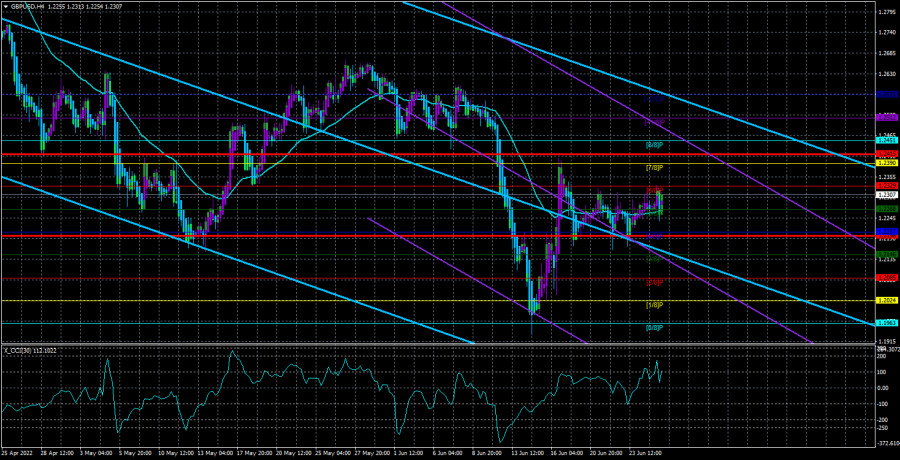

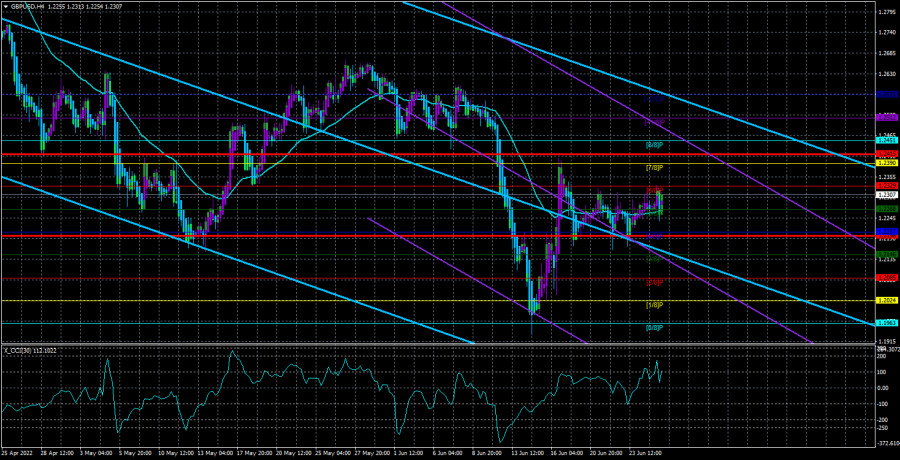

The GBP/USD currency pair on Monday again showed almost identical movements to the EUR/USD pair. As soon as the price got close to the level of Murray "6/8"-1.2329, a downward reversal and a new fall followed. That is, the pair approached the upper limit of the same improvised channel as for the euro, but, of course, could not overcome it. Thus, "swings" remain for the euro currency, and the pound – an outright flat between the levels of 1.2156 and 1.2329. Therefore, it is simply impossible to draw any new conclusions now. There were few macroeconomic statistics last week, and there were none on Monday. At least in the UK. The market had nothing to react to during this period, but even when it did, it also did not show much desire to leave the side channel. Therefore, traders themselves must now decide whether they should trade a flat pair? Recall that the trend is a friend of traders. In a flat, you can try to trade for a rebound from the channel boundaries, but, as you can see, the price does not always even work out.I don't want to talk about the problems of the UK now either. They have already been mentioned many times, but there is simply no new information. All future catastrophes and cataclysms that the Kingdom's economy may face are still in the distant future and it is unlikely that traders will now work out a possible exit of Scotland from the UK. Much more important now is the fundamental background, which continues to keep the pair close to its 2-year lows. Also, once again, we note the fact that the Bank of England raised the key rate five times, which did not lead to an upward trend reversal or at least an end to the depreciation of the pound sterling.

Andrew Bailey's speech and the GDP report.

There will be several important events in the UK this week. First, this is a speech by the Chairman of the Bank of England, Andrew Bailey, which will take place on Wednesday. It is difficult to say what can be expected from Bailey, who is stingy with various comments, now. BA raised the bid five times in a row and each time did not announce its future decision. At the last meeting, three members of the monetary committee voted to raise the rate by 0.5% at once, which gives us reason to assume a sixth consecutive increase at the next meeting. But if the previous five did not help the pound, then what is the probability of its growth in the case of the sixth? And Bailey himself is unlikely to openly declare that the regulator is preparing to raise the rate again. On Thursday, the final GDP value for the first quarter will be published in Britain. According to forecasts, it will not differ from the previous estimate and will amount to 0.8%. This is a very decent level, since in the States the economy will fall by 1.5% in the same period, and the European one will grow by 0.2-0.3% maximum. But in Britain, inflation is much higher than in the EU or the USA.

As for the States, a report on orders for long-term goods was published there yesterday, and the market seems to have decided that it was time to work out this report for the first time in a long time. The number of orders in May turned out to be higher than forecasts, and the dollar strengthened within two side channels against the euro and the pound. There won't be anything interesting in the States today. Tomorrow, the GDP report for the first quarter will be released, which will show a reduction of 1.5% q/q, and Jerome Powell will also make a speech, who will probably once again say that the main goal of the Fed remains to reduce inflation, and a recession is, of course, possible, but the economy is ready for it. On Thursday, information will be received from overseas about changes in the personal income and expenses of the American population – a secondary report that can cause a reaction only if the actual value is very different from the forecast. On Friday, the most important report of the week is the ISM manufacturing Business activity index. Recall that the usual business activity indices declined very much in June, so the ISM may show negative dynamics. And a bad ISM can create pressure on the US dollar. But will the dollar itself come out of the two side channels by Friday? Or will it just show another round of falling inside them?

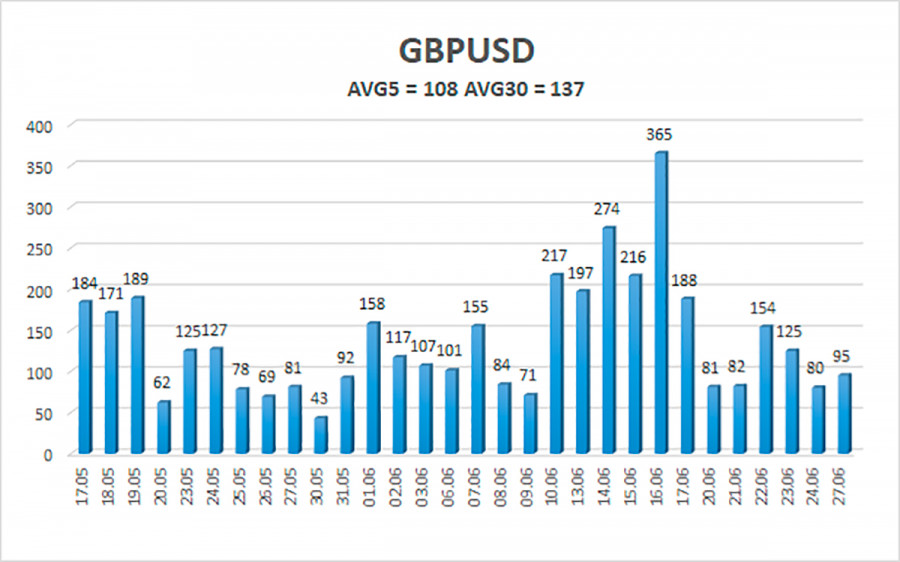

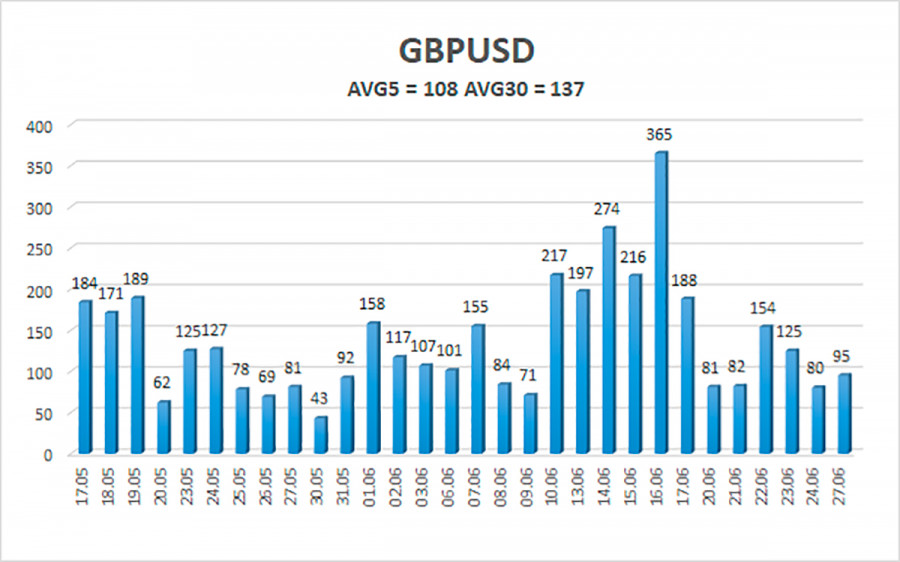

The average volatility of the GBP/USD pair over the last 5 trading days is 108 points. For the pound/dollar pair, this value is "high". On Tuesday, June 28, thus, we expect movement inside the channel, limited by the levels of 1.2198 and 1.2415. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement within the flat.

Nearest support levels:

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest resistance levels:

R1 – 1.2329

R2 – 1.2390

R3 – 1.2451

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues the "swing" mode, flat and daily overcoming the moving average. Thus, at this time, you can trade on the reversals of the Heiken Ashi indicator. Or not to trade at all until the trend movement resumes.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.