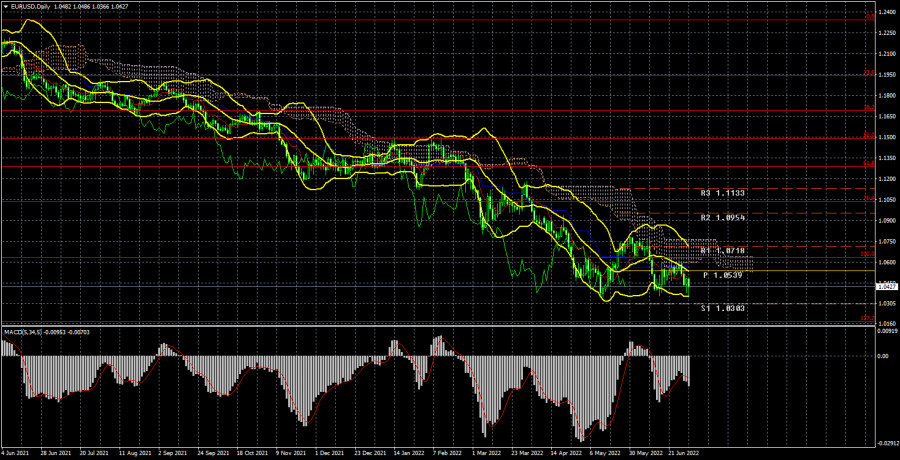

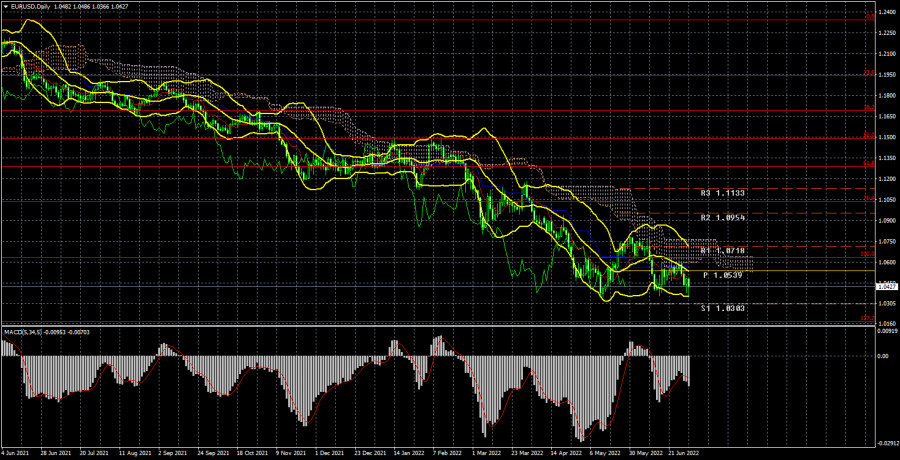

Long-term perspective.

This week has seen a 130-point decline in the EUR/USD currency pair. The euro currency has been trading within a few cents of its 20-year lows for some weeks, so any decrease in value, no matter how modest, would be disastrous. For instance, the pair is currently less than 100 points from hitting these very lows. Additionally, the pair was unable to gain ground above the Ichimoku cloud, and over the last two weeks (when a fresh attempt was made to start a correction), the price was unable to do so even above the pivotal Kijun-sen line. So, we are limited to coming to the same conclusion as before. The bears' positions are solid, and the bulls are still lounging around and taking it easy. Naturally, it is not necessary to anticipate the expansion of the European currency in such circumstances. As a result, we still expect the pair to continue declining to achieve price parity. This week, Christine Lagarde and Jerome Powell appeared at an economic event in the Portuguese city of Sintra. This week, the ECB president spoke four times in all. In theory, it is already evident from the currency pair's movement whether its performances supported the euro. Reply: No. Lagarde reiterated that the ECB would not passively wait for natural circumstances to cause inflation to drop. However, she also stated that the regulator is still not taking action to control inflation. Lagarde maintains her commitment to raising the rate in July (probably by 0.25%) and then, if required, in September. It is not taken into account that it must be increased to a minimum of 2% to compensate for inflation. Thus, traders disregard all of Lagarde's "pseudo-hawkish" claims. This month, the Fed rate could increase to 2.25–2.5%.

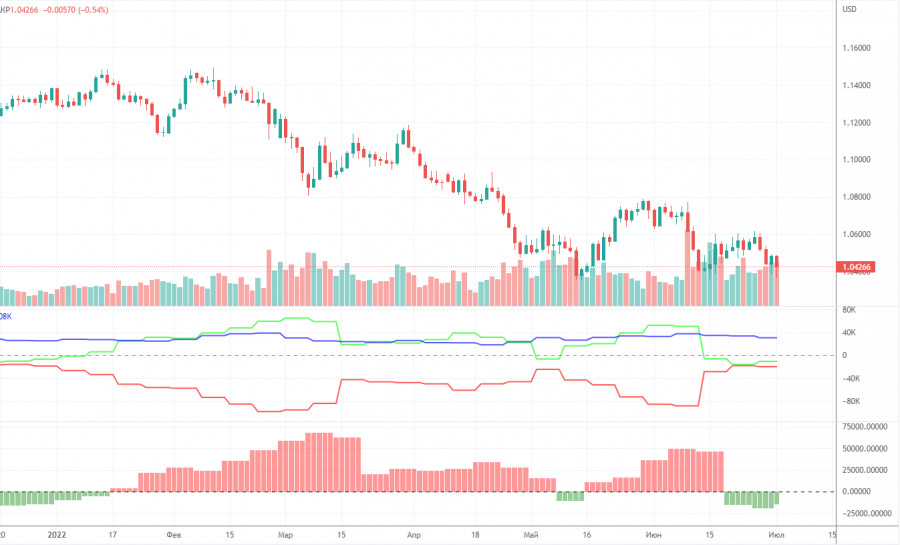

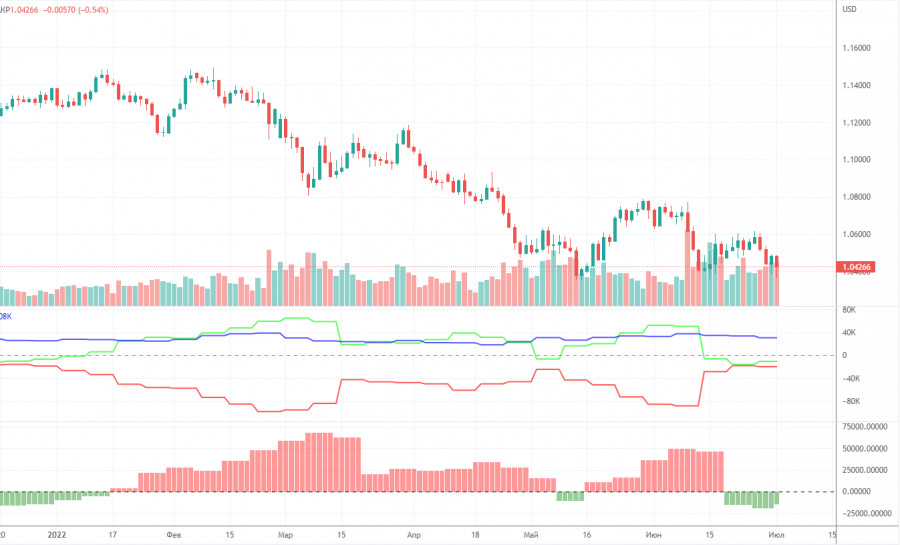

COT analysis.

COT's reports have brought up numerous issues about the euro during the previous six months. The illustration above unequivocally demonstrates that although professional players displayed a candidly "bullish" attitude, the European currency was depreciating simultaneously. The current state of affairs has slightly shifted and is not in the euro currency's favor. If the atmosphere was previously "bullish," but the euro was falling, it is now "bearish," and the euro is still falling. Because the vast majority of forces are still working against the euro's expansion, we cannot see any justification for it now. The number of buy contracts dropped by 6.1 thousand during the reporting week, while the number of "Non-commercial" group shorts dropped by 11.1 thousand. As a result, the net position slightly improved by 5,000 contracts. However, the key players' outlook is still "bearish." From our perspective, this fact speaks volumes about professional traders' lack of confidence in the euro. The quantity of buy contracts for non-commercial traders is 11,000 fewer than the number of sell contracts. Therefore, we may conclude that while demand for the US dollar is still high, it is also relatively low for the euro. This could trigger a fresh, more significant decline in the euro's value. In theory, the euro currency hasn't been able to exhibit even a noticeable correction during the past three months or more, let alone anything else. About 400 points were moved up at the most.

Analysis of fundamental events.

The data on inflation in the European Union was without a doubt the most significant event of this week for the euro currency. It's hard to say if any traders or industry professionals anticipated a decrease in inflation by the end of June; we, for one, did not. The consumer price index increased to 8.6% Y,y/ybut this does not signal that the ECB will start to pursue more aggressive monetary policy measures. Remember that the European regulator has not even raised the main rate once when inflation has been rising for a considerable time. Additionally, the regulator will only just now entirely discontinue the QE program. To stimulate the economy, the Central Bank is still producing money today. Further, the stakes are not raised. How can the European currency grow in such a situation if, in parallel, rates rise every month in the United States, and the QT program begins to operate on July 1, according to which the Fed will sell treasury and mortgage bonds worth $95 billion monthly?

1) On the 24-hour period, the pair stopped only a step away from the minimum for the past 20 years - 1.0340 - but it could not move away from it in recent weeks. This is the trading strategy for the week of July 4 - 8. Almost all evidence continues to point to the US dollar's long-term growth. The rising movement and purchases of the euro currency are still irrelevant because traders could not break through the Ichimoku cloud. Wait until there has been consolidation above the Senkou Span B line before considering buying the euro.

2) The euro/dollar pair sales are still more important right now. We now have a new sales signal with a target of 1.0172 (127.2% Fibonacci), which is already below 20-year lows, as the price has fallen below the crucial line. The signal will be canceled if the pair is fixed above the Kijun-sen line.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them;

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5);

Indicator 1 on the COT charts - the net position size of each category of traders;

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.