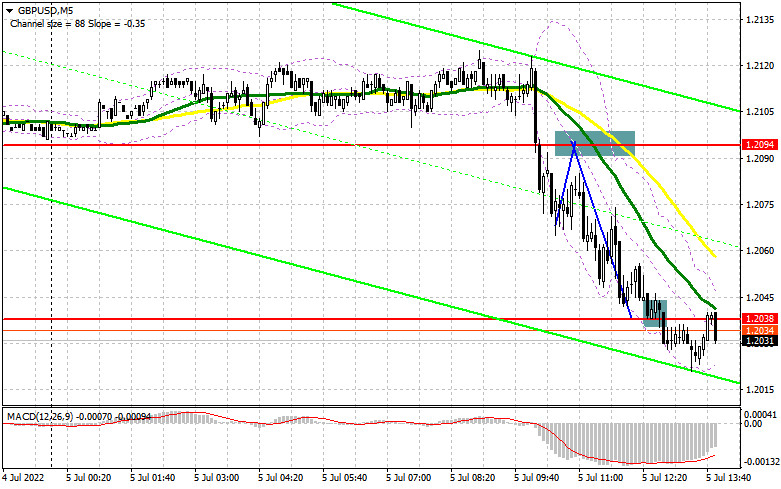

In my morning forecast, I highlighted the level of 1.2094 and advised basing choices on it. Let's examine the 5-minute chart to determine what transpired there. The breach of this range, especially against very satisfactory UK economic data, demonstrates the current pessimism that has permeated the markets due to fears of an oncoming recession. Unfortunately, I did not wait for the 1.2094 reversal test from the bottom up, so short positions were not allowed. The entire technical picture was altered during the day's second portion. And where did the euro enter circulation?

To establish long positions on the GBP/USD, you must:

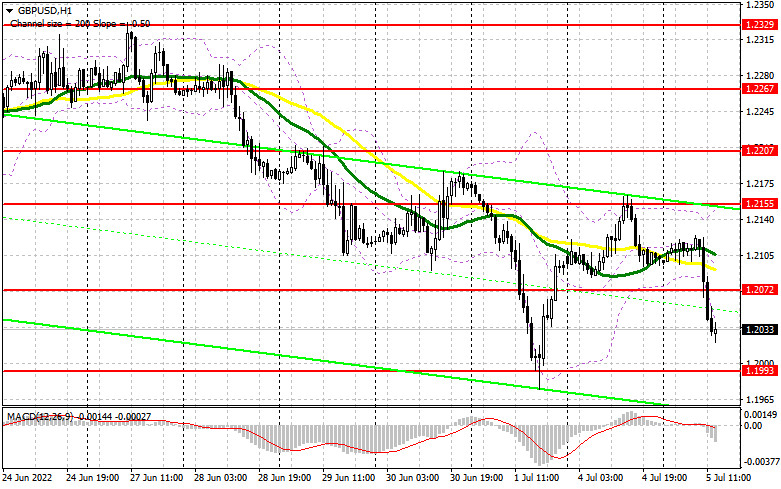

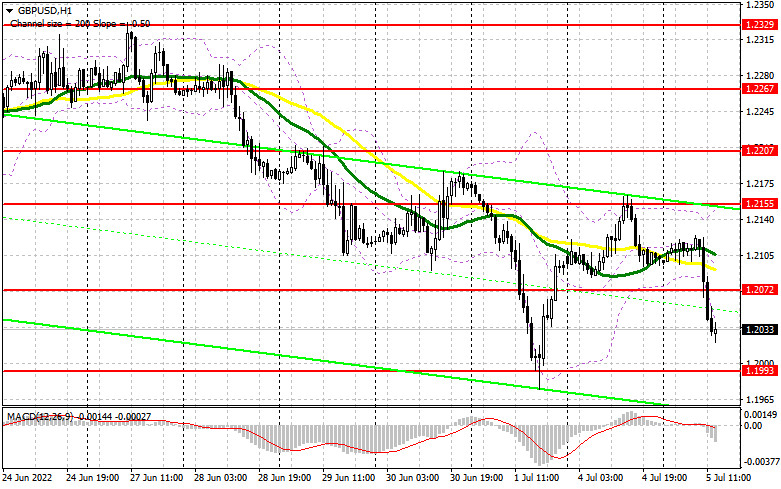

Based on current conditions, purchasers of the British pound have no motive to establish long positions. Moreover, today's statistics demonstrated this; robust data prevented the bulls from remaining above the 21st figure. Reports on the volume of industrial production in the United States are anticipated in the afternoon. Good data will prompt an update of the lows and a test of the new support level at 1.1993. The development of a false collapse will be the first indication to begin long trades to return to the area of 1.2072, where the moving averages favor sellers. It will be possible to discuss the end of the bear market only when buyers reclaim 1.2072. A breakout and a top-down test of this range will generate a buy signal with 1.2155 as the target. A similar breach of this level will result in a second opportunity to enter long positions with the potential to hit 1.2207, where I propose taking profits. If GBP/USD continues to fall, which is more likely, and there are no buyers at 1.1993, it will be impossible to avoid revising the annual lows. I advocate delaying long positions until the next support at 1.1938 is reached. I encourage you to only purchase there on a false decline. It is conceivable to initiate long bets on GBP/USD immediately for a rebound from 1.1876, or even lower – around 1.1816, with the goal of a 30-point-per-day drop.

To open short GBP/USD positions, you must have:

The bears tried everything in their power to seize control of the market, as seen by the pound's steep decline in the first part of the day despite favorable statistical conditions. In the near future, the shortage of buyers prepared to purchase below 1.2100 is another factor that will intensify the pressure on the British pound. In the event of negative US data, it will be possible to notice a pullback of the pound to the region of 1.2072. The formation of a false breakdown at that level will produce a sell signal in the continuance of a bear market, with the possibility of an update to 1.1993. The consolidation below 1.1993 and the reversal test from the bottom up are heavily influenced by the bulls' stop orders, which provide an extra entry point for selling the pound to bring it down to 1.1938, where I advocate partially fixing profits. A more distant objective will be the region around 1.1876 when the yearly minimum of 1.1816 can be attained. With the possibility of GBP/USD growth and the absence of bears around 1.2072 in the afternoon, we can anticipate 1.2155 as the next point of resistance. A false breakout at this level will provide an excellent entry point for short positions in anticipation of a pair retracement. If there is no trading action at 1.2155, another upward shock may occur against speculative sellers who have canceled their stop orders. In this instance, it is prudent to delay short positions until 1.2207. You can sell GBP/USD immediately for a rebound from 1.2267 if you anticipate a 30-35-point drop within a day.

The COT report (Commitment of Traders) for June 21 revealed a decline in both long and short positions, although the fall in short holdings was greater, resulting in a modest decrease in the negative delta. Last week, the Bank of England's stance on monetary policy was validated by inflation data from the United Kingdom. Even according to the official estimates of the regulator, the consumer price index will surpass the mark of 11.0 percent by the end of the year. Thus, the high inflationary spike in May of this year did not come as a surprise to traders. As a result of another collapse of the British pound, the major players took advantage of the situation and boosted their long positions. However, according to the source, fewer people are prepared to sell at present lows, which favors the British pound. No one will likely be startled by the Federal Reserve System's policy and rate of interest rate increases. Thus it is time to consider purchasing cheaper hazardous assets. The COT report reveals that long non-commercial positions declined by only 873 to 28,470, and short non-commercial positions decreased by 3,222 to 91,717. This resulted in a decline from -65,596 to -63,247 in the negative value of the non-commercial net position. The weekly ending price rose to 1.2295 from 1.1991, a gain of 0.5%.

Signals of indicators:Moving AveragesTrading is done below the 30 and 50 daily moving averages, indicating that the pound's decline is likely to continue.The author considers the period and prices of moving averages on the hourly chart H1, which differs from the standard definition of daily moving averages on the daily chart D1.Bollinger BandsIn the event of a price increase, the average boundary of the indicator at 1.2105 will act as resistance.Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.