On Thursday, the EUR/USD pair did not even attempt to begin a correction again. Throughout most of the day, it traded within a narrow range, indicating a high likelihood of future loss. Consequently, the euro will likely close in the red daily this week. We have stated in earlier articles that when the market enters a fury or gains velocity, it is irrelevant whether or not there is a similar underlying background. Traders liquidate (or acquire) the instrument, resulting in an almost recoilless movement in one direction. This week, the market surpassed lows not seen in twenty years, and now every fresh loss is a reiteration of these historic lows. Before price parity, only 150-200 points remained. We initially believed that it could take several weeks or even months for the pair to achieve the level of 1.0000, but now the pair has gathered sufficient momentum to hit this level within a few days. No new conclusions can be formed as all technical indications point downwards. And what theoretical inferences may be derived if the price lowers every day, as if Bitcoin?

Is a fresh rectification feasible? This is an extremely crucial issue for the euro, as it can only rely on technical fixes. This week has already witnessed a substantial decline, so a corrective retreat may commence today, on Friday. The most crucial Nonfarm Payrolls report will be released during the American trading day, and the dollar could probably decrease regardless of the report's strength. The market probably bought dollars this week in anticipation of robust Nonfarm Payrolls.

The Turkish resistance was brief.

Everyone has forgotten about Sweden and Finland's membership in NATO. And also the banning of the transit of sanctioned items through Lithuania to the Kaliningrad region. There was also a sense that these themes no longer piqued anyone's interest, although, from our perspective, they are vital to geopolitics. Initially, the special operation in Ukraine was launched because Kyiv sought to join NATO and the Kremlin wanted to prevent the deployment of NATO military bases near its borders at all costs. Now that it has been determined that NATO bases can be established less than 200 kilometers from St. Petersburg, we have grave concerns that a new special operation will not be launched on Finnish soil. Turkey was the only nation that did not agree to join the Swedish and Finnish military alliance. However, as anticipated, a few weeks of negotiations and some preferences for Ankara led to a good resolution. All 30 NATO member states have already signed the protocol on entering the alliance, and next week their respective parliaments must ratify the agreement. We do not anticipate any issues arising from this. The Kremlin is hence the next target. Either the Russian government will fortify the 1000-kilometer border with Finland.

In addition, there is information regarding the Kaliningrad region, which was under some blockade due to Lithuania's refusal to allow Russian cargo subject to sanctions to travel through its territory. It was revealed that, despite the requests of several EU members, Lithuania has no intention of reversing its decision, which implies that commodities destined for Kaliningrad can now circumnavigate Europe either by air or by sea. It is considerably more costly and takes longer. The Kremlin has also weighed in on the matter, stating that Lithuania's actions constitute open aggression toward Russia. However, Vilnius will not back down. Therefore, a new geopolitical flashpoint may emerge in the Baltic States. We feel that any new geopolitical conflicts or complications could damage the euro currency even more. Remember that the United States is geographically far. Thus, their economy is not in jeopardy. As a result, many traders favor the US dollar over the euro and the pound, which are currently in crisis.

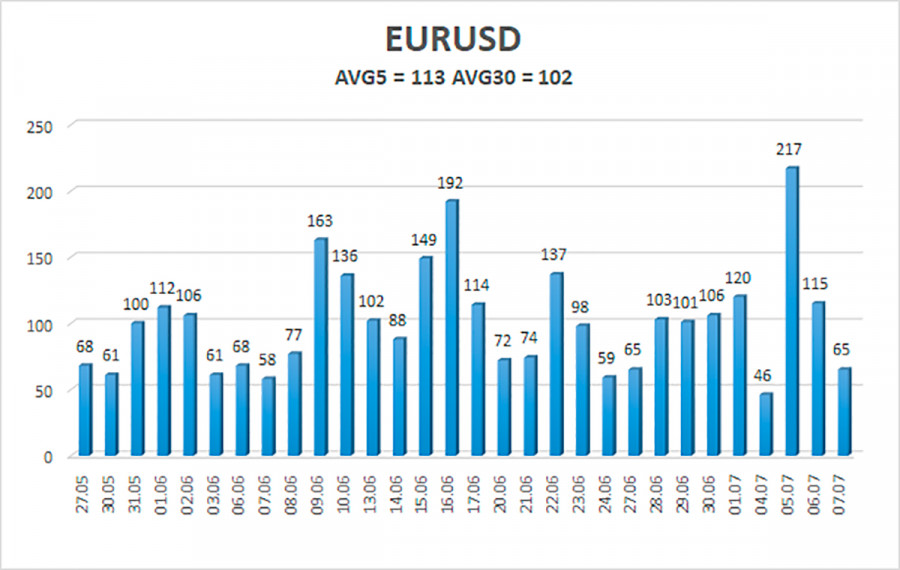

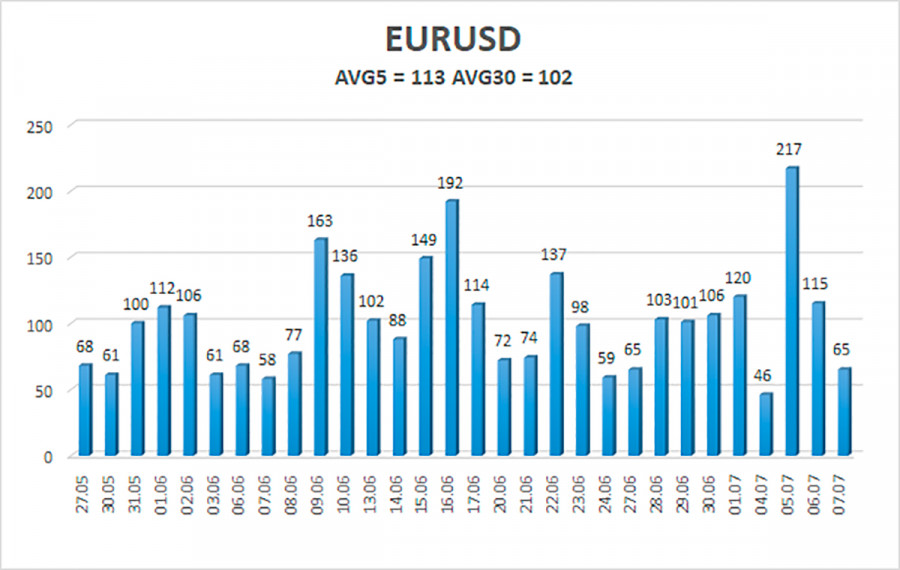

The average volatility of the euro/dollar currency pair over the last five trading days, as of July 8, is 113 points, which is considered "high." Consequently, we anticipate that the pair will fluctuate between 1.0044 and 1.0270 today. A reversal of the Heiken Ashi indicator to the upside will indicate a fresh attempt by the pair to correct.

Nearest support levels:

S1 – 1.0132

Nearest resistance levels:

R1 – 1.0193

R2 – 1.0254

R3 – 1.0315

Trading Recommendations:

The EUR/USD pair maintains its significant downward trajectory. Therefore, it is crucial to maintain short positions with objectives of 1.0132 and 1.0044 so long as the Heiken Ashi indicator is pointing lower. When fixed above the moving average with goals of 1.0376 and 1.0437, purchases of the pair will become advantageous.

Explanations of the illustrations:

Linear regression channels – assist in identifying the present trend. Currently, the trend is strong if both are moving in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be done at the present time.

Murray levels are movement and corrective objectives.

Volatility levels (red lines) represent the price channel in which the pair is anticipated to trade tomorrow, based on current volatility indicators.

CCI indicator — its entry into the oversold region (below -250) or overbought region (above +250) indicates an impending trend reversal in the opposite direction.