Bitcoin and ether have one final opportunity to continue the bullish correction and establish a new lower channel boundary. Before delving into the technical picture, however, I'd like to discuss the forthcoming statements of politicians on the cryptocurrency market; after all, they dictate the rules to lawmakers.

John Cunliffe, Deputy Governor for Financial Stability at the Bank of England, stated that "legislatures should continue to work on regulating crypto technologies before they permeate many sectors of the economy."

Speaking at the residence of the British High Commissioner in Singapore, Cunliffe discussed the recent crypto winter, a period characterized by a precipitous decline in cryptocurrency prices. According to him, finance entails inherent risks, and while technology can alter the management and distribution of these risks, it cannot eliminate them. "Financial assets devoid of intrinsic value are worth precisely what the next buyer is willing to pay. Consequently, they are inherently highly volatile and volatile, as well as highly sentiment-sensitive and prone to collapse, "Cunliffe said.

Recently, bitcoin's market capitalization has dropped below $ 1 trillion, compared to its November peak of $ 3 trillion. Now, the indicator has returned close to the 1 trillion mark. Cunliffe believes that cryptocurrencies will pose a "systemic risk" under the current conditions. In addition, he remarked that the distinctions between the world of cryptocurrencies and the conventional financial system are gradually eroding. "The question for regulators is not what will happen to the value of crypto assets, but rather what must be done to ensure that promising innovations do not introduce systemic risks." Cunliffe believes that the cryptography regulatory framework should be expanded as thoroughly as possible. The manager stated, "If a stablecoin is used as a settlement asset in transactions, it should be as secure as other forms of money."

Stablecoins are a type of cryptocurrency designed to track a real asset, typically a national currency such as the euro or the dollar. Numerous stablecoins are pegged 1:1 to a fiat currency. Some are backed by tangible assets, such as bonds or currency. However, the recent collapse of terraUSD, a so-called "algorithmic" stablecoin pegged to the US dollar, jolted the cryptocurrency markets and compelled many politicians to discuss cryptocurrencies.

Andrew Bailey, the governor of the Bank of England, recently made similar remarks. He mentioned cryptocurrencies, stating that they may have "external" value due to people's desire to purchase tokens and coins. According to Bailey, however, cryptocurrencies lack "intrinsic" value. Bailey has been an ardent opponent of cryptography in the past, but while speaking to British legislators, he made a number of more positive statements while reiterating his view that unsecured crypto-assets pose a "very high risk."

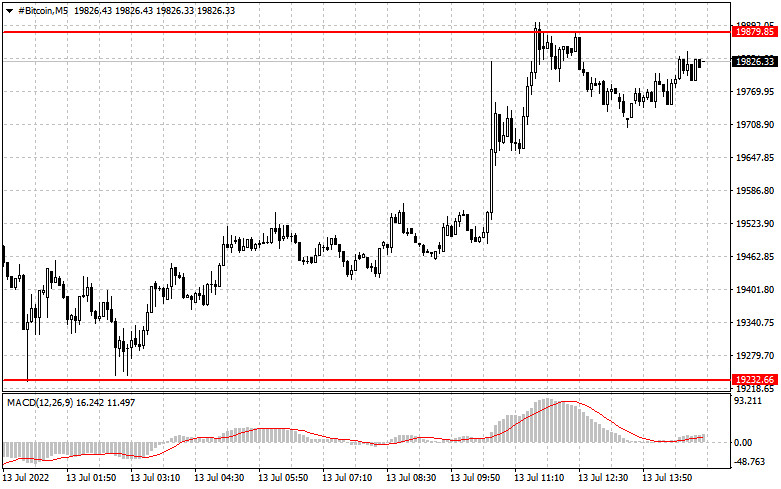

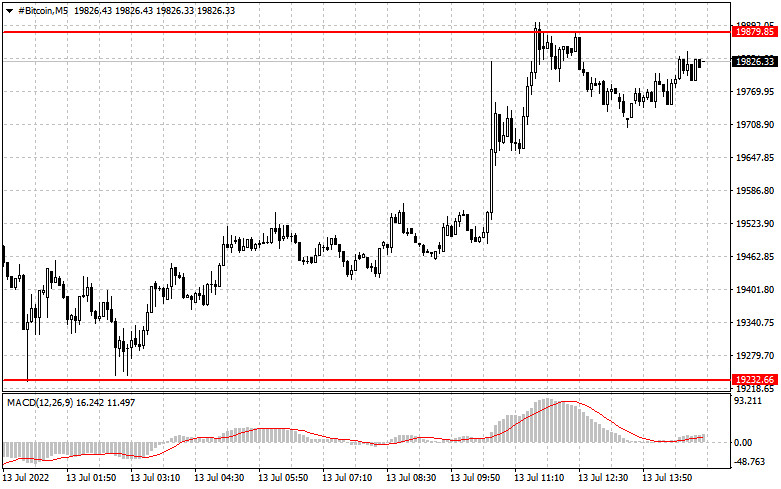

Regarding the technical prospects of bitcoin, it is evident that if buyers do not begin acting more aggressively immediately, it will be impossible to avoid updating the next annual minimum and a major sale of the world's first cryptocurrency. I recommend delaying the establishment of long positions until the trading instrument has stabilized. A breach of the closest support level of $ 19,230 and consolidation below this range would send the trading instrument back to the lows of $ 18,600 and $ 18,120 and then to $ 17,560. In the event of an upward correction, bears will manifest in the vicinity of the closest area of resistance, which is $ 19,880. Only consolidation above this range will return the trading instrument to the $ 20,500 to $ 21,150 range, allowing investors to relax somewhat. A further-off objective will be the $ 21,900 region.

They are attempting to "pick up" ether from the minimum around $ 1,040 – this is the last point below which another major sale will commence with the intention of updating annual lows. Now, purchasers must consider how to return $ 1,095. Only after growth surpasses this threshold can we anticipate an update to the maximum of $ 1,155. Even if bulls break through $ 1,220, it is unlikely to be possible to speak of a bull market developing. Only by fixing higher will the trading instrument be able to return to $ 1,270, at which point a fierce battle will resume. In the event that ETH remains under pressure and falls below $ 1,040, it is prudent to anticipate larger lows near $ 985 and $ 935.