The EUR/USD currency pair spent most of Wednesday attempting to re-adjust at least slightly. Everything became crystal clear as soon as the US inflation report, which the market had been anticipating since the beginning of the week, was released. The United States' inflation rate rose to 9.1% year over year. However, we will briefly discuss inflation; for now, let's examine the technical picture. The European currency immediately updated its 20-year lows following the report's release, reflecting its stance on the ever-increasing inflation. Some may believe that the depreciation of the US dollar is a result of the high inflation rate. It is true. However, inflation in Europe is also skyrocketing, and there is still such a thing as supply and demand for a particular currency on the market. Almost nobody will dispute that the dollar's demand has never been higher.

Thus, yesterday's report revealed what was intended to be revealed. Long-term weakness persists in the European currency. And it can endure for a very long time because the general background does not alter. Additionally, there is geopolitics, which leaves much to be desired. Consequently, the euro may now target the levels of 0.95 to 0.90. From a technical perspective, the psychological and historical level of 1.0000 failed to halt the pair, so there is no reason to expect the downtrend to end soon. Both linear regression channels and the moving average line are still pointing downwards. The CCI indicator entered the oversold region and exited it without inducing even a slight pullback higher.

The United States' inflation rate continues to rise.

Thus, the consumer price index increased 9.1 percent annually. The monthly rate of price increase was 1.3%. Core inflation (which the Fed is more concerned with) slowed to 5.9 percent and increased by 0.7% month-over-month. Thus, the report left a dual taste in the mouth. On the one hand, many experts believe that the Fed relies on the baseline indicator when adjusting monetary policy, and that indicator has recently slowed.

On the other hand, inflation continues to rise, and the market continues to purchase the US dollar, making it clear that it anticipates a new tightening of the Fed's already aggressive monetary policy. From our perspective, there is no doubt that the Fed will raise the key rate by 0.75 percent at its next meeting. Some members of the monetary committee may support an increase of 1.00 percent, which has not occurred in a very long time. In any case, monetary policy will be tightened rapidly, which is currently one of the most important factors supporting the US dollar.

Moreover, even if inflation slows slightly next month, it will have no significance. At least a few negative reports will be required to discuss a downward trend in inflation. Therefore, it is likely that the rate will also be increased at the September meeting. And by then, it may have already reached 2.5 percent. In general, we believe that even a rate of 3.5% may not be sufficient to return inflation to 2%. In such a scenario, monetary policy will have to be tightened even further, exerting pressure on the US economy. With rising inflation and the key rate, the probability of a recession increases.

What shall we do with this? Nothing significant. There is a clear, long-term trend; why try to reinvent the wheel and catch an upturn? We know the pair is trading at an all-time low, and the current levels appear extremely attractive for purchases. From our perspective, however, the euro could fall to depths that no one can currently imagine. Recall that the geopolitical conflict in Ukraine has not subsided and that the European Union is actively considering alternatives to Russian oil and gas. If this occurs, energy prices will rise again, resulting in a new acceleration of global inflation. In addition, the pressure on the European economy, which is highly dependent on Russian hydrocarbons, will intensify.

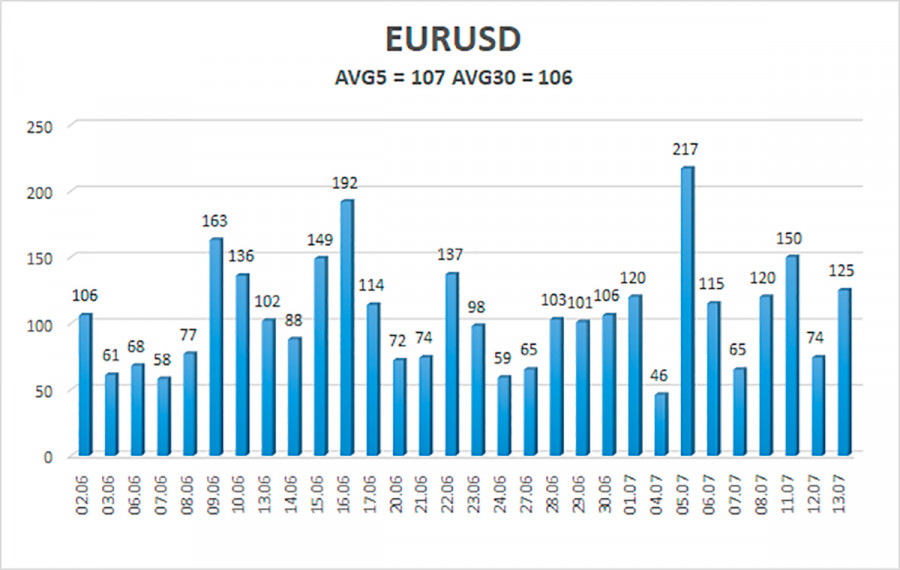

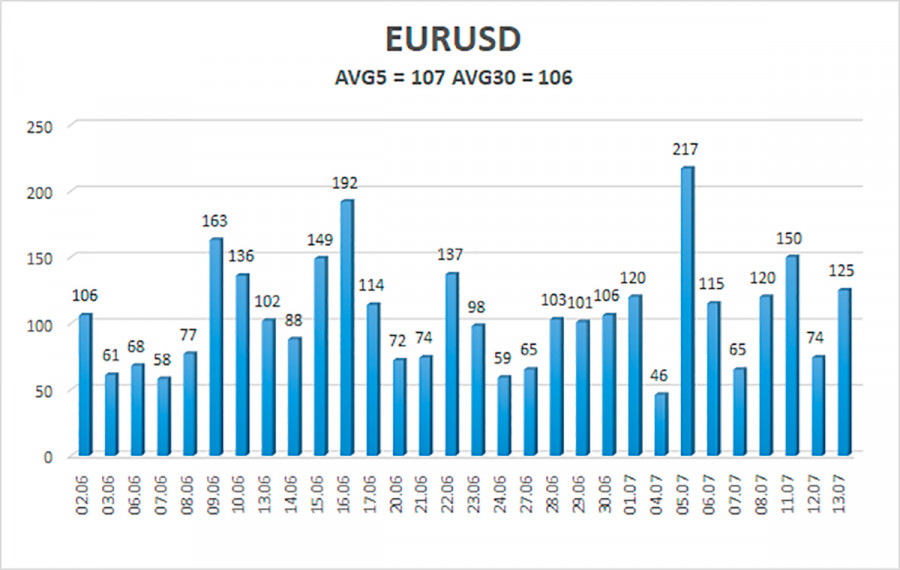

As of July 14, the average volatility of the euro/dollar currency pair over the previous five trading days was 107 points, which is considered "high." Thus, we anticipate the pair to trade between 0.9967 and 1.0182 today. The downward reversal of the Heiken Ashi indicator signifies the continuation of the decline.

Nearest support levels:

S1 – 1.0010

S2 – 0.9888

S3 – 0.9766

Nearest resistance levels:

R1 – 1.0132

R2 – 1.0254

R3 – 1.0376

Trading Recommendations:

The EUR/USD pair is attempting to re-adjust. Consequently, we should now consider new short positions with targets of 1.0010 and 0.9867 if the Heiken Ashi indicator reverses to the downside. When the pair is fixed above the moving average with targets of 1.0254 and 1.0376, purchases become relevant.

Explanations for the figures:

Channels of linear regression – aid in determining the current trend. The trend is currently strong if both are moving in the same direction.

Moving average line (settings 20.0, smoothed) identifies the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the likely price channel the pair will trade within for the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.