The euro-dollar pair tested the area of the 99th figure again on Thursday, plunging under the parity level. Wednesday's upward pullback, which we observed after the release of data on the growth of US inflation, ended just after it began. The inflation report was completely on the side of the greenback, so there were no grounds for a correction or (especially) a trend reversal. The sharp rebound in the price could only be explained by the level of parity, which is a "red line" for many traders: they do not risk holding short positions below the 1.0000 mark.

Nevertheless, the downward trend is in full swing. Judging by Thursday's price dynamics, market participants are gradually getting used to the new realities when the dollar is more expensive than the euro. Therefore, they are already acting much bolder, probing the price territory, which has been "uninhabited" for almost 20 years. In general, there was no doubt that traders would test the parity zone again: the only question is how far the EUR/USD bears will move away from the 1.0000 mark and whether they will be able to settle in the area of the 99th figure in order to claim more ambitious goals.

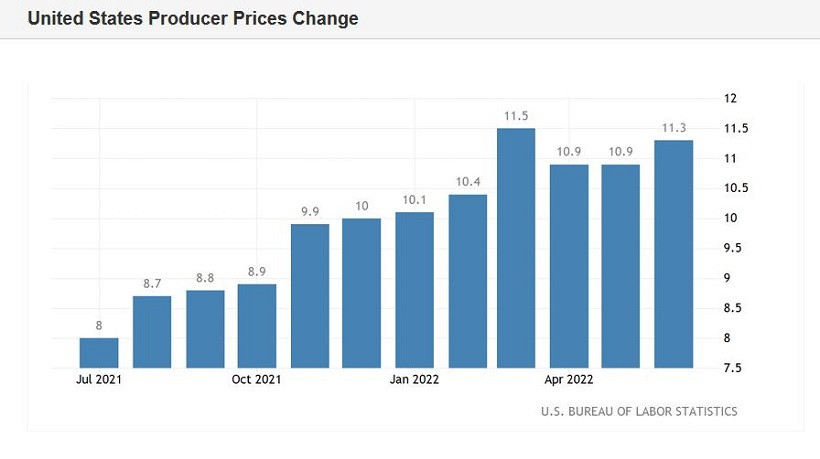

The formal reason for the next downward momentum of EUR/USD was the data report on the growth of the producer price index in the United States. As you know, this indicator is an early signal of changes in inflationary trends (or their confirmation). The release was a good addition to the consumer price index published on Wednesday. Like the CPI growth report, the figures also came out in the green zone. On a monthly basis, the indicator was at 1.1%, with a forecast decline to 0.8%. In annual terms, the index reached 11.3% (with a forecast of growth up to 10.7%). In other words, the producer price index supplemented the fundamental picture positive for the greenback, reinforcing the already strong hawkish expectations regarding the Federal Reserve's next steps.

So, according to CME data, traders estimate the probability of the Fed raising the interest rate by 100 basis points at the July meeting at 85%. Let me remind you that a few weeks ago, Fed Chairman Jerome Powell stated that the members of the central bank would choose between a 50-point and 75-point hike. At the moment, the question is no longer this way: traders are almost certain that the US central bank will have to resort to more aggressive counteraction measures: +100 points in July and +75 points in September.

And although such strong hawkish expectations are fraught with negative consequences for the dollar (if the Fed does not live up to its expectations), the greenback is in high demand on Thursday due to the trading principle "buy on rumors...". Moreover, talk of a 100-point rate hike is taking place amid the phlegmatic position of the ECB, which still cannot decide whether it should raise the rate by 50 basis points in July or limit itself to a 25-point increase?

The US dollar is strengthening its position due to the strengthening of anti-risk sentiment in the market. Key Wall Street indices are trading deep in the red today, reflecting the flight from risks. Geopolitical tensions, the energy crisis, high inflation and the risk of a global recession – all these factors increase the demand for a safe dollar. By the way, the price of Brent crude oil has dropped to $94 per barrel. The fall in the price of oil is associated with the expectation of the onset of the global economic crisis. Meanwhile, in Europe, the price of gas is rising again in the face of news about an accident at a field in Norway and the shutdown of the Russian Nord Stream gas pipeline for repairs. On Wednesday, the nearest (August) TTF futures on the ICE Futures exchange jumped to 1909 dollars per thousand cubic meters.

Thus, the prevailing fundamental background contributes to a further decline in the price of EUR/USD. But on the other hand, we see that traders still do not risk staying below the parity level for a long time. The "scouts" gradually go deeper into the area of the 99th figure, but then they still come back. This suggests that the downward targets still need to be placed above the 1.0000 mark, and short positions should be opened on corrective rollbacks to the 1.0100 target. Despite the strength of dollar bulls, traders prefer to take profits under the parity level. Therefore, it is advisable to use corrective waves here to open short positions as far as possible from the key mark of 1.0000. Downward targets can be located at 1.0050, 1.0000.