The pound remains under pressure against the US dollar, despite the tough rhetoric of the Bank of England officials regarding the prospects for monetary policy and positive macro statistics received last week: the UK manufacturing output increased by +1.4% in May (against the forecast of +0.1% growth). In annual terms, the indicator rose by +2.3%, exceeding expectations of +0.3% after rising by +1.3% in April. The total volume of industrial production increased in annual terms by +1.4% (against the expected decrease by -0.5% and the previous value of +1.6%).

The recovery of the British economy in May was also evidenced by the monthly release of the Office for National Statistics (ONS), which states that the UK GDP in May amounted to +0.5% against the expectation of zero growth and after a decrease of -0.3% in April. At the same time, the indicator (estimate of GDP growth rates) published by the National Institute of Economic and Social Research (NIESR) and estimating the growth rate of the British economy over the past three months also came out with a value of +0.2%, which turned out to be better than the forecast of +0.1%. Note that this report comes out before the release of official GDP data, and its positive value hints at an equally positive official report, and it, in turn, is a bullish factor for the GBP.

Meanwhile, former British Chancellor of the Exchequer and Conservative Party leader candidate Rishi Sunak said last Thursday that "the number one economic priority (for the UK government) is to fight inflation."

"We are working together with the Bank of England to curb inflation and I am confident that we can create a stronger economy for all people in the UK," UK Treasury Secretary Nadhim Zahawi said in unison with Rishi Sunak last week.

As a result of the June meeting, the Bank of England announced its decision to raise interest rates for the fifth time in a row to curb inflation. With 6 out of 9 votes, the Monetary Policy Committee voted to raise the rate by 25 bps to 1.25%; other members of the MPC pushed for a 50 bps rate hike. Interest rates in the UK are now at their highest level since January 2009. In an accompanying statement, the Bank of England said it was ready to continue acting decisively to address the dangers of high inflation above 11%.

Market participants generally reacted positively to this decision of the Bank of England. The pound first sharply weakened but then also sharply strengthened. As a result of this trading day (June 16), the GBP/USD pair rose by 68 points, while intraday volatility amounted to 365 points.

Meanwhile, the external macroeconomic background is not encouraging: energy prices continue to rise, the end of the military conflict in Ukraine is not yet in sight, and sanctions pressure on Russia is growing, creating new risks for the British economy.

The Bank of England forecasts a contraction in UK GDP by 0.25% by 2023, updated from its previous estimate of 1.25% growth. And in 2024, the bank lowered its forecast for GDP growth from 1% to 0.25%.

While markets are forecasting the interest rate to rise to 2.5% by mid-2023, economists believe that the Monetary Policy Committee will be able to raise rates only once more this year, which will probably happen in August. It is not a positive factor for the pound, while the tightening cycle is accelerating in other major world central banks. However, time will tell, as they say.

The next meeting of the Bank of England, dedicated to the issues of monetary policy, will be held on August 4. The bank's management may again raise the interest rate in order to curb inflation, which has reached 40-year highs.

The next release on the current inflation in the country will be published on Wednesday (at 06:00 GMT). UK inflation may set a new anti-record at 9.2% in June (after annual growth of 9.1%, 9.0%, 7.0%, 6.2%, and 5.5% in the previous months since the beginning of this year).

As for tomorrow's publication (at 06:00 GMT), it is expected that the UK ONS report on the labor market will indicate a low unemployment rate of 3.8% and an increase in average wages, including bonuses, over the last calculated 3 months (March-May), by +6.8% (after growth by +6.8%, +7.0%, +5.4%, +4.8%, +4.3%, +4 .2% in previous periods); without premiums by +4.3% (after growth by +4.2%, +4.2%, +4.1%, +3.8%, +3.7%, +3.8% in the previous periods). If the data is confirmed or turns out to be better than the forecast, the pound is likely to strengthen. Worse than expected/previous data will have a negative impact on the pound, as it will reinforce the negative outlook regarding the possibility of an interest rate hike by the Bank of England in August.

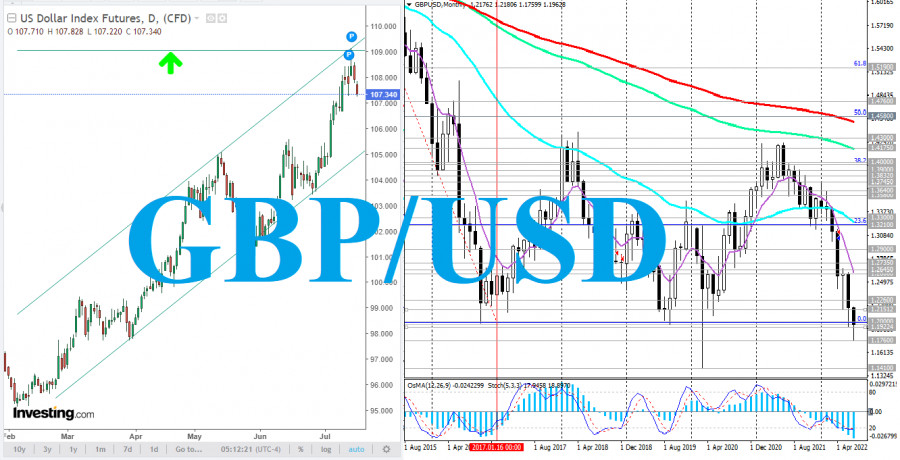

GBP/USD is growing today, having received an impulse from the dollar, developing a downward correction.

The dollar index (DXY) is down today after breaking above 109.00 last week. Given the strong bullish momentum, as well as the long-term upward trend in DXY, a breakdown of this local resistance level will be a signal to increase long positions in DXY futures with the prospect of growth towards multi-year highs of 121.29 and 129.05, reached, respectively, in June 2001 and November 1985.

Market participants continue to evaluate the inflation indicators published last Wednesday, which pointed to the continuing rise in inflation in the US.

As follows from the data of the US Bureau of Labor Statistics, published last Wednesday, in June, inflation in the US accelerated from 1.0% to 1.3%, and in annual terms, jumped to the highest level in the last 40 years, amounting to 9.1%. (YoY) vs. 8.6% in May and market expectations of 8.8%.

Such a sharp increase in inflation, despite the actions of the Fed, strengthened the expectations of market participants regarding a more rapid tightening of the monetary policy of the US central bank, and this is so far the main driver of USD growth.