On Monday, the EUR/USD currency pair, very unexpectedly for many, resumed the upward rise that began on Friday. In recent weeks and even months, traders have become so accustomed to the eternal collapse of the euro and pound that any growth looks weird. However, we have frequently maintained that no instrument should fall consistently. The problem is that it is practically impossible to foresee the beginning of a new correction currently. It would be easier if the market reacted significantly to macroeconomic statistics. But either the facts themselves, in most situations, favor the dollar, or market players, in most circumstances, do not pay heed to the negative data for the dollar. This leads to practically one-way traffic. And suddenly, on Monday, with an empty schedule of macroeconomic and fundamental events, we witnessed a gain of 100 points. And it doesn't matter that after this growth, the pair instantly hurried back down. The crucial issue is an increase, which implies that the pair may fall further lower.

There is a very difficult attitude to almost any correction anymore. On the one hand, the pair has been falling for a very long time and quite forcefully, and any correction is viewed unconsciously as the beginning of a new rally. Conversely, the longer the pair falls, the fewer buyers remain on the market. Why trade against the trend? A significant slump nearly ensures profit for all market participants, so why bother purchasing at all? Therefore, although the pair was fixed above the moving average line yesterday, we believe the decline could restart at any moment. It doesn't even require solid statistics or big fundamental occurrences. With such a powerful trend, sales can be conducted out of the blue.

The entire underlying background hinges on ECB and Fed interest rates.

Do you recall how it was previously? The market frequently discussed the trade war between the United States and China, some elections in the European Union, then in the United States, and every day it was possible to analyze Donald Trump's words, who amused and continue to delight the public. "Coronavirus," stimulus packages, bonds, loans, economic recovery. Currently, nobody is interested in all of this. The pandemic, which scared the globe for two years, was swiftly and readily forgotten. It appears that the coronavirus has taken a vacation and is currently preparing to return. To accomplish this, though, someone must be interested in them, and the world's focus is currently on Russia and Ukraine. This, however, is geopolitics. Certainly, it is crucial, and 60 percent (according to our estimates) of the decline of the euro and the pound against the dollar may be attributed to it. However, there is also a theoretically more significant background than geopolitics. In addition to microeconomics, macroeconomics should also impact the trend. However, this is no longer engaging. The only issue of interest is how much the ECB and the Fed will hike interest rates at their meetings.

Everyone discusses this topic nearly every day. People are busy attempting to forecast the central bank's activities during the entire interval between its two sessions, as we have entered some futuristic era. It appears that approximately 1.5 months pass between meetings on average. The Central Bank makes a decision, it can be analyzed for a few days, and then attention is shifted to other events. But currently, experts, analysts, traders, and the media are only talking about how this or that central bank would boost its key rate? And it appears that the remaining forty percent of geopolitical influence is migrating away from this issue. Because the Fed routinely raises the key rate, whereas the ECB does not. This week, the European regulator will hold a conference at which (miracle of miracles!) the rate may be increased by "up to" 0.25 percent. From our perspective, such an increase to combat inflation, which is already approaching 10 percent, is equivalent to throwing rocks at a train.

Nonetheless, intelligent individuals work at the ECB, so they likely know better. We can only evaluate and respond. And based on the steady decline of the euro, the market concurs that the ECB's efforts thus far appear ridiculous.

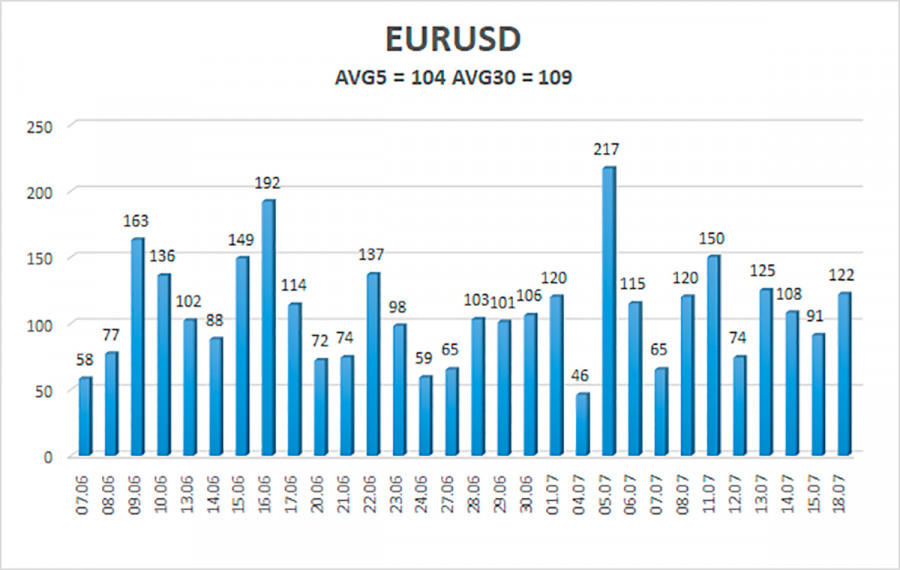

As of July 19, the average volatility of the euro/dollar currency pair for the previous five trading days was 104 points, which is considered "high." Thus, we anticipate the pair to trade between 1.0056 and 1.0265 today. The downward reversal of the Heiken Ashi indicator suggests a likely continuation of the downturn.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading Recommendations:

The EUR/USD pair has maintained its position above the moving average line. Maintain long positions with goals between 1.0254 and 1.0376 until the Heiken-Ashi indicator turns bearish. The pair's sales will become crucial when anchored below the moving average with targets of 1.0010 and 0.9888.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

The moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.