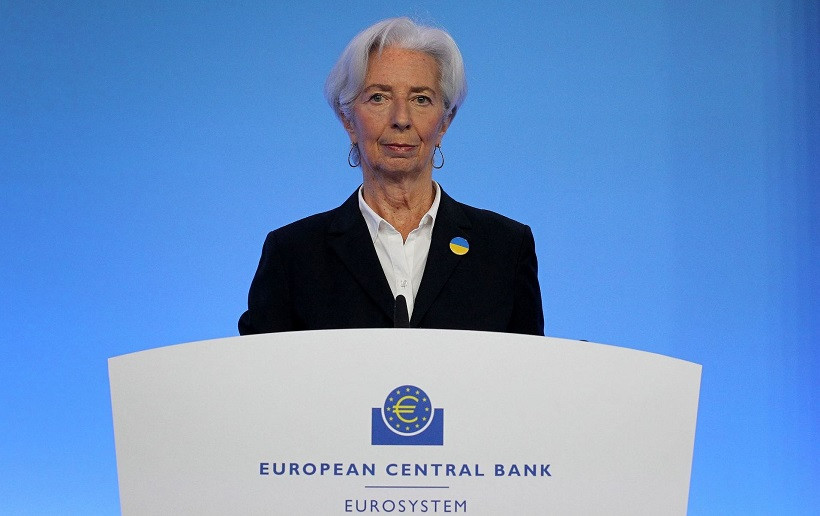

So, following the results of the July meeting, the European Central Bank raised interest rates by 50 basis points, realizing the most hawkish scenario. The overwhelming majority of economists polled by Reuters (62 out of 63) predicted a 25-point increase. In general, many ECB representatives, including ECB President Christine Lagarde, ahead of the July meeting also said that it is necessary to follow the path of normalization of monetary policy at a smooth pace, taking into account the existing risks for the debt market. In particular, one of the members of the Governing Council – Olli Rehn – last week stated that the ECB is preparing to raise the rate by 25 points.

But the ECB still deviated from the basic scenario. It not only raised interest rates for the first time in the last 11 years, but also surprised the markets with its determination, which is not inherent in the ECB a priori. According to the results of the July meeting, from July 27, the interest rate on the main refinancing operations and interest rates on the margin credit line and deposit line will be increased to 0.50%, 0.75% and 0.00%, respectively. Also, the European Central Bank did not rule out further steps in this direction at the next meetings this year.

The euro-dollar pair reacted accordingly to this decision, impulsively rising to the level of 1.0268. However, EUR/USD bulls could not hold their positions: just a few hours after the meeting, the bears intercepted the initiative.

The fact is that a few days before the July meeting (namely on Monday), the journalists of the Reuters news agency, referring to their anonymous sources in the ECB, said that the option of a 50-point rate hike "is still on the agenda." At the same time, it was argued that the pendulum may swing in the direction of this decision, despite the general market sentiment for a 25-point increase. Amid these hawkish rumors, the euro has significantly strengthened its position against the dollar. EUR/USD bulls were able to extinguish the threat of a resumption of the downward trend – they moved away from the parity level by more than 200 points.

As a result, the Reuters insider was confirmed. Contrary to forecasts, the central bank really decided to raise rates at a sharper pace. But de facto, the journalists did the euro a disservice: by announcing a 50-point increase, they increased the hawkish expectations of traders, thereby offsetting the effect of surprise, which is very important in such situations. "At the moment", the EUR/USD pair could overcome the resistance level of 1.0300, thereby changing the price echelon for further offensive. But after the insider revealed the information, the blitzkrieg option was basically impossible: traders reacted reflexively to the very fact of the rate hike, but then lost the initiative. For the development of the upward movement, EUR/USD bulls needed an additional information occasion, but they did not receive it. Moreover, Lagarde voiced rather vague formulations regarding the prospects for further tightening of monetary policy.

According to the head of the ECB, the pace of rate hikes will depend on incoming data. At the same time, she acknowledged that economic activity in the eurozone is slowing down, while risks to the inflation forecast remain: they are shifting upward and are getting stronger. Lagarde said that energy prices in the world will remain at a high level in the near future, but in the absence of interruptions, "they should stabilize."

In other words, Lagarde made it clear that at the moment there is no predetermined trajectory for increasing rates: the approach will change from meeting to meeting. In the current circumstances, the ECB will act cautiously, because on one side of the scale is the fight against inflation, on the other is the risk of recession. The central bank is forced to maneuver "between the raindrops", so there is no pre-approved algorithm of actions: the further path of raising the rate will depend on the incoming data.

Such vague prospects did not allow EUR/USD bulls to develop success. The "surprise effect" of the 50-point hike was offset, while the ECB did not provide any additional reasons for a significant strengthening of the euro. As a result, the pair flared up and immediately faded away.

Speaking about the results of the July meeting, it is impossible not to mention a new tool to combat fragmentation. A special mechanism called the Transmission Protection Instrument (TPI) was created to help the eurozone countries with more debt to prevent financial fragmentation in the currency bloc. It is indicated that the scale of asset repurchase within the TPI "will depend on the degree of risk."

Summarizing the results of the July ECB meeting, we can conclude that the central bank simultaneously surprised the markets with its hawkish decision, and at the same time disappointed with vague rhetoric regarding further prospects for tightening the monetary policy. The single currency could not turn the situation in its favor, and this is also because of the insider's information that was revealed the day before.

Therefore, the EUR/USD pair remains in standby mode. Now the focus of the market's attention will shift to the Federal Reserve, which will announce the results of the next meeting next week.

From a technical perspective, EUR/USD bulls not only failed to enter the area of the 3rd figure, but did not even overcome the resistance level of 1.0270 (the middle line of the Bollinger Bands indicator coinciding with the Kijun-sen line). The price is located between the middle and lower lines of the Bollinger Bands indicator, as well as under the Kumo cloud. In my opinion, it is advisable to use corrective bursts to open short positions. The downward targets are 1.0110 (the Tenkan–sen line on D1) and 1.0050 (the lower Bollinger Bands line on the W1 timeframe).