The EUR/USD currency pair continued its downward movement over the past week. Recall that the starting point for a new decline in the euro was the report on American inflation, which, from our point of view, caused an inadequate market reaction. Inflation in the US slowed down only slightly less than the market expected, but dollar purchases followed as if inflation had increased by 1%. One way or another, you can't argue with the market. After all, we need to predict the further course of the pair and not speculate about whether the majority of traders reacted logically or illogically to this or that event. And the market is now showing that it is still considering selling the European currency, not vice versa.

In the last few weeks, we have noted that the fundamental background is slowly beginning to level out for the euro currency. This does not mean that the long-term downward trend must necessarily be completed. But this means the chances of the euro's growth are a little greater than before. In principle, we remain of the opinion: that the euro currency may continue to fall for several more months, but the higher the ECB rate becomes, the more likely it is to see a reversal of the global upward trend. Naturally, under this condition, the Fed should reduce the pace of its rate increase. In this case, monetary policies will begin to align with each other, which may trigger the end of the trend.

The geopolitical factor has recently receded into the background but remains very important. Recall that a "gas war" is beginning between the European Union and Russia, which does not bode well for Brussels in the first place. Gas supplies through the Nord Stream pipeline have been temporarily stopped, and it is unknown whether they will resume in the future. The European Union is trying to find other gas suppliers. The current reserves may not be enough to provide the alliance throughout the winter, especially if the winter turns out to be cold. And if there is not enough gas, it will provoke a new increase in prices for "blue fuel," as well as its outright shortage. Industrial production may decline significantly, leading to a recession that everyone has discussed for a couple of months.

Inflation is not important; the Fed's decision is essential.

However, now it seems that the market is only interested in the meetings of the Fed and its actions and plans. The inflation report this week showed that this is most likely the case. After all, it is not even the inflation itself that is important, but what actions will follow to respond to this indicator? The market is confident that the slowdown in the consumer price index will force the regulator to raise the rate for the third time in a row by 0.75%. This is the most "hawkish" solution possible. Naturally, the US dollar gets additional "trump cards" on its hands, and traders on Tuesday worked out not inflation but the Fed's rate hike, which will take place next week. Thus, if the fundamental background does not continue to change in favor of the euro, then we will see an update of 20-year lows more than once this year. No matter how low the pair is, the market will continue to sell if there are no buying factors.

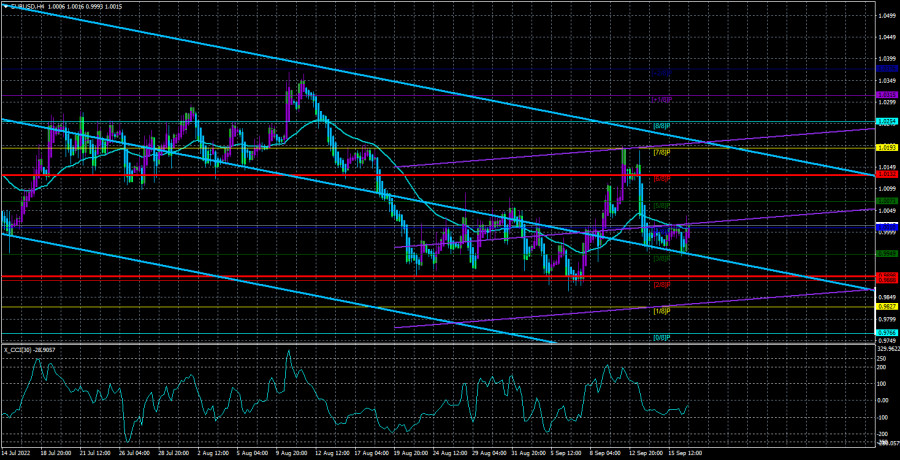

From a technical point of view, everything is simple. The price is again located below the moving average line, and the senior channel of the linear regression is directed downwards. Recently, the CCI indicator has not entered the oversold area. Only the junior regression channel has turned sideways, but it may very soon change its direction back to a downward one. And on the 24-hour TF, the price bounced off the critical line again, which is a strong signal for sales. We would say that the probability of a further fall in the euro currency is 80%.

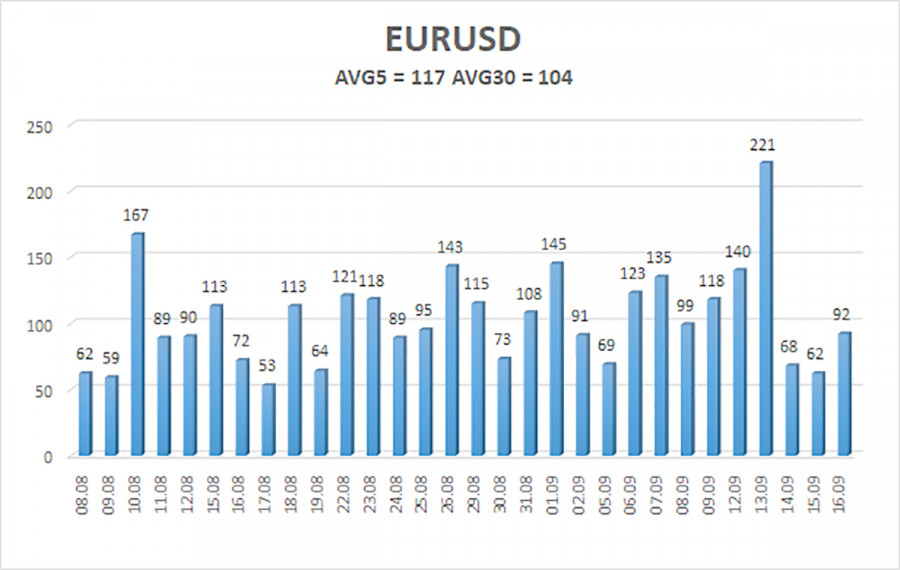

The average volatility of the euro/dollar currency pair over the last five trading days as of September 19 is 117 points and is characterized as "high." Thus, we expect the pair to move today between 0.9898 and 1.0132. A reversal of the Heiken Ashi indicator back down will signal a possible resumption of the downward movement.

Nearest support levels:

S1 – 0.9949

S2 – 0.9888

S3 – 0.9827

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0071

R3 – 10132

Trading Recommendations:

The EUR/USD pair is trying to continue the global downtrend. Sell orders should be considered now if the price bounces off the moving average line with targets of 0.9949 and 0.9898. Buy orders should be opened if the pair is fixed above the moving average, with targets of 1.0071 and 1.0132.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.