EUR/USD 5M

Business activity indices were published in the European Union and the United States on Friday... We tried to make the beginning of this article as absurd as possible, since now hardly anyone is interested in business activity indices. The euro lost about 150 points on Friday and on Monday night within one hour it fell by another 130 points. This is all you need to know now about what is happening in the foreign exchange market and the state of its participants. This is no longer a reaction to the "foundation" or any macroeconomic events. It's just shock and panic. The euro has already almost reached the level of 0.9500, although a few months ago this level looked fantastic. We have repeatedly said that the collapse of European currencies may well continue, given the current geopolitical and fundamental background. Basically, this is exactly what we are seeing now. Yes, a rollback to the top followed at night, but what does it decide? The market is clearly not just running in a panic from risks...

In regards to Friday's trading signals, everything was very, very good, since none were formed. We say this because the market is in a state of shock right now, and trading in such circumstances is not the best thing to do from our perspective. Yes, a clear trend movement was observed all day long, on which one could make very good money, but why open positions if there is not a single level at the current price values? If you are trading our Linear Regression Channels system on the 4-hour time frame, then everything is fine, as there is a Heiken Ashi indicator that shows entries for new falls in the pair. It is very difficult to trade on hourly and lower timeframes due to the lack of reference points and signals.

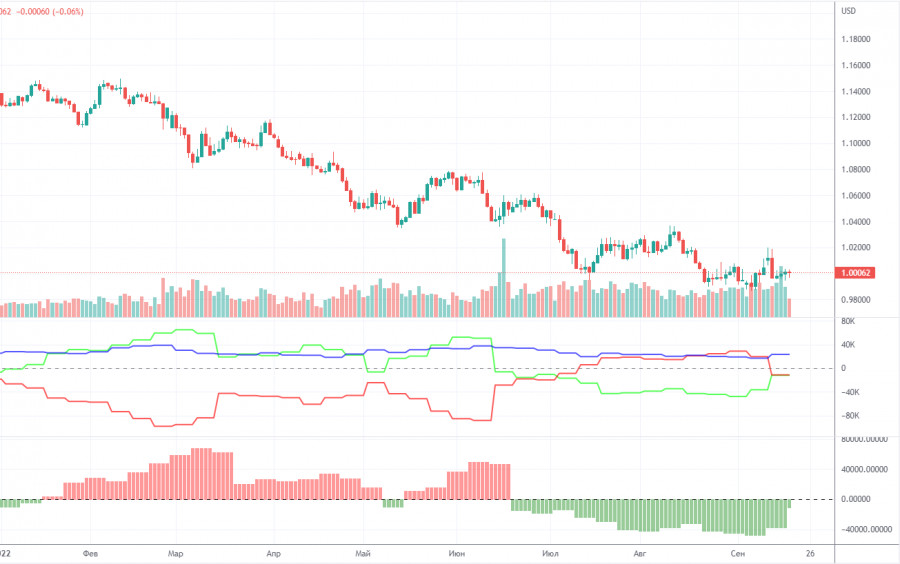

COT report:

The Commitment of Traders (COT) reports on the euro in the last few months clearly reflect what is happening in the euro/dollar pair. For half of 2022, they showed a blatant bullish mood of commercial traders, but at the same time, the euro fell steadily at the same time. At this time, the situation is different, but it is NOT in favor of the euro. If earlier the mood was bullish, and the euro was falling, now the mood is bearish and... the euro is also falling. Therefore, for the time being, we do not see any grounds for the euro's growth, because the vast majority of factors remain against it. During the reporting week, the number of long positions for the non-commercial group increased by 2,500, while the number of shorts decreased by 22,000. Accordingly, the net position grew by about 24,500 contracts. This is quite a lot and we can talk about a significant weakening of the bearish mood. However, so far this fact does not provide any dividends to the euro, which still remains "at the bottom". The only thing is that in recent weeks it has done without another collapse, unlike the pound. At this time, commercial traders still do not believe in the euro. The number of longs is lower than the number of shorts for non-commercial traders by 12,000. This difference is no longer too large, so one could expect the start of a new upward trend, but what if the demand for the US dollar remains so high that even the growth in demand for the euro does not save the situation for the euro/dollar currency pair?

We recommend to familiarize yourself with:

Forecast and trading signals for GBP/USD on September 26. Detailed analysis of the movement of the pair and trading transactions.

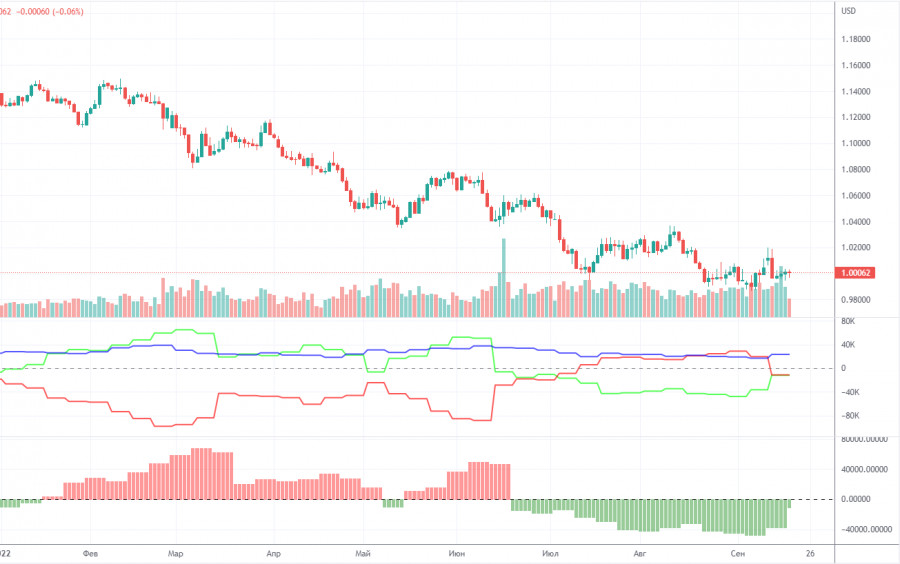

EUR/USD 1H

The prospects for bears remain just fine on the hourly timeframe, given that now no one is even thinking about buying the euro. To say now that the euro's new collapse was provoked by last week's Federal Reserve meeting is like blaming a train derailment due to rain. From our point of view, the market is in a panic, and it is hardly possible to say how long it will persist and how it will end. We highlight the following levels for trading on Monday - 0.9813, 0.9877, 0.9945, 1.0019, as well as Senkou Span B (1.0031) and Kijun-sen (0.9804). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. European Central Bank President Christine Lagarde will speak in the European Union on September 26, which is unlikely to affect anything. You should trade on a 4-hour or daily TF, who considers it necessary to do this in a panic on the foreign exchange market.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.