The EUR/USD currency pair began its systematic decline in the morning. In yesterday's article, we warned that a scenario with further growth of the euro currency after it becomes known about a new increase in the key rate is unlikely. At least because the euro has been growing all week without any reason. Would the following picture have turned out: the euro grew during the first three days of the week and added 200 points, and then it would have to grow by at least another 100 points because the ECB raised the rate? 300 points in four days are too much for a currency that has been in a downward trend for almost 2 years. Thus, when it became known about the decision to raise the key rate by another 0.75%, the European currency rushed down.

This is not surprising, since the ECB's decision to raise the rate was known long before the meeting itself. The market just worked out this decision in advance. However, the question remains whether this week's upward movement was not a banal acceleration before a new prolonged fall. After all, at the moment, the price continues to be located above the moving average line, and the junior channel of linear regression is directed upwards. Everything seems to indicate that the European currency can continue its growth. But what are the grounds for this if the Fed raises its rate by 0.75% next Wednesday? The market, which has been so desperately buying up the dollar in recent months, can't just ignore the fourth consecutive increase of 0.75% in America. Moreover, in this case, the Fed rate will be 4%, and the ECB rate will be 2%. That is, on the face of the continuing advantage of the US currency. Therefore, we are cautious about statements that the euro may continue to grow in the medium term. Recall that on the 24-hour TF, it has not yet managed to overcome the Ichimoku cloud, which is one of the most important indicators of a trend reversal.

The ECB has promised to continue to fight high inflation.

So, the European regulator has raised all three key rates: margin, credit, and deposit. The ECB statement says that this decision will contribute to the return of inflation to the target level, but it will remain above it for a long time. On the one hand, this statement is quite justified, since at the moment inflation in the European Union is 9.9%. How long will it take for it to return to 2%, even if it starts to decline next month? On the other hand, isn't this a hint that the ECB will not be able to raise the rate forever, since some EU countries may simply collapse?

The final communique also stated that the regulator intends to closely monitor all changes in the economy and respond promptly to them. The regulator has decided to continue reinvesting all funds from redeemable securities under the APP program, as well as PEPP. Thus, the ECB does not intend to unload its balance sheet and launch the QT program yet. By and large, nothing but the rate has changed at this meeting.

What conclusions can we draw in this regard? The ECB has raised the rate for the third time in a row but is not launching a bond sale program to reduce the money supply in the European Union, which would also put pressure on inflation. They promised to continue raising the rate, but they did not say to what level. The European currency continues to be very close to its "bottom" and the market shows that it is not yet ready to rush headlong from the pool of purchases of the EU currency. Since the situation is quite ambiguous, we advise you to continue focusing on the Ichimoku cloud on the 24-hour TF and the location of the price relative to the moving average on the 4-hour. In a certain scenario, it can be assumed that all future Fed rate hikes have already been taken into account by the market, but it is still quite dangerous to buy a pair before the Fed meeting, at which the rate is 99% likely to be increased by the same 0.75%.

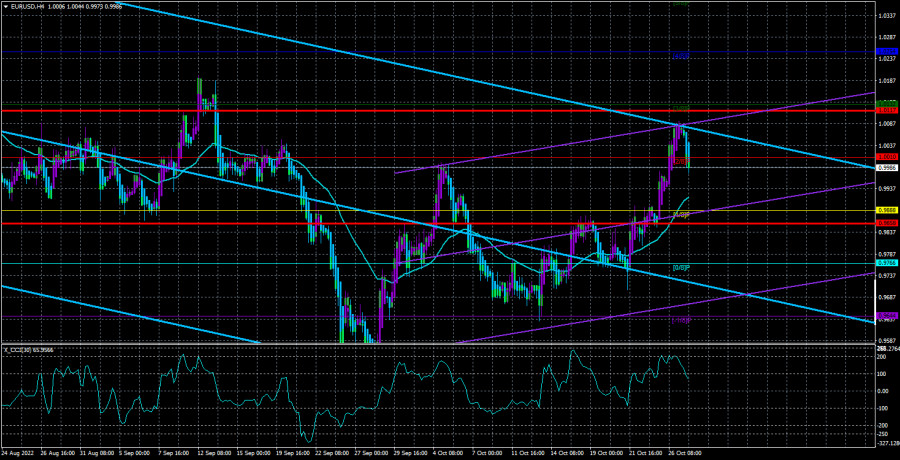

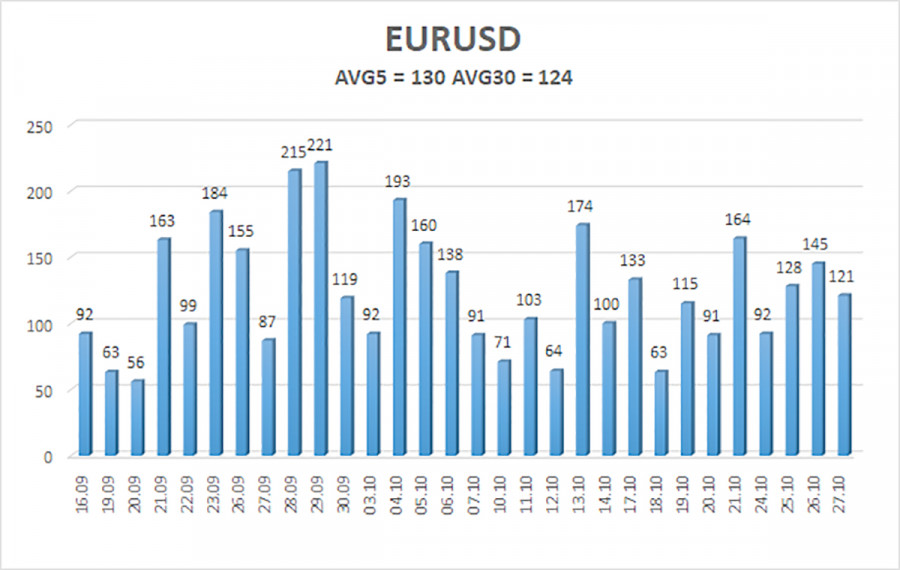

The average volatility of the euro/dollar currency pair over the last 5 trading days as of October 28 is 130 points and is characterized as "high." Thus, we expect the pair to move between the levels of 0.9858 and 1.0117 on Friday. The upward reversal of the Heiken Ashi indicator signals the resumption of the upward movement.

Nearest support levels:

S1 – 0.9888

S2 – 0.9766

S3 – 0.9644

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0132

R3 – 1.0254

Trading Recommendations:

The EUR/USD pair continues to be located above the moving average. Thus, now we should consider long positions with targets of 1.0117 and 1.0132 in the case of a reversal of the Heiken Ashi indicator upwards. Sales will become relevant no earlier than fixing the price below the moving average with a target of 0.9766.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.