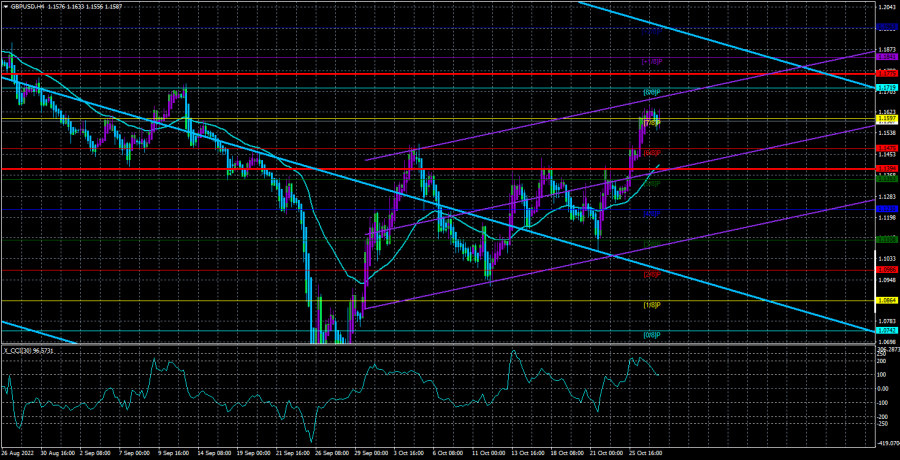

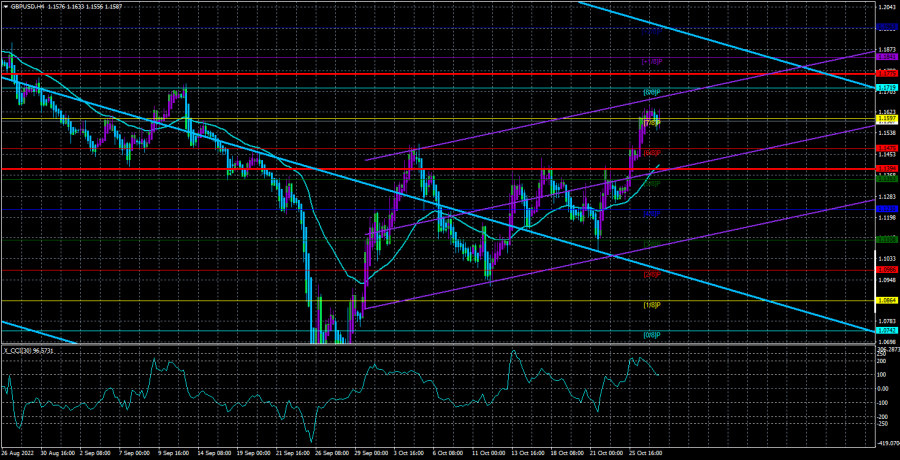

The GBP/USD currency pair traded quite calmly on Thursday, unlike the euro/dollar pair. Even when it became known that the ECB's key rate was raised by 0.75% to a value of 2%, this did not provoke a strong growth or fall of the pair. On the one hand, this is logical, since the ECB rate has nothing to do with the British pound. On the other hand, the euro and the pound regularly show almost identical movements, so the same could have been expected yesterday. In any case, the pound has its own "headache." Namely, the meetings of the BA and the Fed, which will be held next week. We will talk more about them below. In the meantime, it should be noted that the last local maximum of the pair has been updated, which significantly increases the likelihood of continuing northward movement. At the same time, it has not yet been possible to reach the more significant Murray level of "8/8"-1.1719. In parallel, it was not possible to overcome the Ichimoku cloud on a 24-hour TF. Therefore, we would say that certain chances of a new drop in technical terms remain.

If you pay attention to the foundation, then everything remains very bad for the pound here. We have already said that the factors that led to the strongest fall in the British currency (even without taking into account its last collapse by 1000 points) remain in force. The Fed is also raising the rate, inflation in the US has begun to slow down, unlike the British one, and the American economy has much fewer problems in its liability than the British one. Naturally, traders preferred the dollar to the pound in this situation, and international investors sought to invest in the American economy rather than the British one. In addition, at a time when many central banks of the world are tightening their monetary policies, the demand for safe assets is growing. And what is the very first safe asset? Of course, a bank deposit. And it turns out that the higher the rates of a particular Central Bank, the more attractive the deposits of commercial banks within the country. Again, the bias is in favor of the US dollar, the demand for which is growing, since you want to place dollars in an American bank.

The key question is whether the cycle of BA increases is being prepared to end.

It is the Fed that is much closer to completing the cycle of tightening monetary policy, since American inflation has begun to slow down at least, and the rate may rise to 4.5-4.75% in the next two meetings. It may not be necessary to raise the bid further. If in January-February we see a decrease in inflation to 6%, this may already mean that the current rate level will be enough to return inflation to the target level. This is exactly what the head of the San Francisco Federal Reserve, Mary Daly, spoke about earlier this week. She noted that the time is approaching when the regulator needs to start discussing the slowdown in the rate hike. This means that next week the Fed may raise the rate by 0.75%, then by 0.5%, and then by 0.25%. In total, this will lead to an increase in the rate to 4.75%, so the last increase may not even be required. However, in any case, we will see the new tightening of monetary policy at the next two meetings.

But with the Bank of England, everything is much more complicated. According to the calculations of many experts, the rate should be raised to 5-6% so that inflation could decrease to 2% in the future for several years. It is unclear whether the British economy, which has been "out of place" for the past five years, will cope with such a tightening. The recent turmoil in the financial markets of the UK named after Liz Truss showed how fragile the state of the British economy is, and the Bank of England urgently had to buy treasury bonds to stabilize their yields, although at the end of this month it was supposed to start selling them off from its balance sheet. Therefore, we strongly doubt that BA can continue raising the rate "to the bitter end." It may also stop doing this in the coming months, but its rate will be lower than the Fed rate, which will continue to support the dollar.

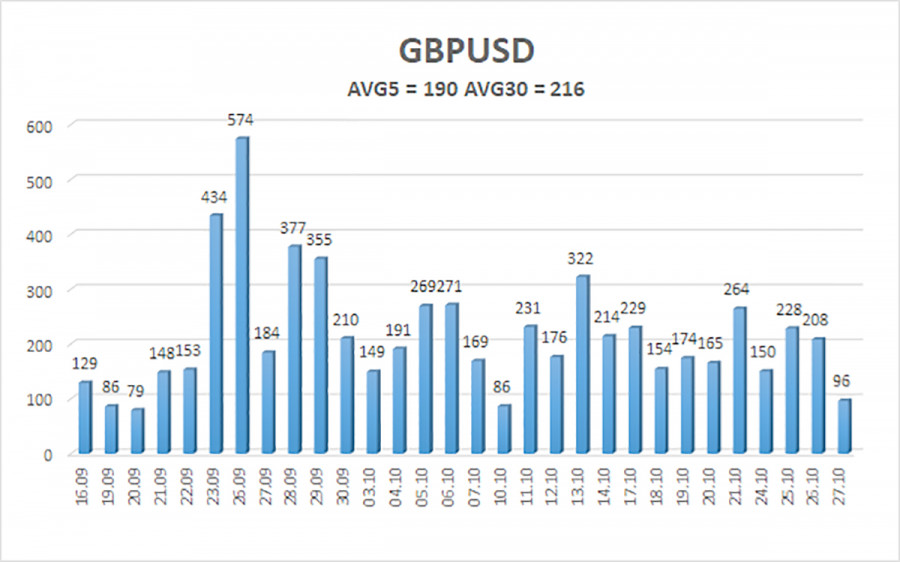

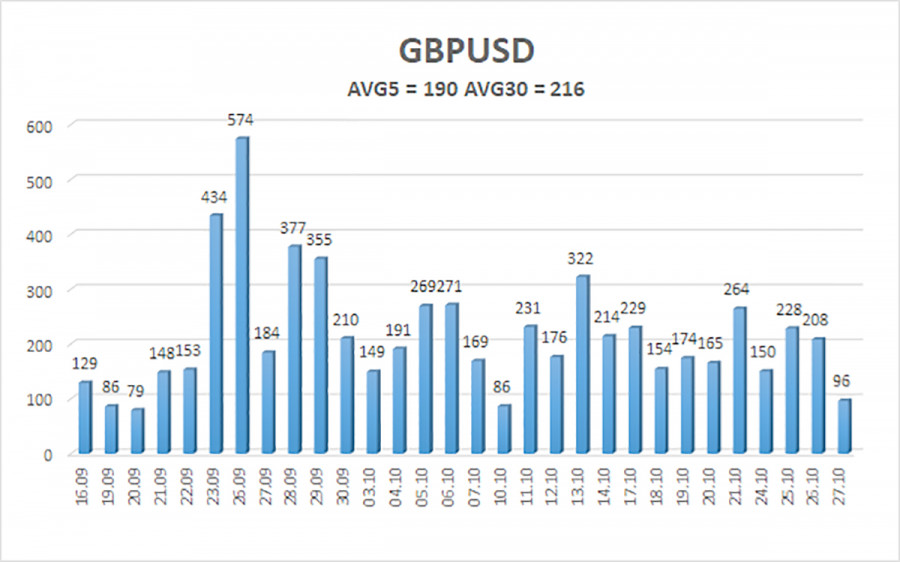

The average volatility of the GBP/USD pair over the last 5 trading days is 190 points. For the pound/dollar pair, this value is "very high." On Friday, October 28, thus, we expect movement inside the channel, limited by the levels of 1.1394 and 1.1775. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The GBP/USD pair began to adjust in the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.1719 and 1.1775 should be considered in the event of an upward reversal of the Heiken Ashi indicator. Open sell orders should be fixed below the moving average with targets of 1.1230 and 1.1108.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.