The GBP/USD currency pair calmly continued its collapse on Thursday, which began on Wednesday evening. We have already figured out why the US dollar rose strongly during the day after the Fed meeting. But why did it rise after the Bank of England raised its rate proportionally? Let's talk about this a little bit below, but for now, the technique. On Wednesday evening, the quotes of the British pound fell below the moving average line. And this is the first reason we could expect a new fall in the pair.

Further, on the 24-hour TF, there was no confidence in overcoming the Ichimoku cloud. Therefore, the global downward trend has not yet been canceled. Third, the pound sterling actively ignored the previous seven rate hikes of the Bank of England and ignored the eighth, so the conclusion suggests that BA's actions on price stabilization are not important for market participants at all. Traders are much more interested in the dollar, the US economy, and actions with the Fed's plans, which once again proved on Wednesday and Thursday.

Thus, we have received a fairly strong upward movement in recent weeks (by 1300 points), which, as it seems now, has no sacramental meaning for the pound sterling. We have already said that the last collapse of the pound by 1000 points and the subsequent increase by 1100 points was quite accidental. They were provoked by Liz Truss's "tax initiatives" and their subsequent cancellation. If Truss had not started "off the bat," there would have been no collapse of the pound, there would have been no subsequent recovery, and Truss herself could have retained the prime minister's chair. And if we cross out these movements, it turns out that the pound has moved away from its 37-year lows by only 200 points. That is, the downward trend has been forming and continues to form. The foundation and geopolitics were crucial for the pound against the dollar. And after two meetings of the central banks, the situation has not changed one iota.

The Bank of England raised the rate by 0.75%, which could support the pound

Andrew Bailey intervened in the matter and felt that the British currency's growth was unnecessary now. His rhetoric at the speech after the meeting looks like a targeted killing of the pound and any investments in the British economy in the coming years. Of course, Mr. Bailey told the truth and dispensed with streamlined interpretations. He cut the truth from the shoulder. But it seems to us that as the head of the central bank, it is necessary to use the most cautious rhetoric because the state of the markets and the mood of their participants depend on the words you say. Bailey immediately said that the economy would fall by 0.5% in the third quarter, which would begin a recession that would last at least two years. Inflation will continue to rise and peak at 10.9% at the end of this year. At the same time, last time, the Bank of England expected inflation to rise to 13-15%, but the actions of the UK government limited the growth of energy prices, so inflation should not grow so fast now. According to Bailey's optimistic forecast, inflation will return to 2% no earlier than 2024. In 2023, the economy will shrink by 1.5%, and in 2024 – by 1%. Unemployment in the UK will rise to 6.5% by the end of 2025. The key rate may rise to 5% or so. Such a forecast upset traders, although it seems to us that they ignored the eighth rate hike and the previous seven.

Experts also note that the November meeting of the BA was held in conditions of total uncertainty since the new government of Rishi Sunak will publish its economic strategy only on November 17. According to the latest information, Sunak will raise some taxes to avoid a budget deficit. Recall that Liz Truss was going to lower taxes, which cost her the post of prime minister. We believe Sunak is walking on very thin ice, as the British will not be happy with the increase in already high taxes against the background of record inflation over the past 40 years and record increases in energy and heating prices.

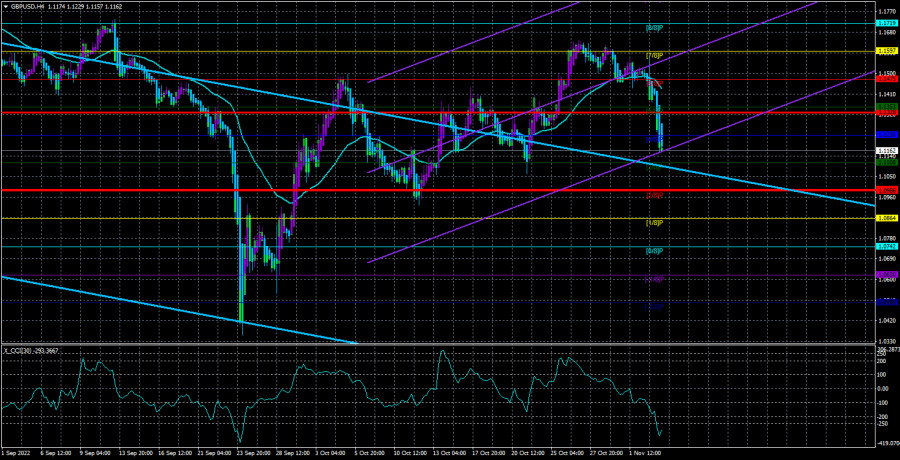

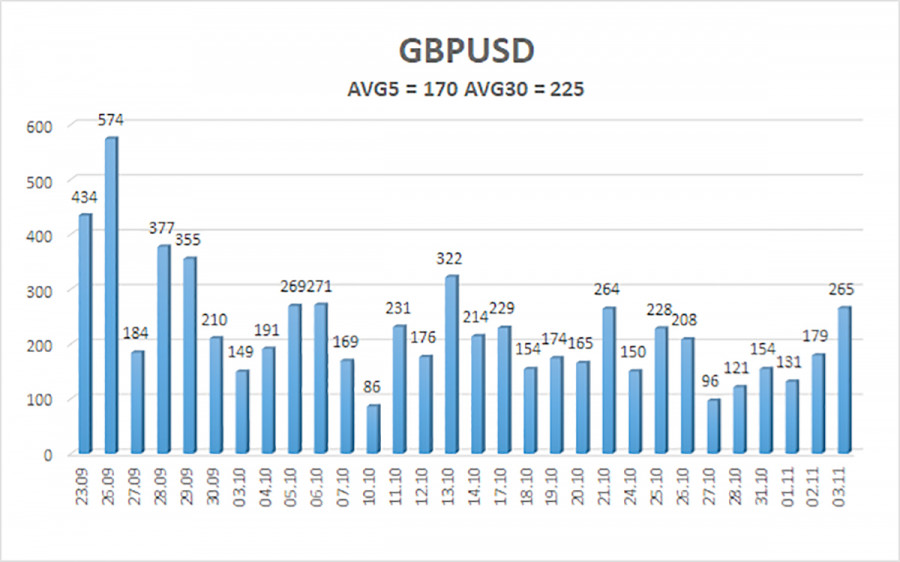

The average volatility of the GBP/USD pair over the last five trading days is 170 points. For the pound/dollar pair, this value is "high." On Friday, November 4, thus, we expect movement inside the channel, limited by the levels of 1.0990 and 1.1328. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

Trading Recommendations:

The GBP/USD pair continues to move down in the 4-hour timeframe. Therefore, at the moment, you should stay in sell orders with targets of 1,1108 and 1,0990 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixing above the moving average with targets of 1.1597 and 1.1719.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.