For most of the day on Wednesday, the EUR/USD currency pair maintained a calm pace of movement. In general, there have been a few significant movements this week. The market experienced a spike in emotions following the release of the US inflation report, which was highly anticipated, and following the release of the minutes from the Fed meeting last night. Tradition dictates that we wait to discuss the Fed meeting's outcomes. At the very least, this is true: only a few hours have passed since they made their announcement, and even this evening, as they have done numerous times, the pair can alter their course drastically. We also want to remind you that the market's response to such a significant event can last up to 24 hours. The European markets can begin analyzing the meeting's outcomes this morning since they didn't have time to do so last night. One significant event will coincide with another today during lunch when the ECB publishes the meeting's outcomes. Furthermore, determining what traders respond to will take a lot of work.

We prefer to hold off on concluding until all relevant events have passed. We still anticipate a significant downward correction, but it has yet to occur. It is noteworthy that the euro did not fall even during those times when there were no supportive factors. There are no longer any corrections of 100-200 points, whereas there were a few months ago. Although it is impossible to predict when strong sales will start, the market is ready for them. As a result, we continue to advise clients to prepare for a significant move south while also opening short positions only in response to the proper sell signals.

The US dollar can benefit from the ECB.

It will be very difficult to predict what could cause the European currency to fall today if the European Central Bank does not initiate it. The market may sell the pair on a day with no macroeconomic or fundamental background. However, it would be pointless to foresee such a turn of events. Today, the ECB plans to increase the key rate by 0.5%. In the context of the struggle against inflation, a slowdown in the pace of monetary policy tightening is ineffective. As we previously stated, some EU nations might not be able to bear the high cost of borrowing, so the ECB will need to give them financial assistance later. And this is a new QE program or something similar. As a result, the European regulator must strike a balance between two competing fires: high inflation and the potential to plunge the economies of some nations into a serious crisis. Because of this, the euro has already appreciated too much about the dollar and will continue to do so without any justification. Only after one decline in inflation could the ECB decide to slow the pace of tightening. For instance, the Fed made this choice in response to five reports on inflation that revealed a slowdown in the price growth rate in the United States.

Given that the Fed rate is already twice as high as the ECB rate and that this gap will continue to grow slowly or not at all in the future, the European currency should lose market support. The ECB may increase its rate several times if the Fed refuses to raise it any further at some point, but this is unlikely to occur before three months. The likelihood of the pair continuing to grow for an additional three months is low. It is preferable to use this time for correction before moving on to growth. Thus, the European currency is still trading at a very high level, and there is currently no selling signal, even after excluding the movements from yesterday evening (which can be easily leveled today). Every trend indicator points upward.

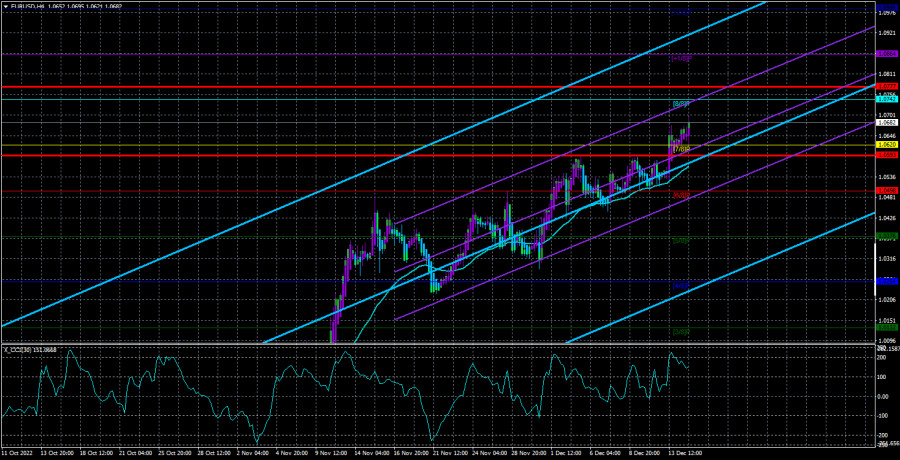

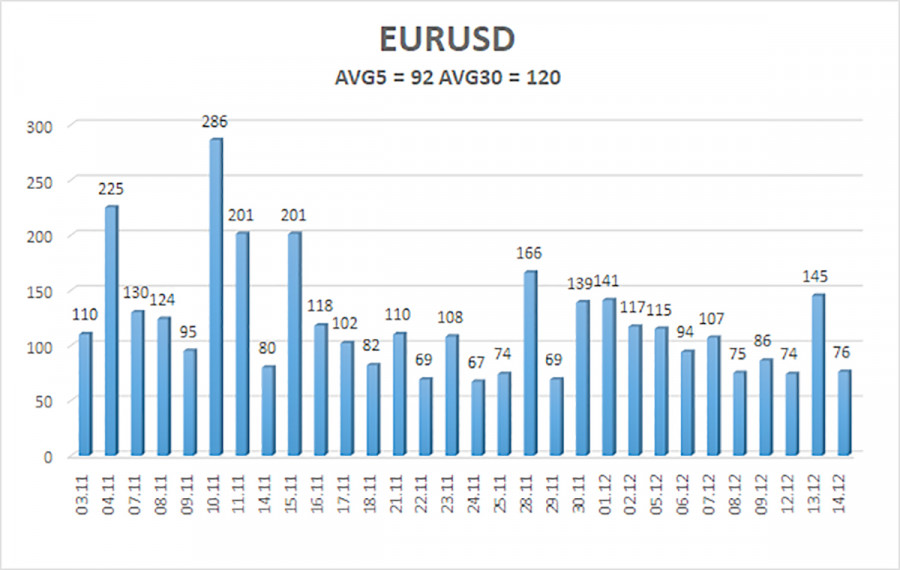

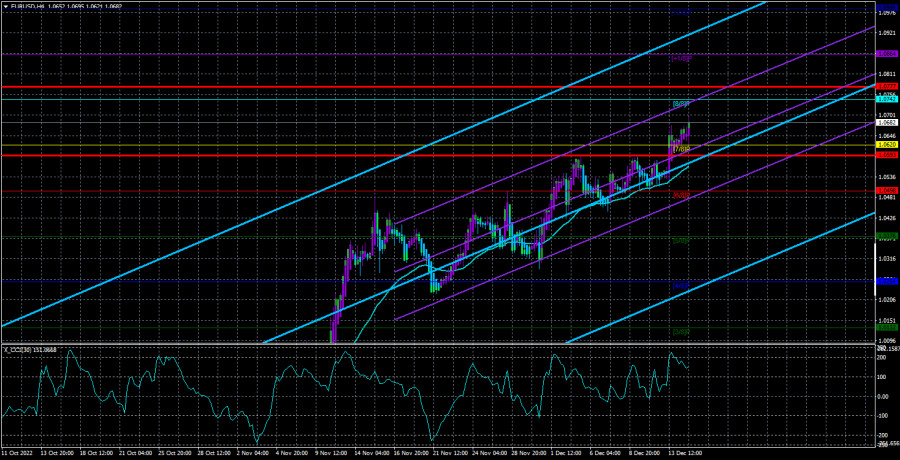

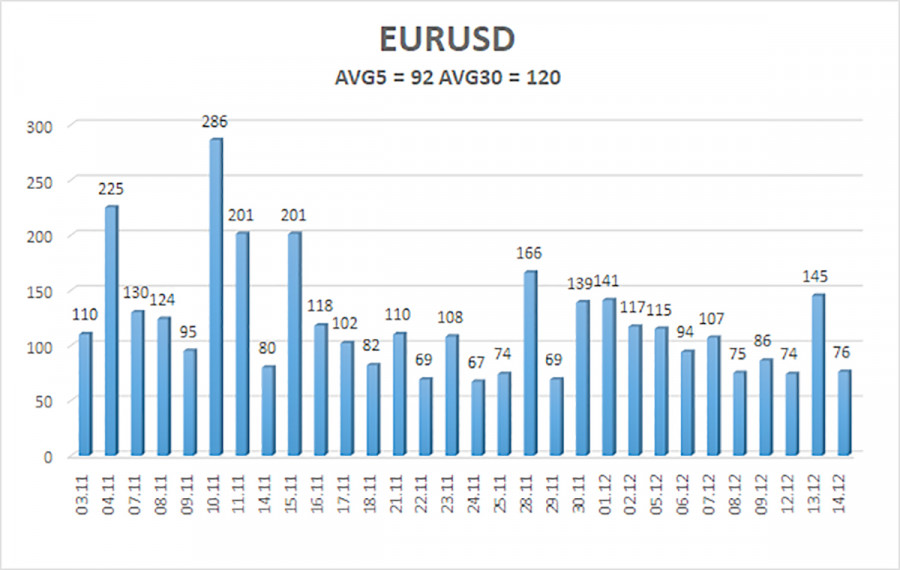

As of December 15, the euro/dollar currency pair's average volatility over the previous five trading days was 92 points, which is considered "high." So, on Thursday, we anticipate the pair to fluctuate between 1.0593 and 1.0777 levels. A round of corrective movement begins when the Heiken Ashi indicator reverses its direction downward.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading Suggestions:

The EUR/USD pair is still moving upward. As a result, until the Heiken Ashi indicator turns down, it is necessary to maintain long positions with targets of 1.0742 and 1.0777. Sales will become significant if the price is fixed below the moving average line with a target of 1.0498.

Explanations for the illustrations:

Determine the present trend with the aid of linear regression channels. The trend is currently strong if they both move in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.