On Thursday, the EUR/USD currency pair remained completely flat in trading. The macroeconomic, structural, and technical conditions have not changed over the past day. The market either keeps celebrating or is simply on vacation. Even in these difficult circumstances, the pair manages to show growth, albeit a weak one. This phenomenon has already been covered extensively. It is evident even from the aforementioned illustration, which shows the most recent 2.2–2.5 months, that the price has only twice in this period managed to break below the moving average. Keep in mind that a fix below the moving average signals a potential trend change. We only had two warnings available to us in 2.5 months, and we never even noticed a downward correction. The price has been close to the moving average line throughout, but in most cases, it has been unable to fall below it. As a result, the paradoxical growth of the euro currency persists, and if it keeps doing so, the effects of the two-year downward trend will quickly level off.

In theory, we have stated numerous times that there are currently essentially no growth factors for the euro. As it waited for a slowdown in the rate of tightening of the Fed's monetary policy starting in September or October, the market started to take profits on short positions. The European currency has increased by 1200 points during this time, and the overall downtrend is 2800 points. As a result, the pair responded roughly one-third to this trend. This is ideal for a correction, but if the movement of recent months signals the start of a new upward trend, then we require convincing justifications for the growth of the euro rather than just a technical requirement to adjust upwards. Additionally, if the upward trend has begun, it cannot occur completely without downward corrections, especially if there are a few reasons for the euro currency to increase in value. The euro currency has been growing in an illogical manner for more than a month, and despite flying the flag of a flat, it has managed to do so even over the New Year's holiday.

There are still no drivers of euro growth.

Beginning in 2023, macroeconomic statistics will have a significant impact on both the euro and the dollar. Remember that there are no central bank meetings planned for January, so the market can only focus on speeches by the Fed and ECB members as well as data. We are anticipating reports on inflation, nonfarm payrolls, GDP, and other economic indicators, as we would with any month. Recall that the only reports that matter right now are those related to inflation and non-farms. How the ECB and the Fed change their monetary policies is dependent on these data. In December, both central banks started to move away from an aggressive monetary policy, but we think that the Fed is the only one whose actions are warranted. The Fed has managed to slow inflation for five months, and there is every reason to believe that this trend will continue. As a result, there is no longer a need for a sharp increase in the key rate. Furthermore, the Fed won't give up on tightening further. It will probably increase the rate by a total of 0.75%. But there are still a lot of issues with the ECB.

It also started to slow down the rate of rate increases, but it did so with only a few declines in inflation. Since the impact of a rate change lasts for 3–4 months, the four previous increases should be sufficient to bring inflation down for a while. However, we think the European regulator gave up the aggressive strategy too soon. By giving up on it, the ECB is also signaling that it is not prepared to raise rates for as long as it takes, which increases the likelihood that the inflation target won't be met or that it will take much longer than in the US. Because neither the euro nor the dollar are currently supported by fundamentals, the euro currency should not grow at all. On the 24-hour TF, however, there is still not a single indication that the correction has started.

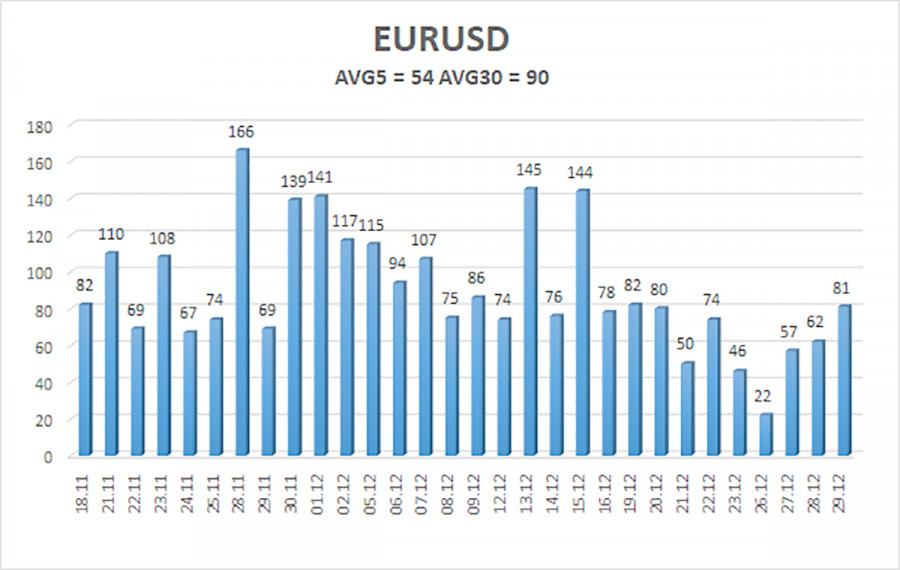

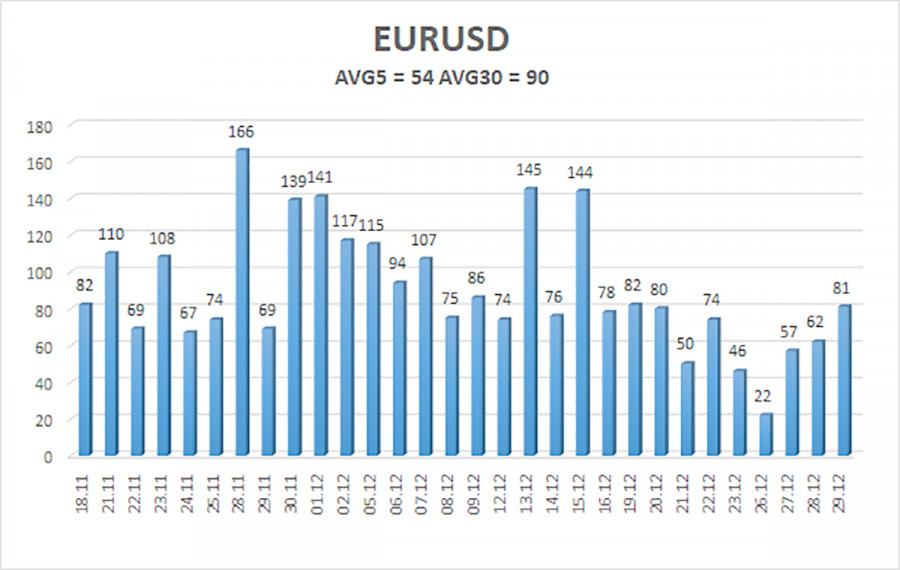

As of December 30, the euro/dollar currency pair's average volatility over the previous five trading days was 54 points, which is considered "average." So, on Friday, we anticipate the pair to fluctuate between 1.0606 and 1.0714. The Heiken Ashi indicator's reversals are now completely irrelevant because the pair is flat.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading Suggestions:

Although there is still an upward trend for the EUR/USD pair, it has been flat for the past two weeks. Trading can only be done on the lower TF inside the side channel because the 4-hour TF hardly ever moves.

Explanations for the illustrations:

Channels for linear regression help identify the current trend. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.