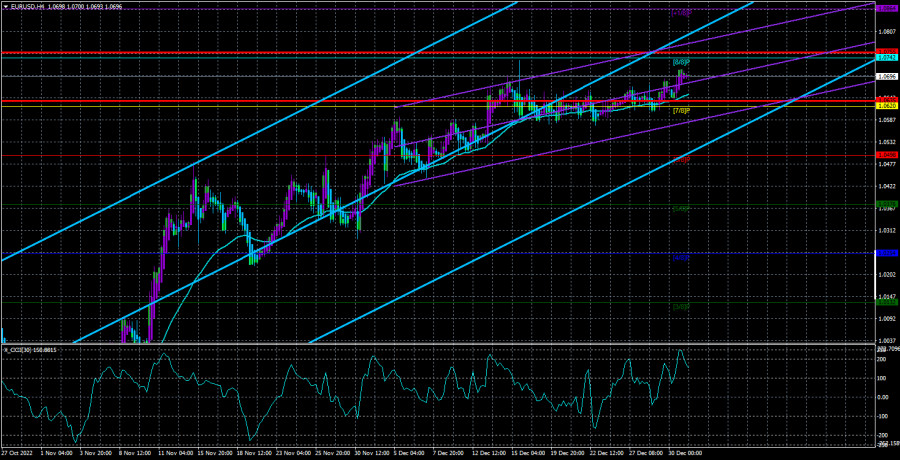

On Friday, the EUR/USD currency pair remained unchanged, but there was a slight upward bias throughout the day. As a result, the pair was unable to even begin to move below the moving average line after more than a month of growth and many weeks of flat. The European currency is once again getting close to the Murray level of "8/8," or 1.0742, where the previous advance came to an end. Therefore, last week's technical situation changed. Technically speaking, traders can still expect the European currency to expand because the price is unable to break through even below the moving average. The euro currency is still not growing for any fundamental or macroeconomic reasons, thus we remain certain that a significant correction will start shortly.

It's also likely that the movement or correction we're seeing now is "inertial" to the overall downturn. Let's examine these two topics in more detail. This would explain a great deal if the movement was "inertial." The bulk of market players may choose to keep trading in line with the trend since there are currently no grounds for trend movement or growth. The majority continues to purchase since there is an upward tendency, which is why the euro is increasing. If most market participants now assume that the long-term downward trend is gone, then we have witnessed a decline in short positions that were established two years ago for several months. As a result, the current growth is closing short positions rather than purchasing the euro. Both in the first and second cases, this movement will eventually come to a stop, and the market will resume trading based on the fundamentals and macroeconomics. It will then recall that there was just no justification for the euro's rapid rise.

The first week of 2023 promises to be fascinating.

In general, traders will have access to macroeconomic indicators on the first day of every week. Today, the EU will release a report on business activity in the manufacturing sector for December. However, as the indicator's second value, it is unlikely to be different from the first. Additionally, the figure itself is not anticipated to rise above 50.0, indicating that the downward trend will persist. The final number for December as well as the service sector business activity index will be released on Wednesday. The most intriguing day will be Friday, when the December inflation report, retail sales, and several secondary reports and indices will all be released. Naturally, traders' attention will be drawn to the consumer price index, which is expected to decline to 9.7-9.8% y/y, according to experts.

In actuality, comparing inflation with ECB monetary policy is becoming increasingly challenging. Although inflation has only slowed once, the ECB has already started to slow the pace of tightening monetary policy. We think that the European regulator has made a hasty choice by not raising the rate as much as is necessary because it is concerned about the severity of a potential recession. If so, it might be a very long time before inflation reaches the desired level of 2%. Additionally, because the ECB would not stop accelerating rate hikes in this event, it will be challenging for speculators to assess the decrease in inflation. Although it is highly challenging to foresee the form of the market response, we think it should occur after this report. We also want to remind you that the market still reacts more strongly to data coming from abroad, so it won't surprise us if the EU inflation report continues to receive little attention. Of course, keep in mind that the forecast and actual values might be the same. In general, we think that American data will have a bigger impact on the market's sentiment this week than European ones. Do traders even need this info, is another query. We can currently only observe their urge to purchase euros; they are completely unconcerned about numbers.

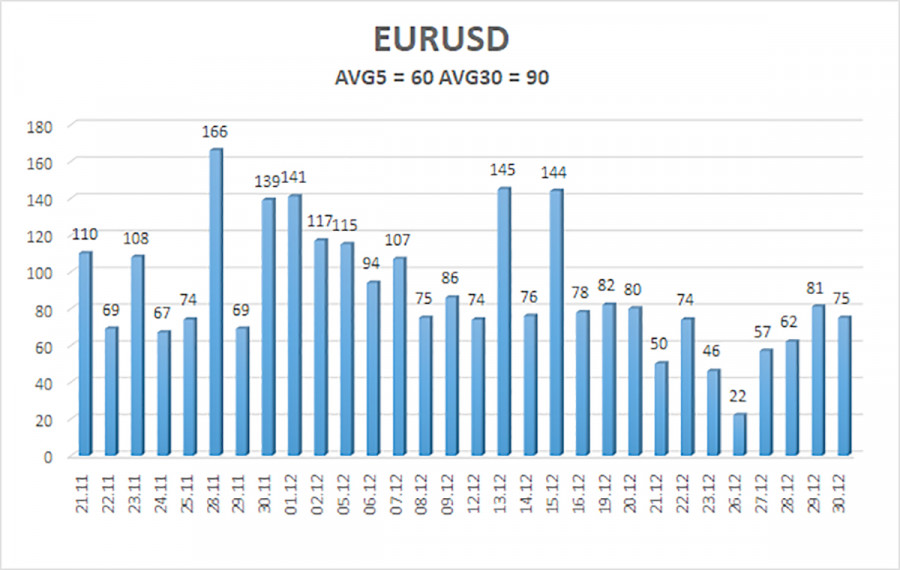

As of January 2, the euro/dollar currency pair's average volatility over the previous five trading days was 60 points, which is considered to be "normal." So, on Monday, we anticipate the pair to fluctuate between 1.0635 and 1.0755. The Heiken Ashi indicator's downward reversal will signal the beginning of a new phase of the corrective movement.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading Suggestions:

Although the EUR/USD pair is continuing to move higher, the trend is still weak and "flat." Trading can only be done on the lower TF inside the side channel because the 4-hour TF hardly ever moves.

Explanations for the illustrations:

Channels for linear regression - allow identifying the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.