On Thursday, the EUR/USD currency pair decreased. If you recall, we stated in the article from yesterday that simply fixing above the moving average is not a strong signal to reverse the trend. This is merely a caution that the trend might change and that traders might gradually start to think about making reverse trades. Well, it happened this time. The euro/dollar pair lasted less than a day above the moving average line before rapidly falling below it. But it should be observed right away that yesterday's macroeconomic and fundamental backgrounds did not lend themselves particularly well to the decline of the euro. For instance, the February inflation report revealed a further reduction in the rate of price growth. Indeed, it was minimal, which is depressing in and of itself. Yet, this aspect was intended to help the euro because there is now a greater likelihood that the ECB will tighten monetary policy for a longer period.

We've already mentioned that compared to the Fed, not everything is as apparent when it comes to the ECB or the Bank of England. The economy, labor market, and unemployment rates are all favorable for the Fed. The unemployment rate in the European Union, which is nearly twice as high as that in the US, stayed at 6.7% in January. The economy has already reached zero growth rates, at a pace of only 3%. The European economy will undoubtedly enter a recession, making it vulnerable to further tightening of monetary policy if we assume that the rate needs to be hiked to at least 5%, if not more. Also, it should be kept in mind that the European Union is a commonwealth of almost thirty nations; therefore, the regulator cannot carelessly raise the rate while concentrating solely on Germany or France.

The situation is significantly worse in the UK because there has been no decrease in inflation there and the rate has already increased to 4%. There is no doubt that a recession will occur; the only question is when it will begin. As a result, unlike the Fed, the Bank of England cannot continuously raise the rate at any level of inflation. It turns out that the time has arrived when the European Union or Britain should no longer maintain a combative "hawkish" attitude due to excessive inflation. The ECB or the BA will most definitely not continue tightening monetary policy, prolong the cycle of rate hikes, or quicken the pace of tightening if inflation starts to grow tomorrow. As a result, the euro and the pound are losing one of their main sources of support and could continue to decline.

Christine Lagarde on EU inflation.

Every speech by Christine Lagarde is interesting. She claimed yesterday that there has been no consistent drop in European Union inflation, which is still at a high level. She added that she is certain that the consumer price index will fall further and that the rate will rise by another 50 points in March. A longer cycle of rate increases may be necessary, Ms. Lagarde added. Although there are numerous ways to read her statements, market participants undoubtedly anticipated hawkish rhetoric in response to the February inflation report. In our opinion, the euro currency was quite able to show growth yesterday, but this didn't happen, and in our opinion, this is a very important development. If the market stops buying when there are valid reasons to do so, this could indicate that the sentiment has shifted to one of bearishness. As a result, we continue to support the decline of the European currency.

The pair is still inside the Ichimoku cloud on the 24-hour TF, but this won't last forever. The price is already getting close to the Senkou Span B line. As a result, one way or another, the pair will leave in the near future. The downward mood is still below the critical level. The pair's decline to the level of $1.02 is now completely supported by the technical picture as well.

In theory, it will be extremely difficult for the European currency to count on observable growth if nothing changes in the foreseeable future. And not much can change now. The Fed will continue to increase interest rates "until the bitter end," and the ECB will respond to the situation while keeping an eye on the economy. The euro currency can quickly regain price parity if the market is fully aware of this fact. Then, new fundamental factors will determine every aspect of life. We do not anticipate a continuation of the upward trend that has been developing over the last five to six months. It is unlikely that anything will change at the Fed and ECB meetings in March.

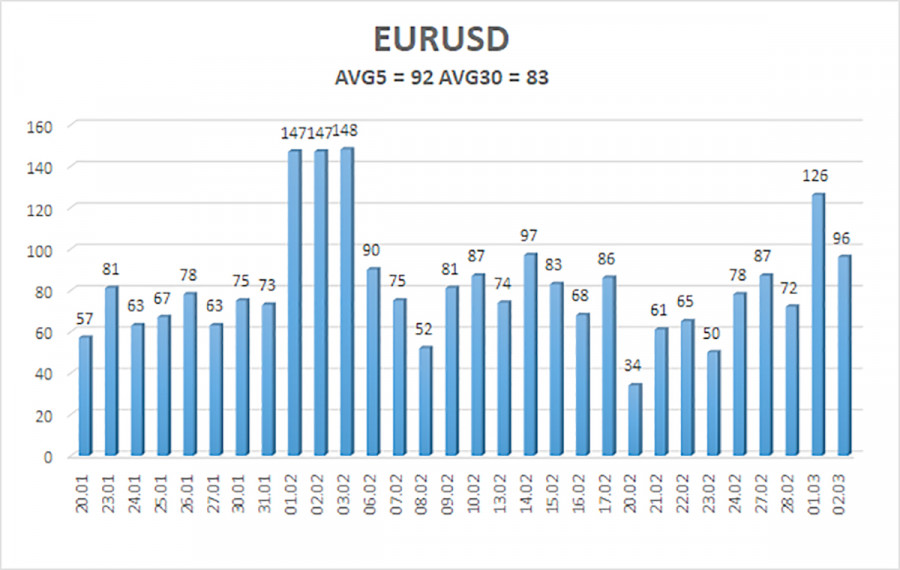

As of March 3, the euro/dollar currency pair has experienced 92 points of "average" volatility over the previous five trading days. Thus, on Friday, we anticipate the pair to move between 1.0496 and 1.0680. A new round of upward movement will be signaled by the Heiken Ashi indicator turning back to the top.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trade Suggestions:

The EUR/USD pair has reconsolidated below the moving average line. Unless the Heiken Ashi indication turns up, you can maintain short positions with a target price of 1.0498. If the price is stabilized back above the moving average line, long positions can be initiated with targets of 1.0680 and 1.0742.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the current trading direction are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.