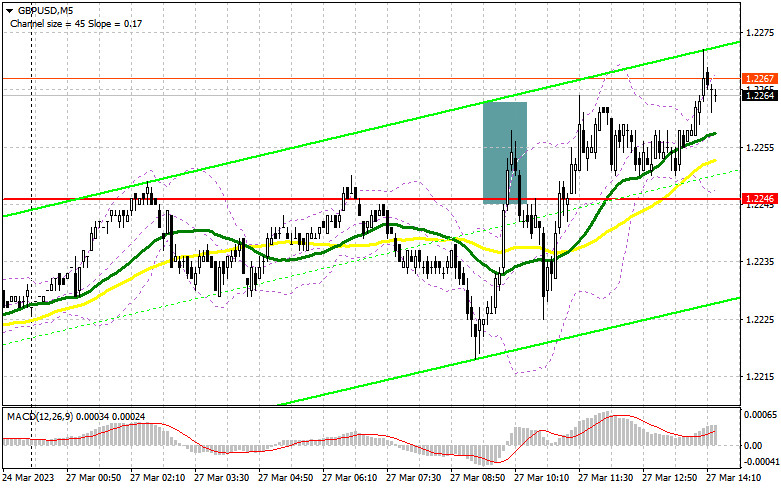

In my morning forecast, I focused on the level of 1.2246 and offered recommendations based on it for market entry decisions. Let's take a look at the 5-minute chart to see what happened. Growth and the formation of a false breakout at this level provided a sell signal in the morning, but the decline from the entry point was only approximately 17 points, and the demand for the pound returned. The technical situation barely changed in the afternoon.

You require the following to open long positions on the GBP/USD:

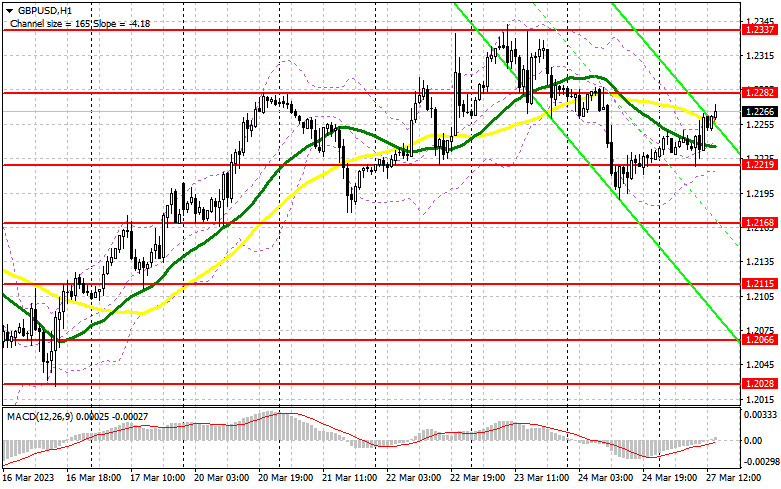

Since there are no other significant statistics in the afternoon, it goes without saying that everyone will be anticipating the speech of Andrew Bailey, Governor of the Bank of England, which could spur further pound purchases. In case of a negative response to the statements, a decline and the development of a false breakout in the area of the new support of 1.2219 created by today's results would be the best options for buying. This will provide an entry point for long positions with the potential to update 1.2282, which is the direction the pound is now moving. When fixing and testing this range from top to bottom, I expect GBP/USD to rise more aggressively to the monthly high of 1.2337, where the bulls will meet new challenges. The possibility of growth at 1.2388, where I fix profits, will also become more likely if this range is broken. The pressure on the pound will rise and it will be feasible to discuss the emergence of a new bear market if the bulls are unable to complete the tasks and miss 1.2219 during the American session. In this situation, I suggest against making hasty purchases and only starting long positions at the next support level of 1.2168 and only in the event of a false decline. With the target of a correction of 30-35 points within the day, I will purchase GBP/USD right away on the rebound only from the low of 1.2115.

For opening short positions on the GBP/USD, you will need:

Sellers tried everything, but they were unable to cause the pound to move more significantly downward. The bears must protect the new resistance of 1.2282 in the second half of the day, and only the development of a false breakout on it after the pound moved up in response to Andrew Bailey's comments will be a great signal to open short positions in anticipation of falling to the support of 1.2219, where I already anticipate active buying activity. The pressure on the pound will intensify with a breakout and reversal test from the bottom up of this range, generating a sell signal with a drop to 1.2168, and the farthest target remains a minimum of 1.2115, where I will fix profits. But only if the Bank of England official uses dovish language can one expect such a course of events. Buyers will attempt to return to the maximum of 1.2337 with the possibility of a GBP/USD rise and lack of action around 1.2282, which cannot be completely ruled out. By analogy with what I previously indicated, only a false breakout at this level will provide an entry point into short positions. If there is no downward movement there, I will sell the GBP/USD pair for a rebound immediately from the maximum of 1.2388, but only if the pair corrects downward by 30-35 points during the day.

Both long and short positions increased in the COT report (Commitment of Traders) for March 7. It should be understood that these data are irrelevant at this time because statistics are just now starting to catch up following the CFTC cyberattack, making the data from two weeks ago not particularly useful. I'll hold off until new reports are released and rely on more recent data. In addition to the Fed meeting this week, the Bank of England will also meet, and significant decisions regarding interest rates will be made at that meeting. Given that the current effort to combat inflation is not yet yielding many positive results, it is anticipated that the regulator may decide to sustain aggressive rates of growth in the cost of borrowing. We can anticipate that the pound will continue to increase and reach new monthly highs if the Fed changes its stance but the Bank of England does not. According to the most recent COT data, long non-commercial positions increased by 1,227 to 66,513 while short non-commercial positions increased by 7,549 to 49,111, bringing the non-commercial net position's negative value down to -17,141 from -21,416 the previous week. The weekly ending price fell from 1.2112 to 1.1830.

Signals from indicators

Moving Averages

The fact that trading is taking place around the 30 and 50-day moving averages suggests that bulls are making an effort to get back into the market.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located at 1.2220, will serve as support in the event of a decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.