The GBP/USD currency pair went into a total flat last week and remained flat at the beginning of the new week. From our point of view, the pound showed the most logical movements on Monday, as there was no important information for it that day. Thus, volatility remains low, and trend movement is absent. The British pound still cannot be properly corrected. If there are at least some downward movements in the euro occasionally, which can be considered corrections, then we see only weak pullbacks in the pound. We have been observing this situation for over a month, and even now, when the pound has not been growing for a couple of weeks, the correction is still absent. If the European currency can have grounds for continuing growth in the form of the "rate divergence" between the Fed and the ECB, the Bank of England was expected to pause at the last meeting. Thus, the pound does not have "monetary" support. Nevertheless, it remains very high.

Trading the pair now on the 4-hour TF is pointless, as there is almost no movement. There is an obvious flat even on the smallest TFs, so if you want to scalp, do it only on the 5-minute TF. But even there, it's not the most pleasant activity. This week, the flat may persist, as the fundamentals and macroeconomics will be virtually absent. We do not believe US GDP data can move the market from the "dead point." Moreover, even if they turn out to be in favor of the dollar, we are unlikely to see its strengthening because the market ignores all such data.

There is nothing to add to the 24-hour TF now, either. The pair has exited the sideways channel 1.1840–1.2440, in which it traded for several months. Still, the consolidation above it is so unconvincing that a drop back to 1.1840 is the most likely scenario.

Patrick Harker does not expect additional rate hikes.

Almost all market participants have already come to terms with the fact that the Fed will complete the monetary policy tightening cycle on May 3. As mentioned, the pound's fate depends on how often the Bank of England raises rates. It will be a little, but the British regulator may have its thoughts on this matter. Either way, Philadelphia Fed President Patrick Harker said last week that he does not expect monetary policy tightening after May. "The impact of high rates on the economy can take up to 18 months, so it would be wise to take a break and carefully study the incoming data to determine if we need additional measures in the future to counter price instability," he said. Recall that last week, Christopher Waller spoke about the lack of significant progress in reducing inflation, hinting at additional tightening. In contrast, James Bullard spoke of raising rates to 5.75%. As we can see, there is no unanimous opinion among the representatives of the monetary committee, but still, most of them support a pause.

Now we need to wait for comments on monetary policy from representatives of the Bank of England, but we are unlikely to get them. In Britain, people are very reluctant to comment on future decisions, especially important ones. BOE Governor Andrew Bailey rarely speaks, so the British regulator remains the only bank from which it is unclear what to expect. The pound may stand still because the market does not understand how events will develop further. Either way, we have a flat for now, and it can last quite a long time. There is no point in discussing the prospects for the pair now. We must wait for important news, publications, and the end of the flat.

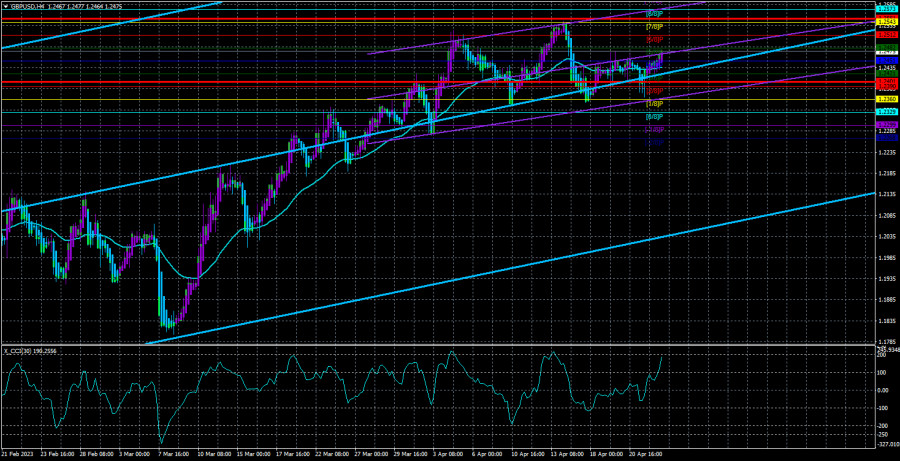

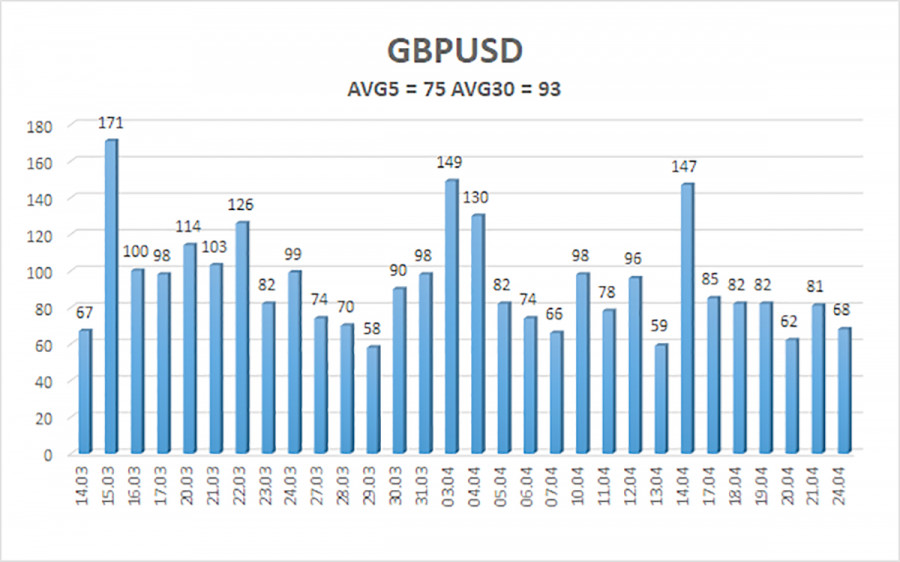

The average GBP/USD pair volatility for the last five trading days is 75 points. For the pound/dollar pair, this value is considered "average." Therefore, on Tuesday, April 25, we expect movement within the channel limited by levels 1.2401 and 1.2551. A reversal of the Heiken Ashi indicator downward will signal a downward movement.

Nearest support levels:

S1 – 1.2451

S2 – 1.2421

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2482

R2 – 1.2512

R3 – 1.2543

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe is trading near the moving average line in a flat. At this time, one can trade only based on Heiken Ashi indicator reversals or on smaller timeframes, as there is no clear trend – the price is located too close to the moving average and ignores it.

Explanations for illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term tendency and direction in which trading should be conducted now.

Murrey levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.