The EUR/USD currency pair continued its downward movement on Thursday, even without a correction. Recall that the European currency was growing in about the same way for two consecutive months. All these two months, we did not stop claiming that the euro's growth was unfounded and that we were expecting a fall in the European currency. Now we are right. However, the potential for the euro to fall is still significant, and there are only a few growth factors. The European currency has already corrected by 50% from its two-month growth. Just in one and a half weeks. One can conclude that the euro's fall is faster than its growth. We also said that: in the last weeks of the ascending impulse, the pair was frankly crawling up. Thus, we expect not only a fall to the last local minimum around the level of 1.0500 but also much lower.

There are a few reasons for such a sharp fall. It should be understood that the key topic in the currency market over the past year has been rates. The market always tries to work out all monetary policy changes in advance (of course, only those about which something is known). Therefore, we believe that all future ECB rate hikes have been worked out, which means the euro has no reason to continue growing. As we have already said, the European economy is in worse shape than the US economy; it shows zero growth, inflation in the EU is higher, and the rate is lower. Even a stronger US banking crisis cannot be a reason for a prolonged fall in the dollar, as a large bank also went bankrupt in Europe. And Gleb Zheglov said that law and order in the country are determined not by the presence of thieves but by the ability of the authorities to neutralize them. The state of the economy is determined not by the number of crashes within it but by the ability of the authorities to quickly and effectively neutralize their consequences, which the Fed and Congress are doing very well.

Calmness, just calmness!

The problem of reaching the US public debt limit arose about a month ago. Then many analysts linked the fall of the American currency specifically with it, as who would want to invest in a country's economy in a pre-default state? But we have repeatedly noted that the debt limit problem arises in the States every year, and every year a way out of it is found. Therefore, we already said that this problem is not a problem and has no influence on the dollar exchange rate. At this time, the American currency is already growing, so many experts have immediately "changed their shoes" and are now declaring that the dollar is growing amid rising "anti-risk sentiments." It turns out that the dollar first fell due to the problem of reaching the "ceiling" of public debt, and now it is growing based on this very problem.

Let's reiterate: The States have been teetering on the edge of default every year, and it still has not happened. Many economists have prophesied a default for the American economy for several decades, but it still has not occurred. The public debt continues to grow, but the dollar only grows long-term. The issuance of US currency is off the charts, but the dollar, in the long term, only grows. Last year, it reached price parity with the euro, which has not happened since 2002, and absolute highs were set against the pound for all time.

Therefore, whatever anyone says, the US currency remains the number one currency globally and has always been the most trusted. This trust signals only one thing - trust in the US economy. There will be no default this time, either. If the Republicans and Democrats do not agree by June 1, the "ceiling" will be "frozen" for a couple of months to allow more time for new negotiations. We expect further strengthening of the US currency. On a 24-hour TF, it may overcome the important Senkou Span B line today or tomorrow, strengthening the "bearish" signal.

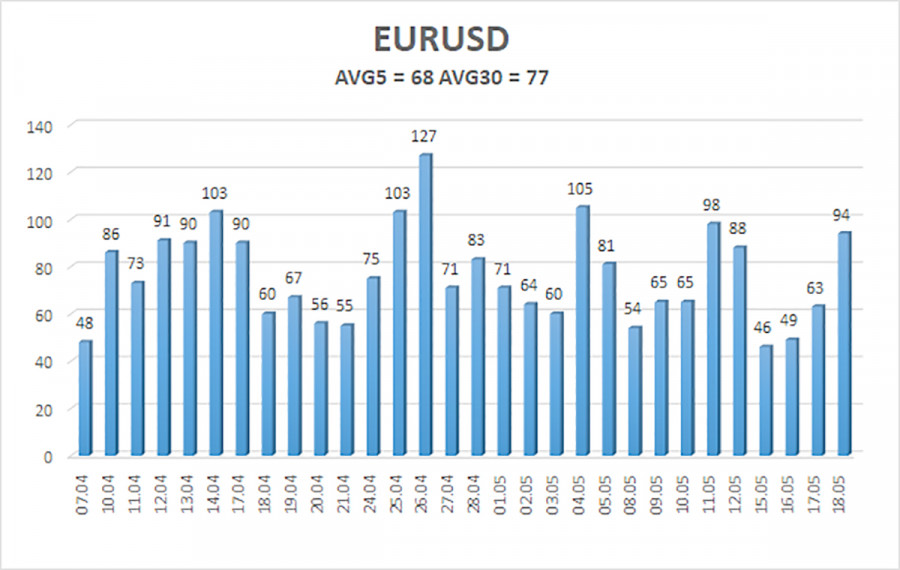

The average volatility of the euro/dollar currency pair for the last five trading days as of May 19 is 68 points and is characterized as "medium." Thus, we expect the pair to move between levels 1.0700 and 1.0836 on Friday. A reversal of the Heiken Ashi indicator upwards will indicate a loop of the corrective movement.

Nearest support levels:

S1 – 1.0742

S2 – 1.0681

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0803

R2 – 1.0864

R3 – 1.0925

Trading recommendations:

The EUR/USD pair continues to move downward confidently. It is advisable to remain in short positions until the Heiken Ashi indicator turns upwards, with targets at 1.0742 and 1.0700. Long positions will become relevant if the price fixes above the moving average with a target of 1.0925.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. The trend is strong now if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which it is now advisable to trade.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.