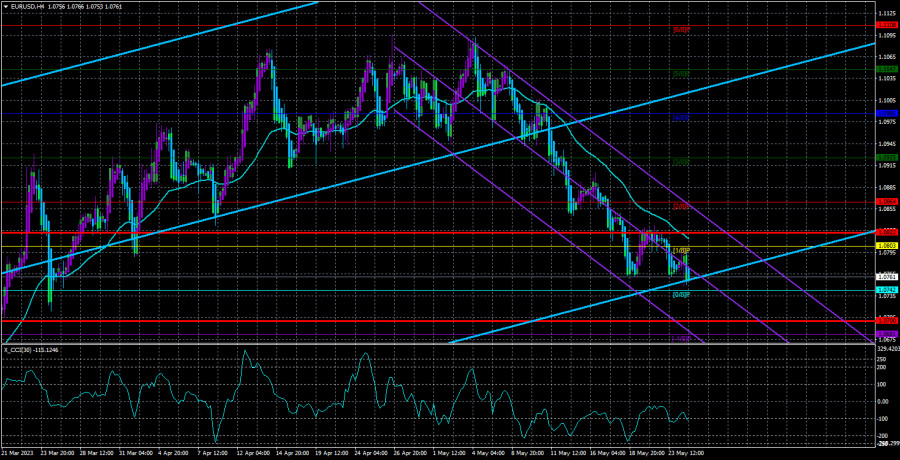

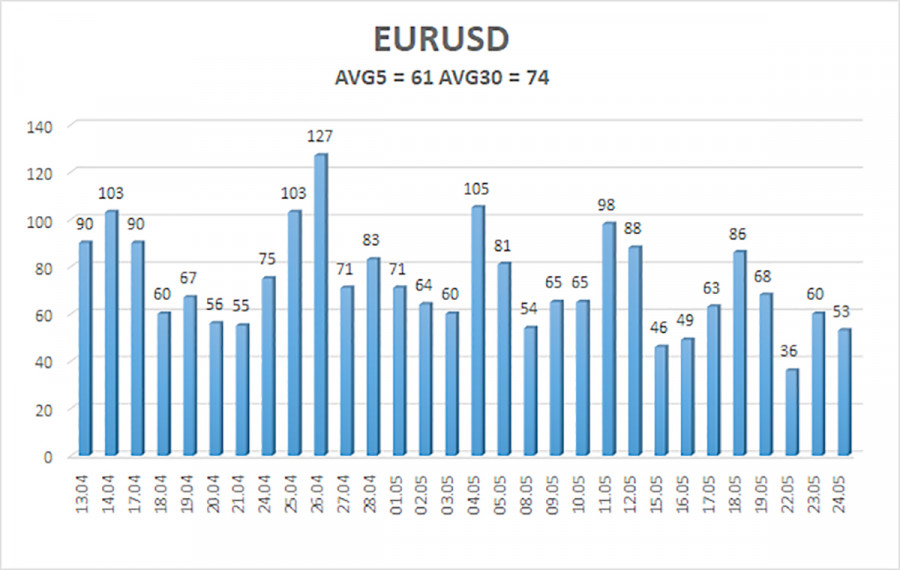

The EUR/USD currency pair hit local lows for the current week on Wednesday but made attempts to correct for most of the day. The technical picture plays the most important role, with several key points. First, the current decline of the European currency is purely technical. The euro has been rising without any justification for two months, making it significantly overbought. Naturally, the market had to balance the situation sooner or later. Second, the current movements of the pair are quite weak. The average volatility continues to decrease, which can be seen even without additional calculations on the chart below. If the pair moves by 50–60 points per day (considering that a certain part of this distance falls during the Asian trading session, that is, at night), it is extremely difficult to expect any profit in short-term trading.

Therefore, the conclusion is that it is better to trade in the medium term now and ignore the Heiken Ashi indicator as it changes direction too frequently. When the pair moves by 100 points daily, Heiken Ashi shows local corrections and pullbacks well. However, the current movements are so weak that capturing them is extremely difficult. Although the euro has been falling for two weeks already, it is far from the end of the movement. From the perspective of 3-6 months, we believe that the pair will enter a consolidation phase, and if you look at the 24-hour time frame, you can assume that it started in December of last year. During all this time, the pair has been relatively stable within the same price range. It may drop down to the 5th level, which will only confirm the consolidation.

The fundamental background is smoothing out because it no longer has such a shocking character that would drive the market actively. Remember (or look at the charts) how the pair moved in 2021–2022. It was a one-sided movement — a trend! At the end of 2022, we saw a significant upward correction, and now traders have no compelling reasons for long-term purchases or sales.

The head of the IMF is confident that there will be no default. Kristalina Georgieva, the head of the IMF, stated a week ago that a default in the United States would severely blow the global economy. Madame Georgieva started sowing panic at the same time as Janet Yellen, the head of the US Treasury Department. These two ladies have been speculating for a month now about the consequences if the US Congress fails to agree on raising the debt ceiling, although a solution to this problem, which arises every year, has always been found in the past. Even a week before the deadline (June 1st), all markets are confident that an agreement between Republicans and Democrats will be reached. It's like the Brexit negotiations that concluded on New Year's Eve, just a few hours before Britain officially left the EU. Each side tries to get as many "carrots" for themselves as possible, so it is not in the interests of either side to reach an agreement as quickly as possible while making concessions.

Theoretically, default is possible, but why would Democrats or Republicans need it? If they don't reach an agreement by June 1st, they will decide on a "freeze" of the debt limit for 1 or 2 months. They will sign an agreement to increase the limit by a hundred billion dollars, enough for the same 1-2 months to continue negotiations. Therefore, there will be no default. Moreover, during the time of Donald Trump, there was already a "shutdown" when government structures could be inactive for more than a month because the treasury was empty. At least their employees were not paid. And nothing happened! Nobody died, the economy did not collapse, and all government services operated as usual. Ms. Georgieva also stated, "No one expects a dollar crash in her department, so it is too early to say goodbye to the US currency." Moreover, the dollar does not react to escalating the situation around the "ceiling" - it continues to grow calmly.

The average volatility of the EUR/USD currency pair over the last five trading days, as of May 25th, is 61 pips and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0700 and 1.0822 on Thursday. A reversal of the Heiken Ashi indicator upwards will indicate a new phase of the corrective movement.

The nearest support levels:

S1 - 1.0742

S2 - 1.0681

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0803

R2 - 1.0863

R3 - 1.0925

Trading recommendations:

The EUR/USD pair continues its downward movement. It is advisable to remain in short positions with targets at 1.0742 and 1.0700 until the price consolidates above the moving average. Long positions will become relevant only after the price is firmly established above the moving average line, with a target at 1.0864.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. It indicates a strong trend if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel in which the pair will move in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an upcoming trend reversal in the opposite direction.