On Tuesday, the GBP/USD currency pair continued to increase. The upward movement is practically non-stop and does not even stop at night, although during Asian trading sessions, we almost always observe flat trading. This indicates that the market has started a new phase of growth for the British currency, and the reasons for such a movement are somewhat reluctant to be discussed. We have repeatedly stated that the pound is growing groundlessly and is overbought. Even considering that the Bank of England unexpectedly raised the rate by 0.5% at the last meeting and will likely continue to tighten, the pound has grown too strongly over the past ten months.

Just yesterday, the CCI indicator entered the overbought area (yet again), but we only saw a rollback of 50–60 points. The pair is overbought, but the market continues to buy it, paying no attention to macroeconomic statistics. At least two weak unemployment reports were released in the UK no later than yesterday, which did not provoke any drop in the pound. As we have already said, the market ignores all information favoring the dollar but reacts to any news that theoretically supports the pound sterling. In such a scenario, the British currency can grow as much as it wants. We can advise traders to pay more attention to technical analysis, as fundamentals currently have almost no impact on the pair's movement.

On the 24-hour TF, everything looks like the ascending trend will end soon. Each correction is weaker than the previous one; even the strongest correction was weak. The pound is not correcting, and this cannot continue forever. There is a feeling that the market understands the closeness of the end of the trend and is trying to jump on the last wagon to make a profit. In any case, it should be understood: the trend is baseless and may end with a serious collapse of the British currency.

Jeremy Hunt added fuel to the fire. One of the few reasons the pound continues to rise may be the market's inflated expectations of the Bank of England's rates. The market believes that the British regulator will raise them as much as needed, as inflation remains excessively high. At the same time, inflation in the US is approaching the target level. This factor may be the reason for the non-stop growth of the pair.

Yesterday, UK Finance Minister Jeremy Hunt stated that the Bank of England is ready to bring inflation back to 2%. He noted that he is working closely with Andrew Bailey, and both are determined to combat price instability. Although Jeremy Hunt did not share anything new, the market is currently seizing any opportunity for new purchases. The question remains: how much further can the British regulator raise the rate? After all, it's clear that the economy will have negative consequences. Since 2016, the British economy has been experiencing challenging times. If a recession hasn't started, it can be considered a "gift of fate." However, the higher the rate rises, the higher the likelihood of a recession. In the future, the Bank of England may be more concerned with stimulating the economy than fighting high inflation rates.

Nevertheless, all of this is currently irrelevant to the market. There is a clear and strong upward trend, leaving only the option to buy the pair and make a profit. This is a sound strategy, but we want to remind you to set stop-loss orders on buy transactions, as the pound can drop significantly at any moment. A trend cannot last forever, and no one knows when it will end.

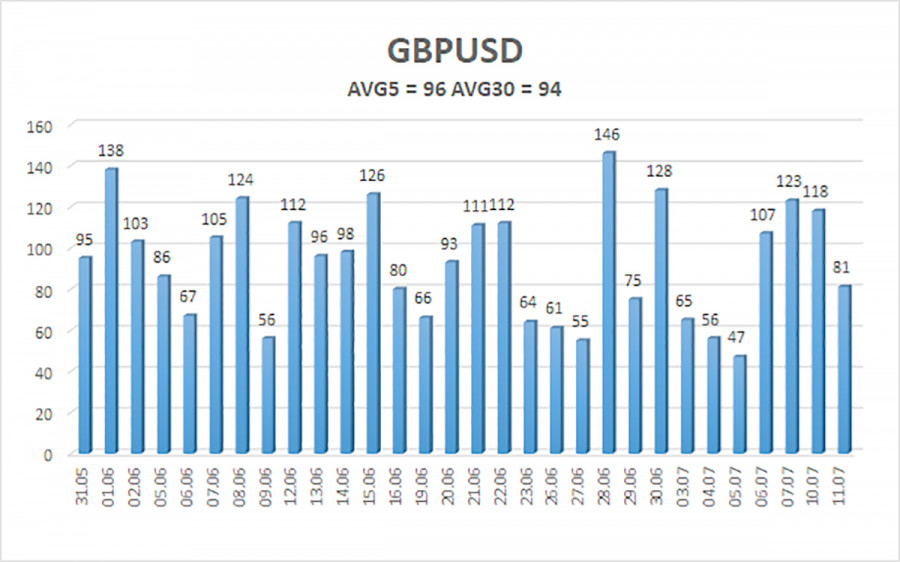

The average volatility of the GBP/USD pair over the last five trading days is 96 points. For the pound/dollar pair, this is a "medium" value. Thus, on Wednesday, July 12th, we expect movement within the range limited by levels 1.2868 and 1.3060. A downward turn of the Heiken Ashi indicator will signal a new round of descending correction.

Nearest support levels:

S1 – 1.2939

S2 – 1.2878

S3 – 1.2817

Nearest resistance levels:

R1 – 1.3000

R2 – 1.3062

R3 – 1.3123

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe continues its strong upward movement. Long positions with targets of 1.3000 and 1.3060 remain relevant, which should be maintained until the Heiken Ashi indicator turns down. Short positions can be considered if the price is below the moving average with targets of 1.2756 and 1.2695.

Explanations of the illustrations:

Linear regression channels help determine the current trend. If both are directed in one direction, the trend is strong now.

Moving average line (settings 20.0, smoothed) determines the short-term trend and direction in which trading should be conducted now.

Murrey levels are the target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day based on current volatility indicators.

The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) indicates an impending trend reversal in the opposite direction.