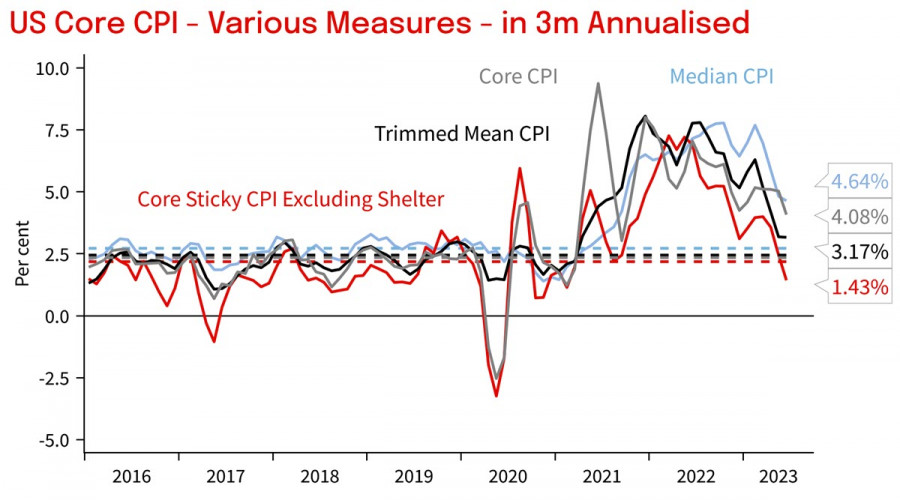

The US consumer price index turned out to be much weaker than forecasts, leading to a drop in yields and a sharp increase in demand for risky assets.

Inflation dropped from 4% YoY to 3% (forecast at 3.1%), the core index from 5.3% to 4.8% (forecast at 5.0%). The main reason for the decrease was the group of volatile goods and services – prices for airline tickets, hotel rooms, and used cars. Fed rate futures slightly changed - the likelihood of a rate hike in July even slightly increased to 92%, while the start of the easing cycle was shifted from May to March 2024.

This is possibly due to the fact that we don't know if this pace of decline will be sustainable. Richmond Fed President Barkin spoke after the report and urged not to pay attention to the fall in inflation, as long as the labor market remains too tense, inflation could return to high levels, and then it would take much more effort. Meester from the Cleveland Fed essentially said the same thing - as long as wage growth is 4.5-5.0%, with productivity growth of less than 1.5%, it is too early to talk about price stability.

Markets quickly reacted and the dollar noticeably weakened, September Brent futures crossed the barrier of 80 dollars a barrel, while demand for commodity currencies increased. The New Zealand dollar rose sharply, despite the fact that the Reserve Bank of New Zealand kept the rate at 5.5% and hinted that it expects further inflation decline from peak levels.

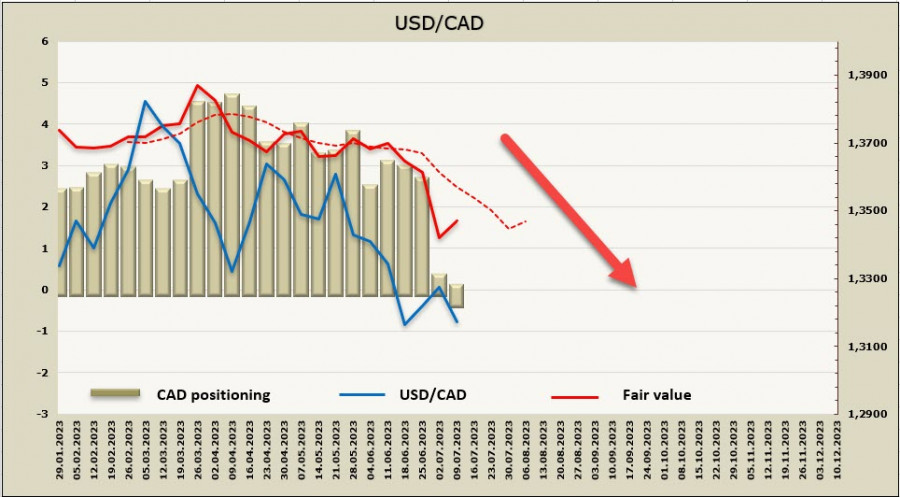

USD/CAD

The Bank of Canada, as expected, raised the benchmark rate by 0.25% to 5.00% at Wednesday's meeting. The forecast for the start of the easing cycle is postponed to the indefinite future, and according to analysts at Scotiabank, another increase should be expected in September or October.

The main reason for such estimates is the high likelihood that inflation in Canada is slowing down much slower than in the US, and economic growth is more stable. The Bank of Canada's updated forecasts claim that GDP will grow by 1.8% this year, 1.5% next year, and 2.5% in 2025, all amid expectations of a recession in the US.

Also, considering that the Canadian labor market has appeared more stable since the time of COVID restrictions, its recovery was faster than in the US.

In general, the week is likely to end in the positive for the loonie, there are fewer factors that could turn the Canadian dollar's course towards weakening.

The net short position on CAD has been liquidated, weekly change +0.51 billion, a long position of 270 million has been formed. The positioning is neutral for now, but the trend is towards further demand for the Canadian dollar. The calculated price is noticeably lower than the long-term average.

USD/CAD continues to trade lower, although it has not yet managed to reach the target of 1.3040/60 outlined a week earlier. We expect the pair to fall further, the next target after passing the lower band of the channel will be the technical level of 1.30.

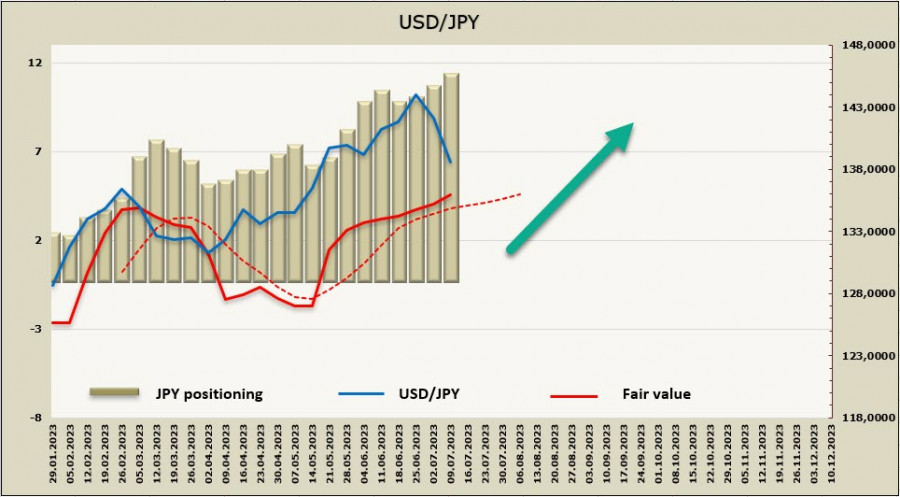

USD/JPY

The Bank of Japan published its latest regional economic report on July 10. One of the key topics is the comments by the leaders of the BoJ's regional offices regarding the pace of growth in average wages, which is key to understanding the BoJ's position on methods of responding to high inflation.

Most of the reports indicate that there is a nationwide increase in average wages by around 5%, in some cases, it rises to 7%, as high inflation reduces real household incomes. In May, the average wage across Japan grew by 2.5% YoY compared to 0.8% in April.

At the same time, comments clearly trace the idea that changing the yield curve control policy means subjecting stability to unjustified risk. Nobody wants to take responsibility, and the question of whether practical steps will be taken at the July meeting remains open. In regards to the yen exchange rate, this uncertainty does not compel us to expect the pair to strengthen.

The net short position on the yen grew by 0.7 billion over the reporting week to -10.5 billion, positioning is confidently bearish. The calculated price is higher than the long-term average and is directed upwards.

The yen sharply corrected, the main reason for the decline is the US dollar's weakness and the growth of the Japanese stock market, which continues to receive foreign capital in large volumes.

Support is provided by the local peak of 137.80 from March 8th, as long as the price is higher, technically the decline is corrective, and after forming a base, we can expect another upward momentum. However, if the yen falls below 137.80, then in this case, the bullish momentum should have ended. The increase in the calculated price indicates that the probability of resuming growth remains higher.