The GBP/USD currency pair stood still on Tuesday with minimal volatility and in an absolute flat. We have yet to see any corrections over the past few weeks. The British pound continues to slide downward very slowly, clearly unwilling to rush events ahead of the Bank of England and Federal Reserve meetings. And today, the inflation report will also be published, which is crucial. We will discuss all of this in this article. In principle, we are only interested in one thing right now - what to expect from the British currency over the next few weeks? To answer this question, it is essential to understand what factors can push the pound up.

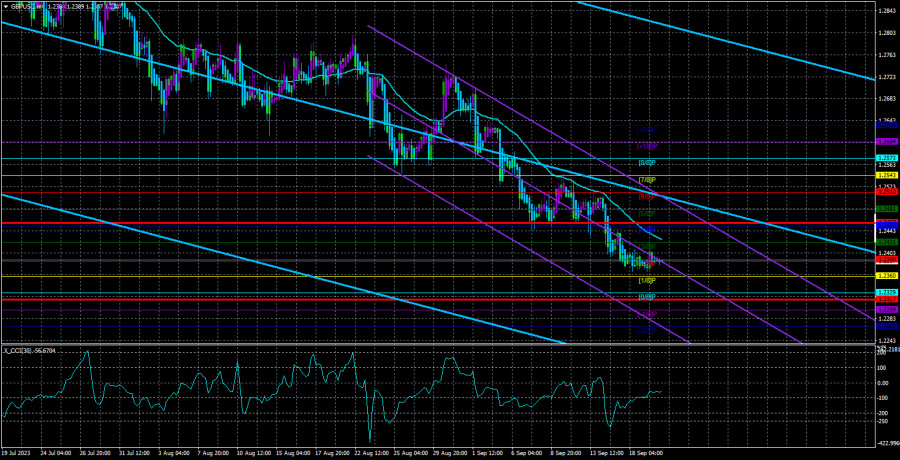

The first and most obvious factor is technical. Corrections should occur from time to time, and at this point, the pound is approaching its nearest target level on the 24-hour TF - the Fibonacci level of 50.0% (1.2304). A bounce from this level could trigger a correction of 100-200 points, enough for the main decline to resume.

The second factor is fundamental. The Bank of England, led by Andrew Bailey, must signal to the market tomorrow that the rate will rise as much as necessary to combat high inflation. Considering that the Chief Economist of the BOE, Huw Pill, has already spoken about the inadvisability of further tightening, we lean towards a similar scenario as the ECB chose. The Bank of England may raise the rate one more time and then keep it at the peak level until inflation falls to the necessary levels, which may take years. And such a scenario is unlikely to support the pound.

British inflation pleased the Bank of England.

Thus, there still need to be factors for a strong rise in the British currency. A rise of 100-200 points can happen almost at any moment. The main thing is that the downward trend persists, so we should strictly look to the south. Tomorrow, the Bank of England will likely raise the key rate by another 0.25%, and this tightening could be the last in the current cycle. The decision to raise the rate could have the same effect on the British pound as the ECB's rate hike did for the euro last week. Remember - the euro fell because the market saw the end of the tightening cycle and is no longer willing to buy the euro under any regulator's decisions.

Therefore, the Bank of England's "hawkish" decision could trigger a fall in the British pound. And just 5 minutes ago, it became known that inflation in the UK for August fell to 6.7% y/y. This value can be considered unexpected and significant, as official forecasts predicted an increase in the consumer price index to 7-7.1% y/y in the last summer month. The British pound dropped 50 points in the first half-hour after the release of this report. Because the probability of a more extended rate hike was already small, and if inflation is declining rapidly, it will decrease even more.

It should also be noted that core inflation in the UK dropped to 6.2% in August, although the most optimistic forecasts spoke of a slowdown to a maximum of 6.7%. Thus, the most critical inflation indicators have decreased much more than the market expected, reducing the likelihood of a longer rate hike. Therefore, the decline in the pound today is entirely justified. It will also be entirely justified if we see it again tomorrow (even with a BOE rate hike).

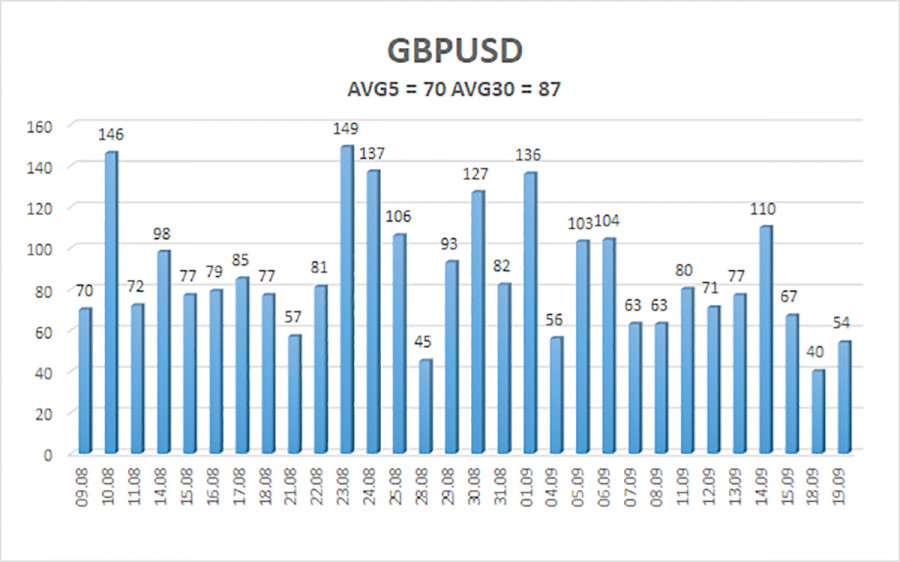

The average volatility of the GBP/USD pair over the last five trading days is 70 pips. For the pound/dollar pair, this value is considered "average." Therefore, on Wednesday, September 20th, we expect movement between 1.2317 and 1.2457. A reversal of the Heiken Ashi indicator upwards will signal a new upward correction phase.

Nearest support levels:

S1 - 1.2329

S2 - 1.2299

S3 - 1.2268

Nearest resistance levels:

R1 - 1.2360

R2 - 1.2390

R3 - 1.2421

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair continues to hover near its local lows and regularly updates them. Therefore, at this time, you can maintain short positions with targets at 1.2317 and 1.2268 until the price consolidates above the moving average. Considering long positions will be possible only after the price consolidates above the moving average line with targets at 1.2457 and 1.2482.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is strong at the moment.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.