The GBP/USD currency pair continued its upward movement on Tuesday, just as before. Yes, this time, the rise of the British currency was very weak, practically absent. Thus, it makes no sense to speculate about the possible completion of the upward correction. For us, it is obvious that there are no fundamental or macroeconomic reasons for further pound growth. It has already climbed too high, thanks to several weak reports across the ocean. However, the market is not ready to sell yet, and there is a high probability that the pound will continue to grow for some time because the current movement strongly resembles inertia. Recall that inertial movement is when the market buys (or sells) simply because the instrument is rising (or falling).

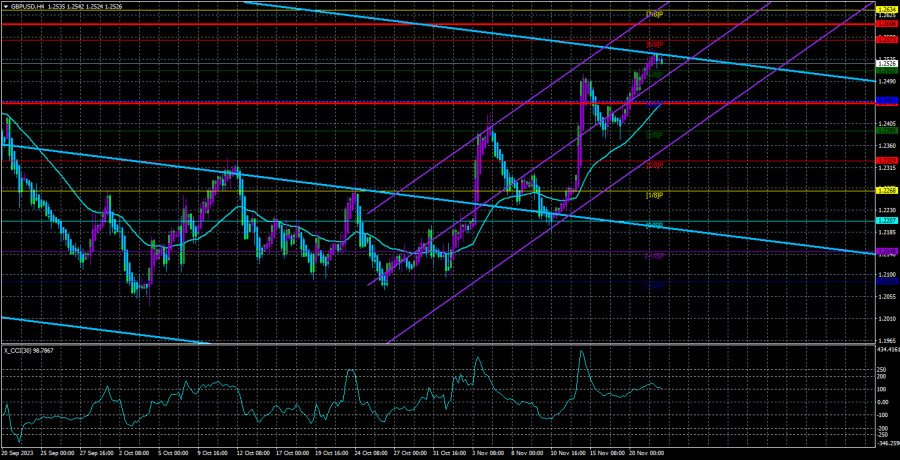

We still consider the triple overbought condition of the CCI indicator an important signal of a possible downward trend reversal. The fundamentals and macroeconomics in the UK are similar to the US. For now, all upward movement looks like a simple correction. Yes, it dragged on, and we expected a weaker version. But it is worth understanding that specifying where the correction will end within 20–30 points is practically impossible. Therefore, we continue to adhere to our basic scenario, which implies a resumption of the downward trend that began this summer.

Of course, selling the pair right now is not worth it, as there is no signal to sell. They will start appearing when the price consolidates in the 4-hour timeframe below the moving average line. After that, you can analyze the 24-hour timeframe again. By that time, sell signals will start appearing there as well. In the 4-hour timeframe, you can consider buying at the moment, but very cautiously, because not all indicators signal a continuation of the movement to the north.

Andrew Bailey spoke in Parliament.

Yesterday, speeches by the Governor of the Bank of England and several colleagues took place in the UK Parliament. Immediately note that different officials held different points of view. Some supported additional tightening of monetary policy, citing the unsatisfactory value of core inflation. However, we will focus on the speech of the head of the Bank of England.

So, Andrew Bailey highly appreciated the latest inflation report, within which the indicator slowed to 4.6%. He noted that by the end of the year, inflation will decrease even more, and the Bank of England's forecasts are exceeded. According to Bailey, there are some signs of a slowdown in wage growth, but it remains significantly above the inflation target. He added that the UK labor market is "cooling," which will benefit prices and spending. Regarding interest rates, he noted that, at the moment, there is no need for additional tightening, and it is better to adhere to a more cautious approach, which implies keeping the rate at the current level. Unfortunately, risks tend to increase due to the situation in the Middle East.

Based on Andrew Bailey's speech, one obvious conclusion can be drawn: there will be no rate hikes in the near future. The Bank of England's monetary policy committee has nine members. At the last meeting, only three of them supported a rate hike. Now, with inflation dropping immediately by 2.1% in October, their number may decrease to two or one. The pattern is simple: the stronger inflation falls, the less chance of seeing new tightening. Therefore, there is no fundamental support for the British pound now, just like for the dollar. Nevertheless, we expect the strengthening of the American currency precisely because of a stronger economy, as well as based on the technical picture. If the pound is going to resume its upward trend, it will have to rise at least to the 31st level and, ideally, much higher. We see no reason for the British currency to rise another 800-900 points.

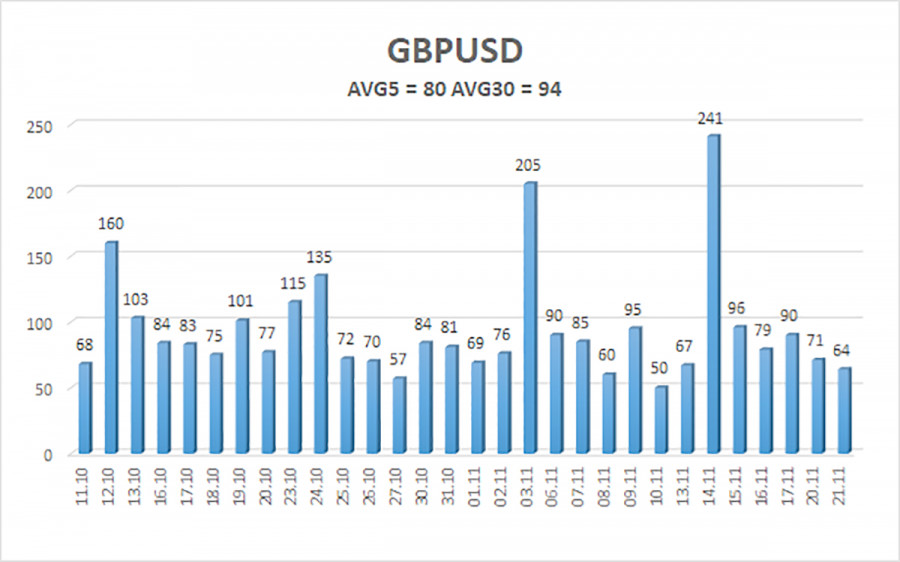

The average volatility of the GBP/USD pair for the last five trading days is 80 points. For the pound/dollar pair, this value is considered "average." Thus, on Wednesday, November 22, we expect movements within the range limited by the levels of 1.2446 and 1.2606. A reversal of the Heiken Ashi indicator downward will indicate a turn of the downward correction.

Nearest support levels:

S1 – 1.2512

S2 – 1.2451

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2634

R3 – 1.2695

Trading recommendations:

The GBP/USD pair continues its new upward movement and is above the moving average line. Short positions can be opened with targets of 1.2390 and 1.2329 if the price consolidates below the moving average. Long positions can formally be considered, as the price is above the moving average, with targets of 1.2573 and 1.2606. Still, the triple overbought condition of the CCI indicator indicates the danger of opening such deals.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction for trading.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.