Analysis of GBP/USD 5M

GBP/USD traded with clear positivity on Tuesday. In general, it doesn't make sense to talk about the macroeconomic or fundamental background right now because neither the first nor the second is present. Yesterday, the British pound traded higher during the U.S. session. Obviously, at this time, the UK did not release any important report. There were no significant events in the United States either. Some Federal Reserve officials spoke, but they did so almost in the evening, so they could not influence the dollar exchange rate during the day. Therefore, the conclusion is that the pound, like the euro, continues to rise speculatively or through following the momentum. For such movement, the market does not need factors, foundations, news, or reports. It simply buys because the instrument is rising.

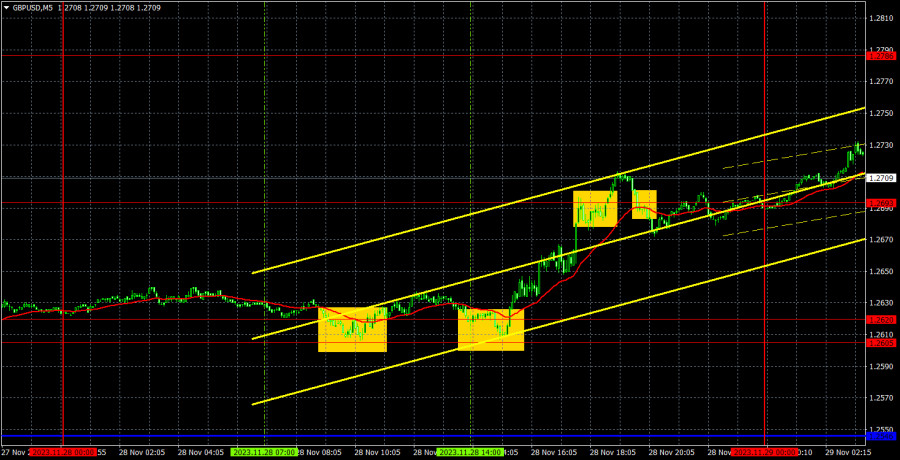

However, yesterday's trading signals were quite good. The pair bounced twice from the 1.2605-1.2620 area, forming two buy signals. After that, the price rose to the level of 1.2693 and even surpassed it, so long positions should have been maintained. But a little later, a sell signal was formed when the price dropped back below the level of 1.2693. At this point, it was necessary to close long positions. The profit was about 40 pips.

COT report:

COT reports on the British pound also align perfectly with what's happening in the market. According to the latest report on GBP/USD, the non-commercial group closed 4,700 long positions and 6,700 short ones. Thus, the net position of non-commercial traders decreased by another 11,400 contracts in a week. The net position indicator has been steadily rising over the past 12 months, but it has been firmly decreasing since August. The British pound is also losing ground. We have been waiting for many months for the sterling to reverse downwards. Perhaps GBP/USD is at the very beginning of a prolonged downtrend or in the middle of a strong correction. At least in the coming months, we do not see significant prospects for the pound to rise. Even if the entire decline is just a correction, it could still last quite a long time.

The British pound has surged by a total of 2,800 pips from its absolute lows reached last year, which is an enormous increase. Without a strong downward correction, a further upward trend would be entirely illogical (if it is even planned). We don't rule out an extension of an uptrend. We simply believe that a substantial correction is needed first, and then we should assess the factors supporting the US dollar and the British pound. A correction to the level of 1.1844 would be enough to establish a fair balance between the two currencies. The non-commercial group currently holds a total of 52,300 longs and 80,50 shorts. The bears have been holding the upper hand in recent months, and we believe this trend will continue in the near future.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD continues its short-term uptrend. For the past two or three weeks, we have been expecting a stable downward movement, but after the U.S. inflation report, the market seems to have completely abandoned buying the dollar and does not want to have anything to do with it. Thus, there are currently no technical reasons to sell the pair. However, at the same time, the euro's growth appears more illogical with each passing day.

As of November 29, we highlight the following important levels: 1.1927-1.1965, 1.2052, 1.2109, 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2605-1.2620, 1.2693, 1.2786. Senkou Span B lines (1.2371) and Kijun-sen (1.2609) lines can also be sources of signals. Signals can be "bounces" and "breakouts" of these levels and lines. It is recommended to set the Stop Loss level to break-even when the price moves in the right direction by 20 pips. The Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The illustration also includes support and resistance levels that can be used to lock in profits from trades.

On Wednesday, there are no significant events planned in the UK. The U.S. will publish the third estimate of its quarterly GDP data, which is unlikely to differ significantly from the second and is unlikely to boost the dollar.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.