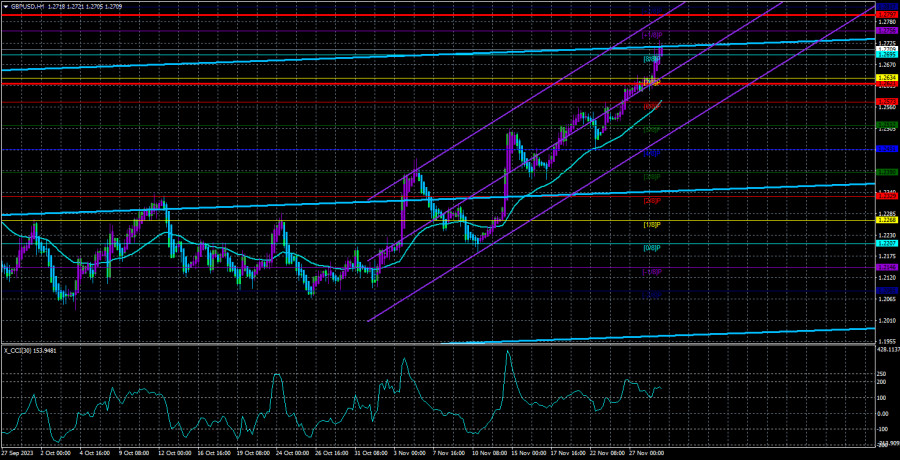

The GBP/USD currency pair continued its upward movement on Tuesday without any signs of correction. The Heiken Ashi indicator, which is the first to react to local price reversals, has recently completely ceased to turn downward. In other words, our movement is not just illogical and unfounded, but also non-retracing. As we can see, there are many peculiarities.

Recall that the rise of the British currency began after a series of weak US reports. However, not all of them can be considered genuinely weak. For example, the latest inflation report showed a slowdown to 3.2% y/y, although the market expected a slowdown to 3.3%. The deviation from the forecast was minimal, but the market reacted as if the Fed had announced a key rate cut. Two weeks have passed since the publication of this report, and during all this time, the dollar has only been falling. In the last three trading days in the US and the UK, there has been no report or important event that could support a new fall in the dollar.

Thus, the pair continues to rise, which is almost impossible to explain from a macroeconomic or fundamental perspective. However, from a technical point of view, everything is going well. The price almost always moves in one direction, ignoring all sell signals. Therefore, essentially, traders are left with only buying without even considering whether there are any reasons for it.

This movement is either inertia-driven or speculative. And for it, news, reports, and events that would support it are unnecessary. Volatility for the pound remains average, but it doesn't matter if the pair continues to move consistently in one direction.

Jonathan Haskel suggests not jumping to conclusions.

As usual, we receive very little important information from the Bank of England. While representatives of the Fed and the ECB speak practically every day, often in large numbers, representatives of the British regulator speak once or twice a week at best. Even though there are almost no questions to all three regulators at the moment, it would still be very nice to receive information about the plans of the central bank or changes in their sentiment.

Yesterday, Jonathan Haskel, a member of the Bank of England's monetary policy committee, delivered a report on monetary policy to the UK Parliament. He stated that the main inflation indicator is not a good guide to determine inflation trends. In other words, the decline in the main inflation indicator does not mean that core inflation, which does not include changes in energy and food prices, will decrease. Thus, if we exclude these two categories of goods from the equation, inflation in the UK is still decreasing rather slowly. Core inflation as of November is 5.7%. Its slowdown from the peak reached in May of this year is only 1.4%.

It follows that prices for food and energy have slowed down in the UK. Prices for oil and gas have already been discussed even in the ECB, noting their decline. Thus, if energy prices start rising again (which is very likely), inflation in the EU and the UK may also start accelerating again. This is why most representatives of the two European central banks are very cautious in choosing their expressions when talking about key rates. They understand that inflation may start rising again, and in this case, additional tightening may be needed. Another question is whether the ECB and the BOE are ready to raise the rate by another 0.5-0.75%. After all, the British and European economies have not been growing for several quarters, and each additional rate hike brings them closer to a recession.

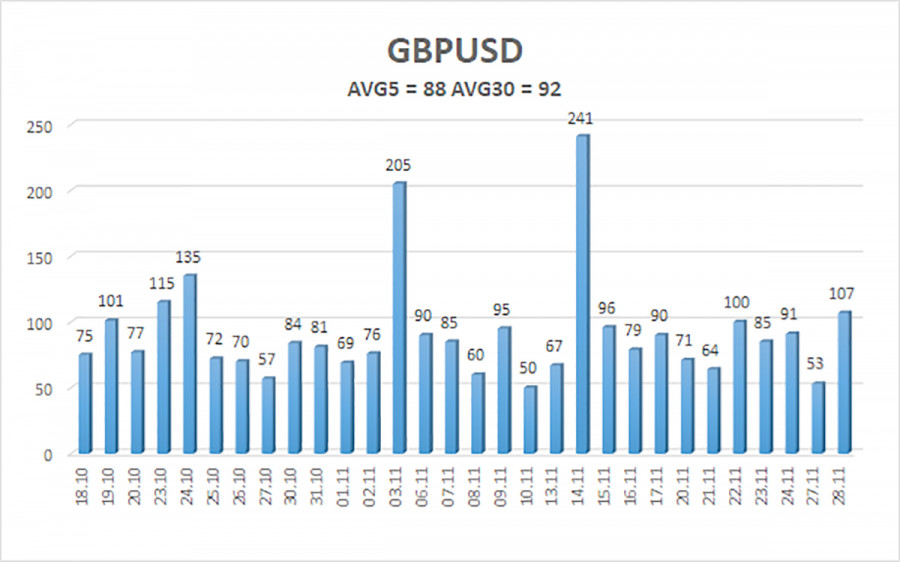

The average volatility of the GBP/USD pair for the last 5 trading days is 88 points. For the pound/dollar pair, this value is considered "average." Therefore, on Wednesday, November 29, we expect movements within the range limited by the levels of 1.2621 and 1.2797. A reversal of the Heiken Ashi indicator back down will indicate a new downturn in the corrective movement, which may be the beginning of a downward trend.

Nearest support levels:

S1 – 1.2695

S2 – 1.2634

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2817

Trading recommendations:

The GBP/USD pair continues its new upward movement and is above the moving average line. Short positions can be opened with targets at 1.2512 and 1.2451 in case the price consolidates below the moving average. Long positions formally remain relevant, as the price is above the moving average, with targets at 1.2797 and 1.2817. However, the triple overbought condition of the CCI indicator and the illogical rise of the British pound still indicate the danger of opening such deals.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means the trend is strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an approaching trend reversal in the opposite direction.