Wall Street's major indices ended the session marginally lower on Tuesday, erasing modest intraday gains in the final minutes of trading as investors looked to fresh earnings reports from Alphabet (GOOGL.O) and Tesla (TSLA.O).

The so-called "Magnificent Seven" companies reported results after the market closed, posting positive financial results for the second quarter.

Tesla surprised analysts with an unexpected revenue gain, delivering more cars than expected on the back of price cuts and incentives. Meanwhile, Alphabet beat revenue estimates, helped by higher digital ad sales and strong demand for its cloud services.

However, ahead of the earnings call, Tesla shares fell 2%, while Google's parent company rose 0.1%.

The tech giants' financial results are critical to understanding whether they can sustain their record growth in 2024 or whether U.S. stocks are overvalued. Investors are also concerned about whether the shift away from mega-caps to less-efficient sectors will continue.

The Russell 2000 small-cap (.RUT) rose 1% on the day.

"We're focusing on earnings because that's what's going to be the story this week and next, and the market's reaction to those numbers will be very telling," said Jack Janasiewicz, chief portfolio strategist at Natixis Investment Managers.

Speaking about the shift in focus in smaller-cap stocks, the expert added: "The jury is still out on this and we need more evidence that this is sustainable, which again comes down to earnings."

Big-cap stocks initially supported the markets on Tuesday, with all three benchmark indexes in positive territory. However, while the likes of Apple (AAPL.O), Microsoft (MSFT.O) and Amazon.com (AMZN.O) rose between 0.3% and 2.1%, the overall market rally slowed in the afternoon, leading to a slight decline in the final results.

Stock markets were also under pressure from disappointing earnings from big-name companies.

United Parcel Service (UPS.N), a leading indicator of the health of the global economy, fell 12.1% after earnings fell short of expectations amid weaker delivery demand and rising labor costs. UPS shares ended the day at their lowest in four years.

General Motors (GM.N) fell 6.4% despite reporting strong second-quarter results and raising its full-year profit forecast. Comcast (CMCSA.O) lost 2.6% after disappointing revenue data.

NXP Semiconductors (NXPI.O) fell 7.6% after reporting third-quarter revenue that missed expectations, dragging the Philadelphia SE Semiconductor (.SOX) index down 1.5%.

Spotify (SPOT.N) jumped 12% after reporting record quarterly profit that slightly beat analysts' expectations. Coca-Cola (KO.N) also rose 0.3% after raising its full-year sales and profit forecasts.

Of the first 74 S&P 500 companies to report quarterly results this season, 81.1% beat estimates, according to LSEG.

Yanasevich noted that while it's too early to draw definitive conclusions, the current earnings call shows that companies that miss expectations are suffering greatly, even if their results are generally positive. High market prices and expectations don't always guarantee significant stock gains.

"If your results don't meet expectations, the punishment may be more severe given current market conditions," he added.

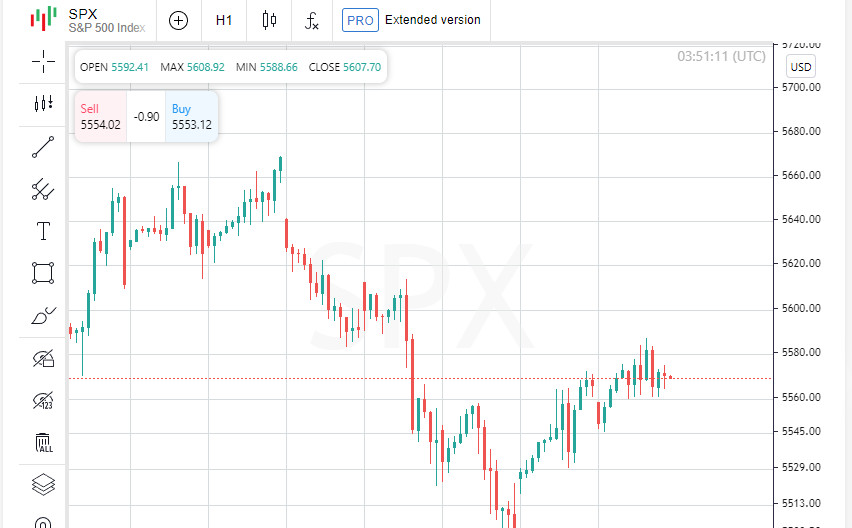

The S&P 500 (.SPX) fell 8.67 points, or 0.16%, to 5,555.74. The Nasdaq Composite (.IXIC) fell 10.22 points, or 0.06%, to 17,997.35. The Dow Jones Industrial Average (.DJI) lost 57.35 points, or 0.14%, to 40,358.09.

Eight of the S&P's 11 major sectors ended the day in the red, with energy (.SPNY) the worst performer, down 1.6% as U.S. oil prices fell to a six-week low.

Trading volume on U.S. exchanges totaled 10.45 billion shares, below the 20-day average of 11.33 billion.

The Federal Reserve's core consumer spending index, the benchmark inflation gauge, is due out Friday. The yield on the benchmark 10-year Treasury note fell 0.9 basis point to 4.251%.

"The market is now at a stage where we need real results to confirm the rally," said Wasif Latif, chief investment officer at Sarmaya Partners.

The MSCI World Share Index (.MIWD00000PUS) was down 0.06% at 816.37. On Wall Street, all three major indexes gave up their morning gains to end lower, led by losses in energy and utilities.

The pan-European STOXX 600 (.STOXX) was up 0.13%, led by gains in tech. In Asia, the MSCI Asia-Pacific Index outside Japan (.MIAPJ0000PUS) ended 0.30% higher at 566.92.

"We have seen a strong rally this year, with a lot of positives already built into it, including earnings and rate cuts," Latif added.

Vice President Kamala Harris will campaign in the battleground state of Wisconsin on Tuesday after winning the majority of delegates to the Democratic National Convention, strengthening her position as the party's presumptive nominee.

The U.S. dollar was broadly stronger, while the yen extended gains against the greenback for a second straight day.

The dollar index, which tracks the dollar against a basket of major currencies, rose 0.14% to 104.45. The euro was down 0.37% at $1.0849, while the yen gained 0.9% against the dollar to 155.63 yen per dollar.

Crude oil prices fell about 2% to a six-week low on rising expectations for a Gaza ceasefire and growing concerns about Chinese demand. Brent crude futures were down 1.7% to settle at $81.01 a barrel, while U.S. West Texas Intermediate (WTI) crude fell 1.8% to settle at $76.96 a barrel.

Gold was up, with spot prices up 0.43% to $2,407.87 an ounce. U.S. gold futures were also up 0.43% to settle at $2,402.40 an ounce.

Bitcoin, which had earlier risen on expectations that a potential Trump administration would be more lenient on cryptocurrency regulations, was down 3.60% to $65,698. Ethereum was also down 0.48% to settle at $3,473.