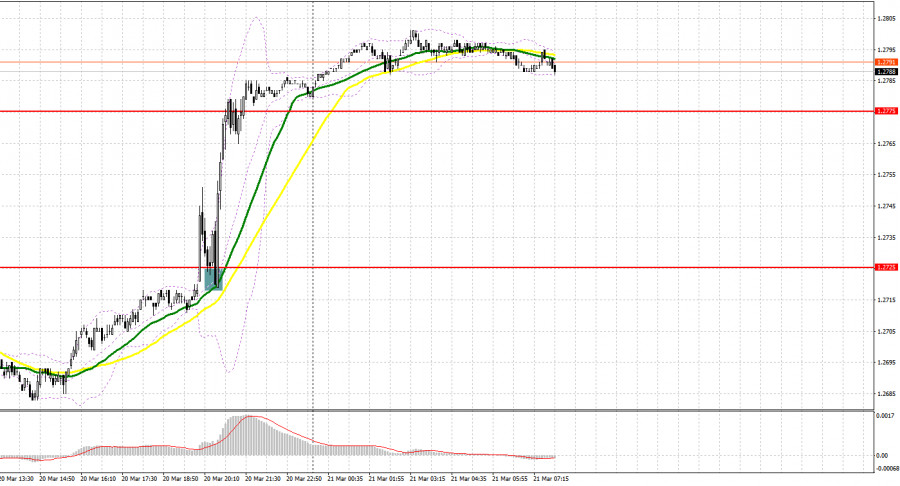

Yesterday, traders received some great signals to enter the market. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2703 as a possible entry point. A decline and false breakout there produced a buy signal, but I missed this signal, as it was formed far from the place where a stop order could be placed. And considering the inflation report, it was quite difficult to expect that the pair would strengthen. In the afternoon, a breakout and retest of 1.2725 generated another buy signal. As a result, the pair was up by more than 50 pips.

What is needed to open long positions on GBP/USD

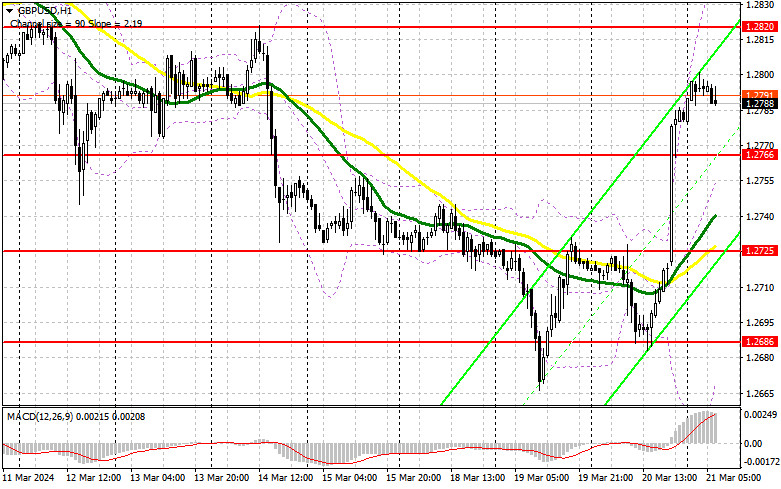

The Fed's stance on lowering interest rates this year has made it possible for the British pound to trade higher against the US dollar. But things are not as simple as they seem. Ahead of us is the Bank of England meeting, and the central bank's stance may not please traders and economists. Let me remind you that the BoE is willing to lower interest rates even if inflation does not return to the target level of 2.0%. And this kind of signal in today's meeting can hurt the pound. Hence, an optimal buying opportunity might arise on dips near the nearest support at 1.2766, established yesterday. A false breakout there will give a good entry point for long positions in hopes that demand will return with the prospect of testing 1.2820. A breakout and consolidation above this range will strengthen the bulls' positions and open the way to 1.2855. The farthest target is seen at the high of 1.2890, where I am going to take profit. In case of a decline and a lack of bullish activity at 1.2766, the pound may fall, and this could lock the pair in the sideways channel. In this case, only a false breakdown near the next support at 1.2725, which is in line with the moving averages, will confirm the correct entry point. I plan to buy GBP/USD just after a rebound from the low of 1.2686, aiming for a correction of 30-35 pips within the day.

What is needed to open short positions on GBP/USD

The bears lost control of the market yesterday and they could face new challenges today, provided that the PMI data turns out to be better than economists' forecasts and the BoE continues to fight inflation through high interest rates. For this reason, the sellers' goal is to protect the resistance at 1.2820, a breakout of which could take place in the near future. A false breakout near 1.2820 will confirm the sell signal, which will lead to selling with the target of a downward correction and a decline to 1.2766. A breakout and an upward test of this range will deal a blow to tthe bulls' positions, leading to the removal of stop orders and open the way to 1.2725. This is where I expect big buyers to show up. The farthest target will be the area of 1.2686, where they will take profits. If GBP/USD grows and there is no activity at 1.2820, buyers will become active. In this case, I will postpone selling until there is a false breakdown at 1.2855. If there is no downward movement there, I will sell GBP/USD just after a bounce from 1.2890, in anticipation of the pair declining by 30-35 pips intraday.

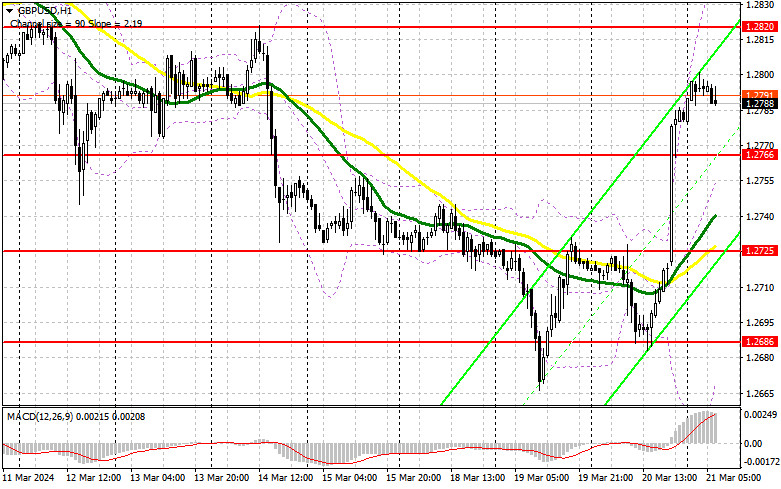

COT report:

According to the COT report (Commitment of Traders) for March 12, the number of both short and long positions increased. Despite expectations that rates in the UK may be lowered even if inflation does not reach the 2% target, the British pound continues to be in demand. The current corrective phase is entirely due to sharp demand for the US dollar across the market, which is associated with the release of the US inflation data last week. The third consecutive month of price increases will surely compel the Federal Reserve to adhere to a tight policy for as long as possible, which is currently reflected in the market. The latest COT report unveiled that long non-commercial positions rose by 21,006 to 123,285, while short non-commercial positions jumped by 8,940 to 52,834. As a result, the spread between long and short positions increased by 4,760.

Indicators' signals

Moving averages

The instrument is trading above the 30 and 50-day moving averages. It indicates that GBP/USD is likely to rise further

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD goes down, the indicator's lower border near 1.2680 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.