The US dollar has a fairly good disposition against the euro, and a weak one against the pound. The market still expects growth from the pound, while the news background and wave analysis suggest a downward trend. Overall, we have a sideways movement. However, the upcoming US reports will be quite strong, so there is a good chance that the EUR/USD downtrend will continue, and the long-awaited Wave 3 will begin for GBP/USD.

Important data will start coming in on Monday. The ISM Manufacturing Purchasing Managers' Index (PMI) could be the first report to support demand for the US dollar. The index is expected to rise to 48.4 points for March. This is still below the important threshold of 50, but the index is rising, and the market should take note of this fact.

On Tuesday, a significant report on JOLTS (Job Openings and Labor Turnover Survey) for February will be released. This report is directly related to the unemployment rate and the labor market. The higher the value, the more likely the US dollar is to strengthen further. However, this report is not as crucial as the ISM indices and labor market data, which will be released later.

On Wednesday, another ISM index will be released, this time for the services sector, and its value may be similar to that of the February value. While this report may not trigger a strong dollar rally, a positive value may bring the dollar closer to new local highs. Furthermore, the ADP report on non-farm employment in the US will also be released, and Federal Reserve Chairman Jerome Powell will speak. Given Powell's hawkish stance on Friday, one can expect firm statements from him once again. His rhetoric could lift the demand for the US dollar.

Thursday will bring only initial and continuing jobless claims, which have minor impact on the US dollar. On Friday, the focus will be on Nonfarm Payrolls, unemployment rate, and average hourly earnings in the US. Any payroll figure above 200,000 will strengthen the US dollar. It's difficult to expect another significant increase in unemployment after March's 3.9% figure; so we're more likely to see a slight decrease. Overall, I believe that the US news background will support the dollar in the upcoming week.

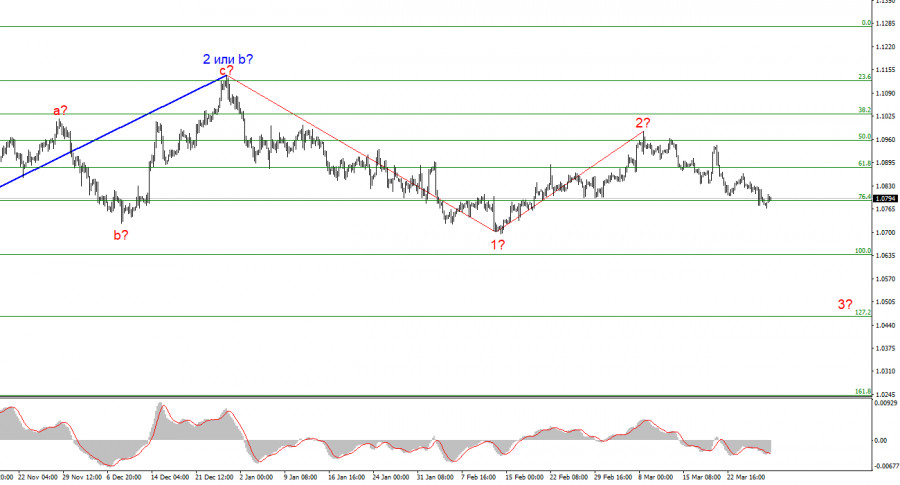

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% Fibonacci.

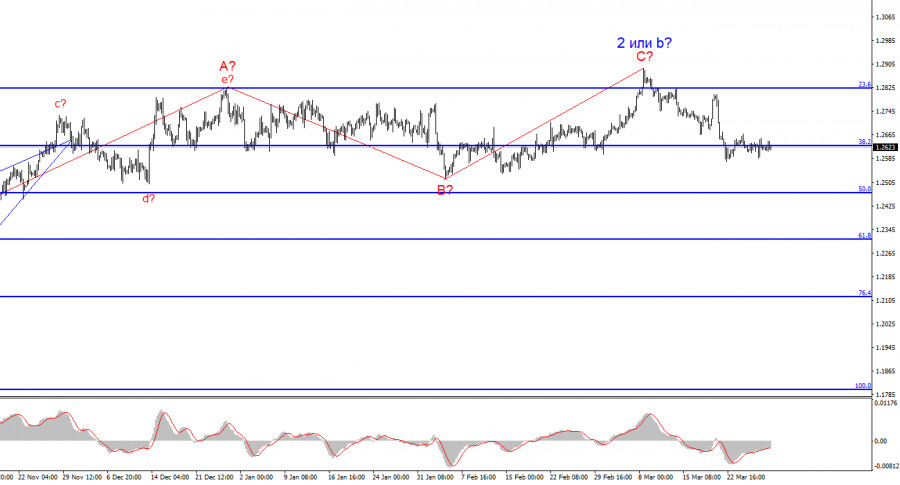

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless we can confirm that wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The quotes haven't moved far away from the peaks, so we cannot confirm the start of the wave 3 or c.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.