Analysis of GBP/USD 5M

GBP/USD gained 110 pips on Wednesday solely based on the U.S. inflation report. We would understand such a significant drop in the dollar if U.S. inflation had decreased by 0.3% or more. That would bring the first Federal Reserve rate cut closer. But as we can see, the market responded to just a 0.1% slowdown in inflation for the second consecutive month by selling the dollar. Once again, we have to say that the pair exhibited illogical movements.

The British pound continues to rise for any reason. The market interprets all the latest information in its favor, while the dollar continues to act as a "punching bag." Until the market's attitude towards the U.S. currency changes, we cannot expect any logical and consistent movements from the pair. In addition, it's worth noting that four out of five of this week's UK reports turned out to be worse than expected. The pound lost less overall on these reports than it gained from a single U.S. report. We saw something similar a month ago with the inflation report for April, as well as last week with the ISM Manufacturing PMI in the U.S..

Speaking of trading signals, they turned out to be quite good. The pair showed strong movement and a trend. The first sell signal around the Kijun-sen and Senkou Span B lines turned out to be a false signal and resulted in a small loss. However, the next buy signal around the same lines made it possible for traders to gain about 80 pips. Up until the announcement of the results of the Fed meeting, the pair only moved in one direction, giving traders plenty of time and opportunity to close the trade with a good profit.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent years. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and generally remain close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 9,000 buy contracts and closed 8,700 short ones. As a result, the net position of non-commercial traders increased by 17,700 contracts over the week, which is quite significant for the pound. Thus, sellers failed to seize the initiative at the most critical moment.

The fundamental background still does not provide a basis for long-term purchases of the pound sterling, and the currency has a good chance to resume the global downward trend. However, the price has already breached the trend line on the 24-hour timeframe at least twice. The level of 1.2765 is currently preventing the pound from rising further, but it has been quite difficult to do so.

The non-commercial group currently has a total of 102,000 buy contracts and 58,900 sell contracts. The bulls have taken the initiative, but aside from the COT reports, there is nothing else that suggests a potential rise in the GBP/USD pair.

Analysis of GBP/USD 1H

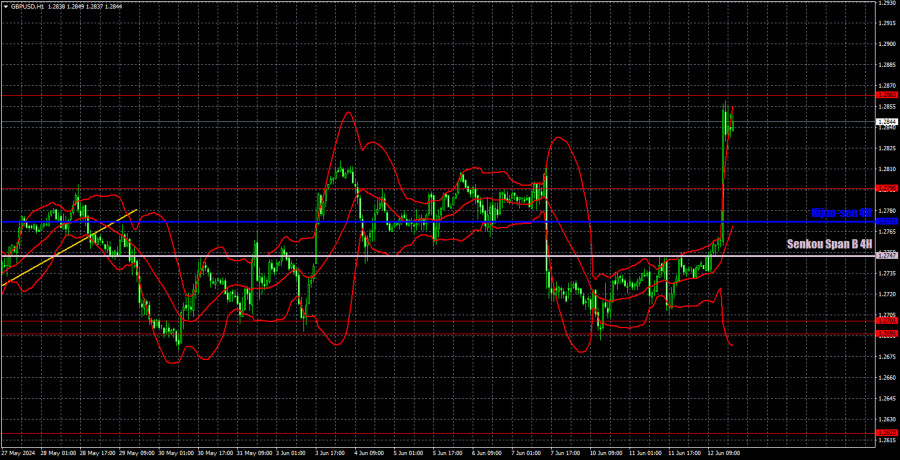

On the 1H chart, GBP/USD rose by 110 pips in just a few hours. It seems pointless to discuss the rationale behind such a movement. Clearly, a 0.1% decrease in US inflation is not a basis for such a significant drop. However, we are already accustomed to the market either buying the pound or doing nothing. Today, we need to conduct a new analysis considering the pair's movements after the Fed meeting and Jerome Powell's speech. Nevertheless, it is already clear that the market is set to resume the upward trend.

As of June 13, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691-1.2701, 1.2796, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2747) and Kijun-sen (1.2772) lines can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

On Thursday, no significant events are scheduled in the UK. The US docket will feature a report on jobless claims and the producer price index. In general, the market doesn't even need weak figures from these reports—the dollar keeps falling regardless. In the first half of the day, market participants may continue to react to the results of the Fed meeting, as European traders did not have the opportunity to do so on Wednesday evening.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;