On Wednesday, EUR/USD showed a strong upward movement throughout the day. While the movement was extremely weak in the first half of the day, the market went off the rails and rushed to get rid of the U.S. dollar right before and immediately after the U.S. inflation report was published. Take note that this review does not consider the results of the Federal Reserve meeting and Fed Chair Jerome Powell's speech. As we've mentioned many times before, it's best to analyze such a significant event no earlier than a day later, when market tensions have subsided.

Let's return to the inflation report. The Headline Consumer Price Index increased by 3.3% year over year in May from 3.4%, a mere 0.1% decrease. Core inflation slowed from 3.6% to 3.4%. So what does this change? Essentially, nothing. Headline inflation is still far from the target level, and the Fed cannot start easing monetary policy. Let's dive deeper into this report. The CPI fell to 3% in June 2023, exactly one year ago. It can be said that over the past 12 months, not only has inflation failed to slow down, it has actually accelerated. This already works against a potential Fed rate cut. Furthermore, let's look at the changes in inflation over the past year. From 3%, it rose to 3.7%, then decreased to 3.1%, then rose to 3.5%, and now it has fallen to 3.3%. As we can see, it has been fluctuating almost all the time between 3.0% and 3.5%.

Thus, a decline to 3.3% in May shouldn't draw any significant conclusions. A change of 0.1% year-over-year is mere noise, not a trend. Nevertheless, the market reacted to this report as if inflation had dropped to 3% or even lower. We agree that a more substantial decrease in the CPI could have triggered a fall in the US dollar, but we do not believe it should impact the overall trend, which had presumably shifted to a downward one just a few days ago. Therefore, we expect the euro to resume its decline and the dollar to strengthen in almost any scenario.

Of course, we can't dictate how the market should trade. It's impossible to accurately predict its actions. Thus, there is a possibility that the uptrend, which has been forming on the 4-hour timeframe over the last two months, could resume. However, in that case, we would have to conclude the same thing we have over the past few weeks—the market is buying the euro for illogical reasons. Last week the European Central Bank decided to lower the key rate, marking the beginning of a whole cycle of monetary easing. Meanwhile, even with the May slowdown in inflation, the Fed does not have the opportunity to start lowering rates in the foreseeable future. If the euro resumes its uptrend under such fundamental conditions, the pair's movement would have nothing to do with the concepts of "logic" and "rationality." However, conclusions should be drawn after the market has finally settled down and shows a proper reaction to the results of the Fed meeting and Powell's speech.

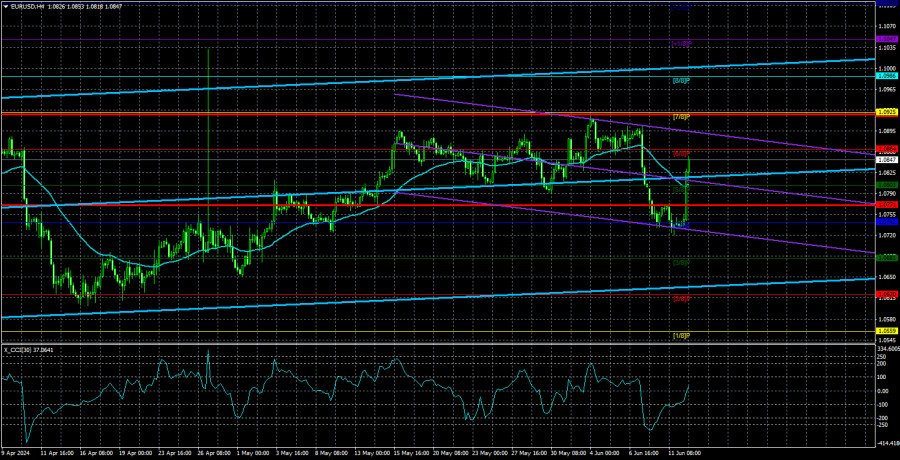

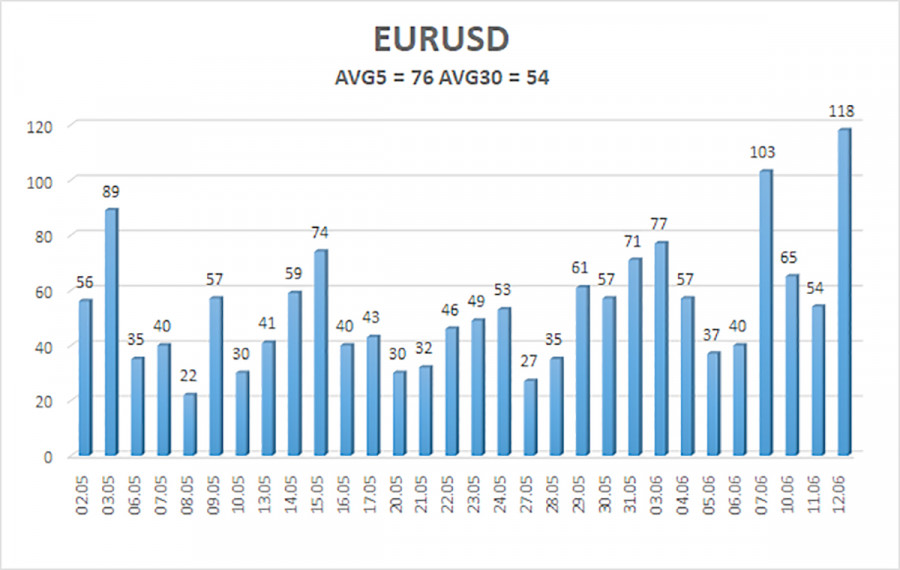

The average volatility of the EUR/USD pair over the last five trading days as of June 13 is 76 pips, which is considered an average value. We expect the pair to move between the levels of 1.0771 and 1.0923 on Thursday. The higher linear regression channel has turned upwards, but the global downtrend persists. The CCI indicator entered the oversold area, but at this time we do not expect the uptrend to resume.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, but on the 4-hour TF, it has once again consolidated above the moving average. Thus, long positions have become formally relevant at this time, but we are still skeptical about buying the pair. Unfortunately, yesterday the market reacted to the inflation report as if the Fed lowered the rate by 0.5%. It will be possible to return to short positions after the price settles back below the moving average line.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.